Liquidity provision in the overnight foreign exchange market

Liquidity provision in the overnight foreign exchange market

Liquidity provision in the overnight foreign exchange market

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

11.0<br />

10.5<br />

10.0<br />

9.5<br />

9.0<br />

8.5<br />

8.0<br />

1994 1995 1996 1997 1998 1999 2000 2001 2002<br />

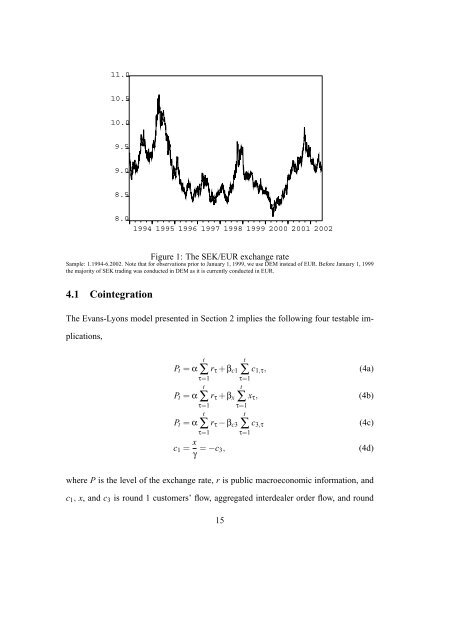

Figure 1: The SEK/EUR <strong>exchange</strong> rate<br />

Sample: 1.1994-6.2002. Note that for observations prior to January 1, 1999, we use DEM <strong>in</strong>stead of EUR. Before January 1, 1999<br />

<strong>the</strong> majority of SEK trad<strong>in</strong>g was conducted <strong>in</strong> DEM as it is currently conducted <strong>in</strong> EUR.<br />

4.1 Co<strong>in</strong>tegration<br />

The Evans-Lyons model presented <strong>in</strong> Section 2 implies <strong>the</strong> follow<strong>in</strong>g four testable implications,<br />

P t = α<br />

P t = α<br />

P t = α<br />

t<br />

∑<br />

τ=1<br />

t<br />

∑<br />

τ=1<br />

t<br />

∑<br />

τ=1<br />

r τ + β c1<br />

r τ + β x<br />

r τ − β c3<br />

c 1 = x γ = −c 3,<br />

t<br />

∑<br />

τ=1<br />

t<br />

∑ x τ ,<br />

τ=1<br />

t<br />

∑ c 3,τ<br />

τ=1<br />

c 1,τ ,<br />

(4a)<br />

(4b)<br />

(4c)<br />

(4d)<br />

where P is <strong>the</strong> level of <strong>the</strong> <strong>exchange</strong> rate, r is public macroeconomic <strong>in</strong>formation, and<br />

c 1 , x, and c 3 is round 1 customers’ flow, aggregated <strong>in</strong>terdealer order flow, and round<br />

15