LOGITECH INTERNATIONAL SA - Shareholder.com

LOGITECH INTERNATIONAL SA - Shareholder.com

LOGITECH INTERNATIONAL SA - Shareholder.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Table of Contents<br />

The decrease in net foreign currency exchange gains for fiscal year 2007 resulted from fluctuations in exchange rates. The Company does<br />

not speculate in currency positions, but is alert to opportunities to maximize our foreign exchange gains. During fiscal year 2007, we sold our<br />

investment in Anoto Group AB and recognized a gain of $9.1 million. In fiscal year 2006, we recorded a gain on another investment and a $1.2<br />

million impairment of our investment in A4Vision, Inc.<br />

Provision for In<strong>com</strong>e Taxes<br />

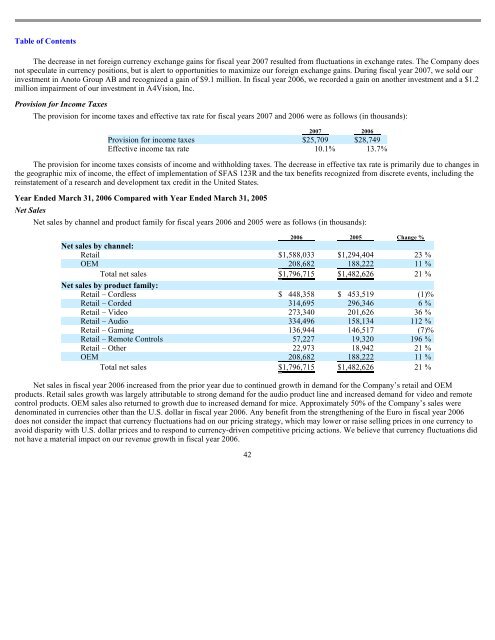

The provision for in<strong>com</strong>e taxes and effective tax rate for fiscal years 2007 and 2006 were as follows (in thousands):<br />

2007 2006<br />

Provision for in<strong>com</strong>e taxes $ 25,709 $ 28,749<br />

Effective in<strong>com</strong>e tax rate 10.1 % 13.7 %<br />

The provision for in<strong>com</strong>e taxes consists of in<strong>com</strong>e and withholding taxes. The decrease in effective tax rate is primarily due to changes in<br />

the geographic mix of in<strong>com</strong>e, the effect of implementation of SFAS 123R and the tax benefits recognized from discrete events, including the<br />

reinstatement of a research and development tax credit in the United States.<br />

Year Ended March 31, 2006 Compared with Year Ended March 31, 2005<br />

Net Sales<br />

Net sales by channel and product family for fiscal years 2006 and 2005 were as follows (in thousands):<br />

Net sales in fiscal year 2006 increased from the prior year due to continued growth in demand for the Company’s retail and OEM<br />

products. Retail sales growth was largely attributable to strong demand for the audio product line and increased demand for video and remote<br />

control products. OEM sales also returned to growth due to increased demand for mice. Approximately 50% of the Company’s sales were<br />

denominated in currencies other than the U.S. dollar in fiscal year 2006. Any benefit from the strengthening of the Euro in fiscal year 2006<br />

does not consider the impact that currency fluctuations had on our pricing strategy, which may lower or raise selling prices in one currency to<br />

avoid disparity with U.S. dollar prices and to respond to currency-driven <strong>com</strong>petitive pricing actions. We believe that currency fluctuations did<br />

not have a material impact on our revenue growth in fiscal year 2006.<br />

42<br />

2006 2005 Change %<br />

Net sales by channel:<br />

Retail $ 1,588,033 $ 1,294,404 23 %<br />

OEM 208,682 188,222 11 %<br />

Total net sales $ 1,796,715 $ 1,482,626 21 %<br />

Net sales by product family:<br />

Retail – Cordless $ 448,358 $ 453,519 (1 )%<br />

Retail – Corded 314,695 296,346 6 %<br />

Retail – Video 273,340 201,626 36 %<br />

Retail – Audio 334,496 158,134 112 %<br />

Retail – Gaming 136,944 146,517 (7 )%<br />

Retail – Remote Controls 57,227 19,320 196 %<br />

Retail – Other 22,973 18,942 21 %<br />

OEM 208,682 188,222 11 %<br />

Total net sales $ 1,796,715 $ 1,482,626 21 %