LOGITECH INTERNATIONAL SA - Shareholder.com

LOGITECH INTERNATIONAL SA - Shareholder.com

LOGITECH INTERNATIONAL SA - Shareholder.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Table of Contents<br />

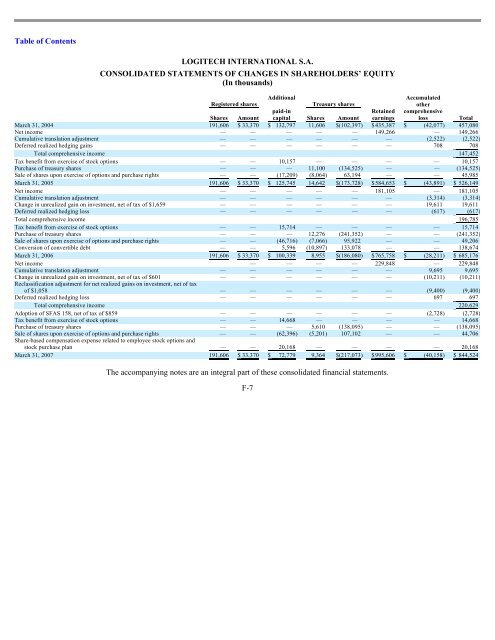

<strong>LOGITECH</strong> <strong>INTERNATIONAL</strong> S.A.<br />

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY<br />

(In thousands)<br />

Additional<br />

Accumulated<br />

March 31, 2004<br />

Net in<strong>com</strong>e<br />

Cumulative translation adjustment<br />

Deferred realized hedging gains<br />

Total <strong>com</strong>prehensive in<strong>com</strong>e<br />

Tax benefit from exercise of stock options<br />

Purchase of treasury shares<br />

Sale of shares upon exercise of options and purchase rights<br />

March 31, 2005<br />

Net in<strong>com</strong>e<br />

Cumulative translation adjustment<br />

Change in unrealized gain on investment, net of tax of $1,659<br />

Deferred realized hedging loss<br />

Total <strong>com</strong>prehensive in<strong>com</strong>e<br />

Tax benefit from exercise of stock options<br />

Purchase of treasury shares<br />

Sale of shares upon exercise of options and purchase rights<br />

Conversion of convertible debt<br />

March 31, 2006<br />

Net in<strong>com</strong>e<br />

Cumulative translation adjustment<br />

Change in unrealized gain on investment, net of tax of $601<br />

Registered shares<br />

Shares Amount<br />

191,606 $ 33,370<br />

— —<br />

— —<br />

— —<br />

— —<br />

— —<br />

— —<br />

191,606 $ 33,370<br />

— —<br />

— —<br />

— —<br />

— —<br />

— —<br />

— —<br />

— —<br />

— —<br />

191,606 $ 33,370<br />

—<br />

— —<br />

— —<br />

paid-in<br />

capital<br />

$ 132,797<br />

—<br />

—<br />

—<br />

10,157<br />

—<br />

(17,209 )<br />

$ 125,745<br />

—<br />

—<br />

—<br />

—<br />

15,714<br />

—<br />

(46,716 )<br />

5,596<br />

$ 100,339<br />

—<br />

—<br />

—<br />

Treasury shares<br />

Shares Amount<br />

11,606 $ (102,397 )<br />

— —<br />

— —<br />

— —<br />

— —<br />

11,100 (134,525 )<br />

(8,064 ) 63,194<br />

14,642 $ (173,728 )<br />

— —<br />

— —<br />

— —<br />

— —<br />

— —<br />

12,276 (241,352 )<br />

(7,066 ) 95,922<br />

(10,897 ) 133,078<br />

8,955 $ (186,080 )<br />

— —<br />

— —<br />

— —<br />

other<br />

Retained <strong>com</strong>prehensive<br />

earnings loss<br />

$ 435,387 $ (42,077 )<br />

149,266 —<br />

— (2,522 )<br />

— 708<br />

— —<br />

— —<br />

— —<br />

$ 584,653 $ (43,891 )<br />

181,105 —<br />

— (3,314 )<br />

— 19,611<br />

— (617 )<br />

— —<br />

— —<br />

— —<br />

— —<br />

$ 765,758 $ (28,211 )<br />

229,848 —<br />

— 9,695<br />

— (10,211 )<br />

Total<br />

457,080<br />

149,266<br />

(2,522 )<br />

708<br />

147,452<br />

10,157<br />

(134,525 )<br />

45,985<br />

$ 526,149<br />

181,105<br />

(3,314 )<br />

19,611<br />

(617 )<br />

196,785<br />

15,714<br />

(241,352 )<br />

49,206<br />

138,674<br />

$ 685,176<br />

229,848<br />

9,695<br />

(10,211 )<br />

Reclassification adjustment for net realized gains on investment, net of tax<br />

of $1,058<br />

Deferred realized hedging loss<br />

Total <strong>com</strong>prehensive in<strong>com</strong>e<br />

Adoption of SFAS 158, net of tax of $859<br />

Tax benefit from exercise of stock options<br />

Purchase of treasury shares<br />

Sale of shares upon exercise of options and purchase rights<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

14,668<br />

—<br />

(62,396 )<br />

—<br />

—<br />

—<br />

—<br />

5,610<br />

(5,201 )<br />

—<br />

—<br />

—<br />

—<br />

(138,095 )<br />

107,102<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

(9,400 )<br />

697<br />

(2,728 )<br />

—<br />

—<br />

—<br />

(9,400 )<br />

697<br />

220,629<br />

(2,728 )<br />

14,668<br />

(138,095 )<br />

44,706<br />

Share-based <strong>com</strong>pensation expense related to employee stock options and<br />

stock purchase plan<br />

March 31, 2007<br />

—<br />

191,606<br />

—<br />

$ 33,370 $<br />

20,168<br />

72,779<br />

—<br />

9,364<br />

—<br />

$ (217,073 )<br />

—<br />

$ 995,606 $<br />

—<br />

(40,158 )<br />

20,168<br />

$ 844,524<br />

The ac<strong>com</strong>panying notes are an integral part of these consolidated financial statements.<br />

F-7