LOGITECH INTERNATIONAL SA - Shareholder.com

LOGITECH INTERNATIONAL SA - Shareholder.com

LOGITECH INTERNATIONAL SA - Shareholder.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Table of Contents<br />

Note 7 — Short-term Investments<br />

<strong>LOGITECH</strong> <strong>INTERNATIONAL</strong> S.A.<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)<br />

During the second quarter of fiscal year 2007, the Company invested in U.S. Government Guaranteed Student Loan Issues, which are<br />

auction rate securities collateralized by student loans and guaranteed by the United States Department of Education. Although the student loans<br />

securitizing the auction rate securities have maturity dates greater than 15 years, these investments are considered highly liquid and typically<br />

reset every 28 days. These securities are classified as available-for-sale as of March 31, 2007 and are reported at fair value. As of March 31,<br />

2007, the Company had not recognized any unrealized gains or losses for its auction rate securities.<br />

Note 8 — Investments<br />

In July 2003, the Company made a $15.1 million cash investment in Anoto Group AB (“Anoto”), a publicly traded Swedish technology<br />

<strong>com</strong>pany from which Logitech licenses its digital pen technology. The investment represented approximately 9.5% of Anoto’s outstanding<br />

shares as of March 31, 2006. During fiscal year 2007, the Company sold its Anoto investment and recognized a gain of $9.1 million, which was<br />

included in other in<strong>com</strong>e, net for fiscal year 2007.<br />

In connection with the investment, a Logitech executive was elected to the Anoto board of directors. The license agreement requires<br />

Logitech to pay a license fee for the rights to use the Anoto technology and a license fee on the sales value of digital pen solutions sold by<br />

Logitech. Also, the agreement includes non-recurring engineering (“NRE”) service fees primarily for specific development and maintenance of<br />

Anoto’s licensed technology. During fiscal years 2007 and 2006, expenses incurred for license fees to Anoto were $0.3 million and $0.5<br />

million. Expenses incurred for license fees and NRE service fees to Anoto were $0.7 million in fiscal year 2005.<br />

Note 9 — Goodwill and Other Intangible Assets<br />

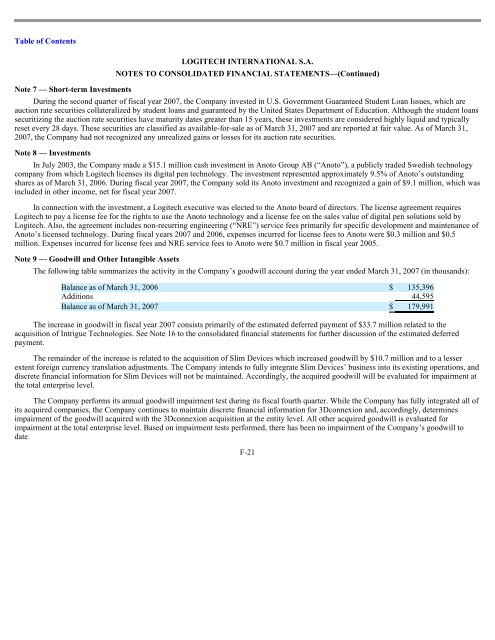

The following table summarizes the activity in the Company’s goodwill account during the year ended March 31, 2007 (in thousands):<br />

Balance as of March 31, 2006 $ 135,396<br />

Additions 44,595<br />

Balance as of March 31, 2007 $ 179,991<br />

The increase in goodwill in fiscal year 2007 consists primarily of the estimated deferred payment of $33.7 million related to the<br />

acquisition of Intrigue Technologies. See Note 16 to the consolidated financial statements for further discussion of the estimated deferred<br />

payment.<br />

The remainder of the increase is related to the acquisition of Slim Devices which increased goodwill by $10.7 million and to a lesser<br />

extent foreign currency translation adjustments. The Company intends to fully integrate Slim Devices’ business into its existing operations, and<br />

discrete financial information for Slim Devices will not be maintained. Accordingly, the acquired goodwill will be evaluated for impairment at<br />

the total enterprise level.<br />

The Company performs its annual goodwill impairment test during its fiscal fourth quarter. While the Company has fully integrated all of<br />

its acquired <strong>com</strong>panies, the Company continues to maintain discrete financial information for 3Dconnexion and, accordingly, determines<br />

impairment of the goodwill acquired with the 3Dconnexion acquisition at the entity level. All other acquired goodwill is evaluated for<br />

impairment at the total enterprise level. Based on impairment tests performed, there has been no impairment of the Company’s goodwill to<br />

date.<br />

F-21