Liquidity provision in the overnight foreign exchange market

Liquidity provision in the overnight foreign exchange market

Liquidity provision in the overnight foreign exchange market

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ysis presented above. As <strong>the</strong> two price co<strong>in</strong>tegration vectors are equivalent, we use <strong>the</strong><br />

vector estimated us<strong>in</strong>g Non-F<strong>in</strong>ancial positions, as presented <strong>in</strong> Table 3. Us<strong>in</strong>g <strong>the</strong> price<br />

vector with F<strong>in</strong>ancial positions would not alter any results. To utilize <strong>the</strong> fact that we<br />

have access to daily data, we apply a standard GMM procedure to account for <strong>the</strong> fact<br />

that we have overlapp<strong>in</strong>g observations when we look at changes beyond one day.<br />

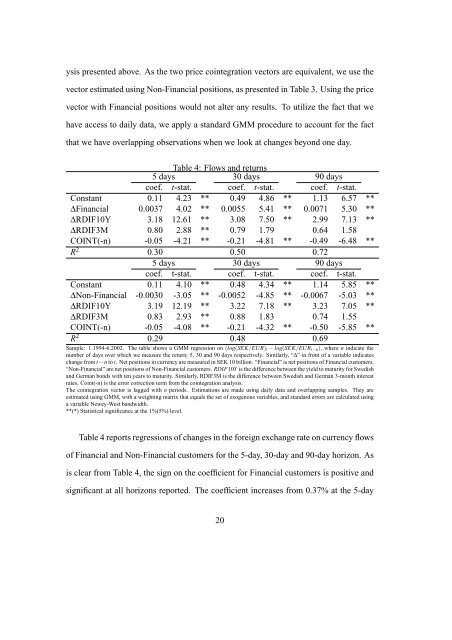

Table 4: Flows and returns<br />

5 days 30 days 90 days<br />

coef. t-stat. coef. t-stat. coef. t-stat.<br />

Constant 0.11 4.23 ** 0.49 4.86 ** 1.13 6.57 **<br />

∆F<strong>in</strong>ancial 0.0037 4.02 ** 0.0055 5.41 ** 0.0071 5.30 **<br />

∆RDIF10Y 3.18 12.61 ** 3.08 7.50 ** 2.99 7.13 **<br />

∆RDIF3M 0.80 2.88 ** 0.79 1.79 0.64 1.58<br />

COINT(-n) -0.05 -4.21 ** -0.21 -4.81 ** -0.49 -6.48 **<br />

R 2 0.30 0.50 0.72<br />

5 days 30 days 90 days<br />

coef. t-stat. coef. t-stat. coef. t-stat.<br />

Constant 0.11 4.10 ** 0.48 4.34 ** 1.14 5.85 **<br />

∆Non-F<strong>in</strong>ancial -0.0030 -3.05 ** -0.0052 -4.85 ** -0.0067 -5.03 **<br />

∆RDIF10Y 3.19 12.19 ** 3.22 7.18 ** 3.23 7.05 **<br />

∆RDIF3M 0.83 2.93 ** 0.88 1.83 0.74 1.55<br />

COINT(-n) -0.05 -4.08 ** -0.21 -4.32 ** -0.50 -5.85 **<br />

R 2 0.29 0.48 0.69<br />

Sample: 1.1994-6.2002. The table shows a GMM regression on (log(SEK/EUR) t − log(SEK/EUR t−n ), where n <strong>in</strong>dicate <strong>the</strong><br />

number of days over which we measure <strong>the</strong> return; 5, 30 and 90 days respectively. Similarly, “∆” <strong>in</strong> front of a variable <strong>in</strong>dicates<br />

change from t −n to t. Net positions <strong>in</strong> currency are measured <strong>in</strong> SEK 10 billion. “F<strong>in</strong>ancial” is net positions of F<strong>in</strong>ancial customers,<br />

“Non-F<strong>in</strong>ancial” are net positions of Non-F<strong>in</strong>ancial customers. RDIF10Y is <strong>the</strong> difference between <strong>the</strong> yield to maturity for Swedish<br />

and German bonds with ten years to maturity. Similarly, RDIF3M is <strong>the</strong> difference between Swedish and German 3-month <strong>in</strong>terest<br />

rates. Co<strong>in</strong>t(-n) is <strong>the</strong> error correction term from <strong>the</strong> co<strong>in</strong>tegration analysis.<br />

The co<strong>in</strong>tegration vector is lagged with n periods. Estimations are made us<strong>in</strong>g daily data and overlapp<strong>in</strong>g samples. They are<br />

estimated us<strong>in</strong>g GMM, with a weight<strong>in</strong>g matrix that equals <strong>the</strong> set of exogenous variables, and standard errors are calculated us<strong>in</strong>g<br />

a variable Newey-West bandwidth.<br />

**(*) Statistical significance at <strong>the</strong> 1%(5%) level.<br />

Table 4 reports regressions of changes <strong>in</strong> <strong>the</strong> <strong>foreign</strong> <strong>exchange</strong> rate on currency flows<br />

of F<strong>in</strong>ancial and Non-F<strong>in</strong>ancial customers for <strong>the</strong> 5-day, 30-day and 90-day horizon. As<br />

is clear from Table 4, <strong>the</strong> sign on <strong>the</strong> coefficient for F<strong>in</strong>ancial customers is positive and<br />

significant at all horizons reported. The coefficient <strong>in</strong>creases from 0.37% at <strong>the</strong> 5-day<br />

20