Warners

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

'<br />

'<br />

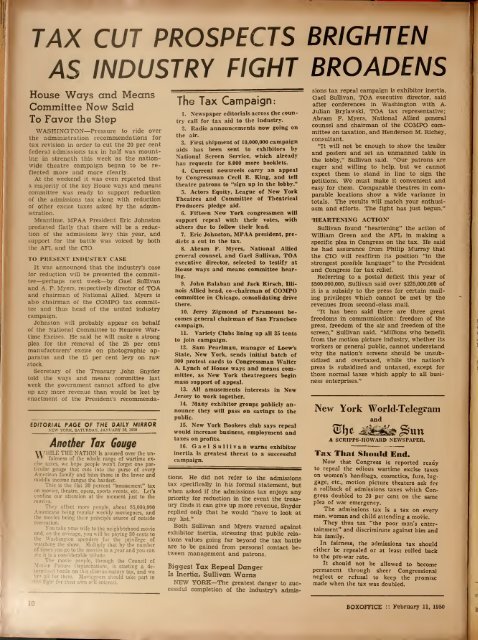

TAX CUT PROSPECTS<br />

AS INDUSTRY FIGHT<br />

House Ways and Means<br />

Committee Now Said<br />

To Favor the Step<br />

WASHINGTON—Pressure to ride over<br />

the administration recommendations for<br />

tax revision in order to cut the 20 per cent<br />

federal admissions tax in half was mounting<br />

in strength this week as the nationwide<br />

theatre campaign began to be reflected<br />

more and more clearly.<br />

At the weekend it was even reported that<br />

a majority of the key House ways and means<br />

committee was ready to support reduction<br />

of the admissions tax along with reduction<br />

of other excise taxes asked by the administration.<br />

Meantime. MPAA President Eric Johnston<br />

predicted flatly that there will be a reduction<br />

of the admissions levy this year, and<br />

support for the battle was voiced by both<br />

the AFX and the CIO.<br />

TO PRESENT INDUSTRY CASE<br />

It was announced that the industry's case<br />

for reduction will be presented the committee—perhaps<br />

next week—by Gael Sullivan<br />

and A. F. Myers, respectively director of TOA<br />

and chairman of National Allied. Myers is<br />

also chairman of the COMPO tax committee<br />

and thus head of the united industry<br />

campaign.<br />

Johnston will probably appear on behalf<br />

of the National Committee to Remove Wartime<br />

Excises. He said he will make a strong<br />

plea for the removal of the 25 per cent<br />

manufacturers' excise on photographic apparatus<br />

and the 15 per cent levy on raw<br />

stock.<br />

Secretary of the Treasury John Snyder<br />

told the ways and means committee last<br />

week the government cannot afford to give<br />

up any more revenue than would be lost by<br />

enactment of the President's recommenda-<br />

EDfTORI>tL PAGE OF THE DAILY MIRROR<br />

NEW YORK. SATURDAY. JA.NUARY 28. 1950<br />

Another Tax Gouge<br />

VI/HILE THE NATION is aroused over the un-<br />

*' fairness of the whole range of wartime excise<br />

taxes, we hope people won't forget one particular<br />

gouge that cuts into the purse of every<br />

American family and bites those in the lower and<br />

middle income ranges the hardest.<br />

This is the flat 20 percent "amusement" tax<br />

on movies, theatre, opera, sports events, etc. Let's<br />

confine our attention at the moment just to the<br />

movies.<br />

"They affect more people, about 85,000,000<br />

Americans being regular weekly moviegoers, and<br />

the movies being their principle source of outside<br />

recreation.<br />

You take your wife to the neighborhood movie<br />

and, on the average, you will be paying 30 cents to<br />

the Washington spenders for the privilege of<br />

watching the show. Multiply that by the number<br />

of times you go to the movies in a year and you can<br />

see it is a considerable tribute.<br />

The movie people, through the Council of<br />

-Mntion Picture Organizations, starting a dermined<br />

is<br />

battle on this discriniinatorv tax, and we<br />

ivl' all for them. Moviegoers should take part in<br />

iO<br />

fight for their own self-interest.<br />

The Tax Campaign:<br />

1. Newspaper editorials across the country<br />

call for tax aid to the industry.<br />

2. Radio announcements now going on<br />

the<br />

air.<br />

3. First shipment of 10.000,000 campaign<br />

aids has been sent to exhibitors by<br />

National Screen Service, which already<br />

has requests for 8,000 more booklets.<br />

4. Current newsreels carry an appeal<br />

by Congressman Cecil R. King, and tell<br />

theatre patrons to "sign up in the lobby."<br />

5. Actors Equity, League of New York<br />

Theatres and Committee of Theatrical<br />

Producers pledge aid.<br />

6. Fifteen New York congressmen will<br />

support repeal with their votes, with<br />

others due to follow their lead.<br />

7. Eric Johnston, MPAA president, predicts<br />

a cut in the tax.<br />

8. Abram F. Myers, National Allied<br />

general counsel, and Gael Sullivan, TOA<br />

executive director, selected to testify at<br />

House ways and means committee hearing.<br />

9. John Balaban and Jack Kirsch, Illinois<br />

Allied head, co-chairman of COMPO<br />

committee in Chicago, consolidating drive<br />

there.<br />

10. Jerry Zigmond of Paramount becomes<br />

general chairman of San Francisco<br />

campaign.<br />

11. Variety Clubs lining np all 35 tents<br />

to join campaign.<br />

12. Sam Pearlman, manager of Loew's<br />

State, New York, sends initial batch of<br />

900 protest cards to Congressman Walter<br />

A. Lynch of House ways and means committee,<br />

as New York theatregoers begin<br />

mass support of appeal.<br />

13. All amusements interests in New<br />

Jersey to work together.<br />

14. Many exhibitor groups publicly announce<br />

they will pass on savings to the<br />

public.<br />

15. New York Bookers club says repeal<br />

would increase business, employment and<br />

taxes on profits.<br />

16. Gael Sullivan warns exhibitor<br />

inertia is greatest threat to a snccessfnl<br />

campaign.<br />

tions. He did not refer to the admissions<br />

tax specifically in his formal statement, but<br />

when asked if the admissions tax enjoys any<br />

priority for reduction in the event the treasury<br />

finds it can give up more revenue, Snyder<br />

replied only that he would "have to look at<br />

my list."<br />

Both SulUvan and Myers warned against<br />

exhibitor inertia, stressing that public relations<br />

values going far beyond the tax battle<br />

are to be gained from personal contact between<br />

management and patrons.<br />

Biggest Tax Repeal Danger<br />

Is Inertia, Sullivan Warns<br />

NEW YORK—The greatest danger to successful<br />

completion of the industry's admis-<br />

BRIGHTEN<br />

BROADENS<br />

sions tax repeal campaign is exhibitor inertia,<br />

Gael Sullivan. TOA executive director, said<br />

after conferences in Washington with A.<br />

Julian Brylawski, TOA tax representative;<br />

Abram P. Myers, National Allied general<br />

counsel and chairman of the COMPO committee<br />

on taxation, and Henderson M. Richey,<br />

consultant.<br />

"It will not be enough to show the trailer<br />

and posters and set an unmanned table in<br />

the lobby." Sullivan said. "Our patrons are<br />

eager and willing to help, but we cannot<br />

expect them to stand in line to sign the<br />

petitions. We must make it convenient and<br />

easy for them. Comparable theatres in comparable<br />

locations show a wide variance in<br />

totals. The results will match your enthusiasm<br />

and efforts. The fight has just begun."<br />

'HEARTENING ACTION'<br />

Sullivan found "heartening" the action of<br />

William Green and the AFL in maldng a<br />

specific plea in Congress on the tax. He said<br />

he had assurance from Philip Murray that<br />

the CIO will reaffirm its position "in the<br />

strongest possible language" to the President<br />

and Congress for tax relief.<br />

Referring to a postal deficit this year of<br />

$500,000,000. Sullivan said over $225,000,000 of<br />

it is a subsidy to the press for certain mailing<br />

privileges which cannot be met by the<br />

revenues from second-class mail.<br />

"It has been said there are three great<br />

freedoms in communication: freedom of the<br />

press, freedom of the air and freedom of the<br />

screen," Sullivan said. "Millions who benefit<br />

from the motion picture industry, whether its<br />

workers or general public, cannot understand<br />

why the nation's screens should be imsubsidized<br />

and overtaxed, while the nation's<br />

press is subsidized and untaxed, except for<br />

those normal taxes which apply to all business<br />

enterprises."<br />

New York World-Telegram<br />

and<br />

A SCRIPPS-HOWARD NEWSPAPER.<br />

Tax That Should End.<br />

Now that Congress is reported ready<br />

to repeal the odious wartime excise taxes<br />

on women's handbags, cosmetics, furs, luggage,<br />

etc., motion picture theaters ask for<br />

a rollback of admissions taxes which Congress<br />

doubled to 20 per cent on the same<br />

plea of war emergency.<br />

The admissions tax is a tax on every<br />

man, woman and child attending a movie.<br />

They thus tax "the poor man's entertainment"<br />

and discriminate against him and<br />

his family.<br />

In fairness, the admissions tax should<br />

either be repealed or at least rolled back<br />

to the pre-war rate.<br />

It should not be allowed to become<br />

permanent through sheer Congressional<br />

neglect or refusal to keep the promise<br />

made when the tax was doubled.<br />

BOXOrnCE :: February 11, 1950