Liquidity provision in the overnight foreign exchange market

Liquidity provision in the overnight foreign exchange market

Liquidity provision in the overnight foreign exchange market

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

participants. The correlation when measured <strong>in</strong> changes (flows) is about -0.7.<br />

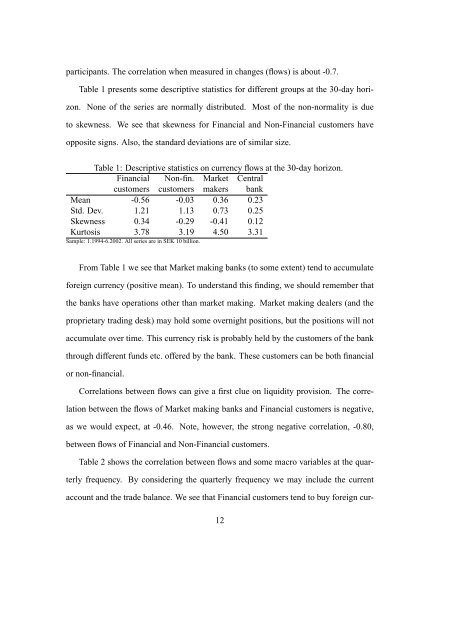

Table 1 presents some descriptive statistics for different groups at <strong>the</strong> 30-day horizon.<br />

None of <strong>the</strong> series are normally distributed. Most of <strong>the</strong> non-normality is due<br />

to skewness. We see that skewness for F<strong>in</strong>ancial and Non-F<strong>in</strong>ancial customers have<br />

opposite signs. Also, <strong>the</strong> standard deviations are of similar size.<br />

Table 1: Descriptive statistics on currency flows at <strong>the</strong> 30-day horizon.<br />

F<strong>in</strong>ancial Non-f<strong>in</strong>. Market Central<br />

customers customers makers bank<br />

Mean -0.56 -0.03 0.36 0.23<br />

Std. Dev. 1.21 1.13 0.73 0.25<br />

Skewness 0.34 -0.29 -0.41 0.12<br />

Kurtosis 3.78 3.19 4.50 3.31<br />

Sample: 1.1994-6.2002. All series are <strong>in</strong> SEK 10 billion.<br />

From Table 1 we see that Market mak<strong>in</strong>g banks (to some extent) tend to accumulate<br />

<strong>foreign</strong> currency (positive mean). To understand this f<strong>in</strong>d<strong>in</strong>g, we should remember that<br />

<strong>the</strong> banks have operations o<strong>the</strong>r than <strong>market</strong> mak<strong>in</strong>g. Market mak<strong>in</strong>g dealers (and <strong>the</strong><br />

proprietary trad<strong>in</strong>g desk) may hold some <strong>overnight</strong> positions, but <strong>the</strong> positions will not<br />

accumulate over time. This currency risk is probably held by <strong>the</strong> customers of <strong>the</strong> bank<br />

through different funds etc. offered by <strong>the</strong> bank. These customers can be both f<strong>in</strong>ancial<br />

or non-f<strong>in</strong>ancial.<br />

Correlations between flows can give a first clue on liquidity <strong>provision</strong>. The correlation<br />

between <strong>the</strong> flows of Market mak<strong>in</strong>g banks and F<strong>in</strong>ancial customers is negative,<br />

as we would expect, at -0.46. Note, however, <strong>the</strong> strong negative correlation, -0.80,<br />

between flows of F<strong>in</strong>ancial and Non-F<strong>in</strong>ancial customers.<br />

Table 2 shows <strong>the</strong> correlation between flows and some macro variables at <strong>the</strong> quarterly<br />

frequency. By consider<strong>in</strong>g <strong>the</strong> quarterly frequency we may <strong>in</strong>clude <strong>the</strong> current<br />

account and <strong>the</strong> trade balance. We see that F<strong>in</strong>ancial customers tend to buy <strong>foreign</strong> cur-<br />

12