LOGITECH INTERNATIONAL SA - Shareholder.com

LOGITECH INTERNATIONAL SA - Shareholder.com

LOGITECH INTERNATIONAL SA - Shareholder.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Table of Contents<br />

<strong>LOGITECH</strong> <strong>INTERNATIONAL</strong> S.A.<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)<br />

The dividend yield assumption is based on the Company’s history and future expectations of dividend payouts. The Company has not<br />

paid dividends since 1996.<br />

The expected option life represents the weighted-average period the stock options or purchase offerings are expected to remain<br />

outstanding. The expected life is based on historical settlement rates, which the Company believes are most representative of future exercise<br />

and post-vesting termination behaviors.<br />

Expected share price volatility is based on historical volatility using daily prices over the term of past options or purchase offerings. The<br />

Company considers historical share price volatility as most representative of future stock option volatility. The risk-free interest rate<br />

assumptions are based upon the implied yield of U.S. Treasury zero-coupon issues appropriate for the term of the Company’s stock options or<br />

purchase offerings.<br />

SFAS 123R requires the Company to estimate forfeitures at the time of grant and to revise those estimates in subsequent periods if actual<br />

forfeitures differ from those estimates. The Company uses historical data to estimate pre-vesting option forfeitures and records share-based<br />

<strong>com</strong>pensation expense only for those awards that are expected to vest. For purposes of calculating pro forma information under SFAS 123 for<br />

periods prior to April 1, 2006, forfeitures were recognized as they occurred.<br />

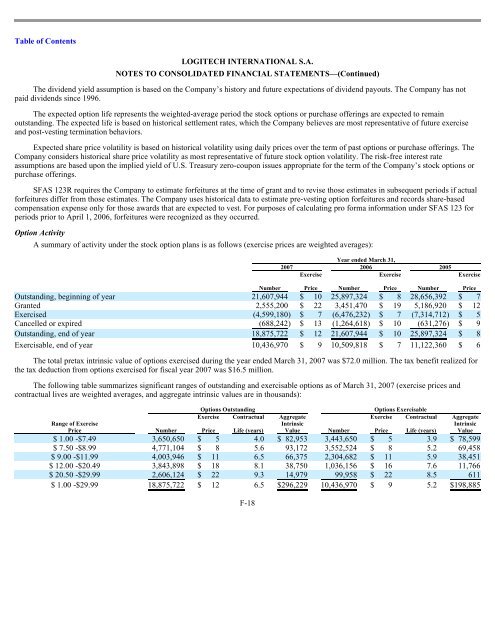

Option Activity<br />

A summary of activity under the stock option plans is as follows (exercise prices are weighted averages):<br />

The total pretax intrinsic value of options exercised during the year ended March 31, 2007 was $72.0 million. The tax benefit realized for<br />

the tax deduction from options exercised for fiscal year 2007 was $16.5 million.<br />

The following table summarizes significant ranges of outstanding and exercisable options as of March 31, 2007 (exercise prices and<br />

contractual lives are weighted averages, and aggregate intrinsic values are in thousands):<br />

F-18<br />

Number<br />

2007<br />

Year ended March 31,<br />

2006 2005<br />

Exercise<br />

Exercise<br />

Price Number<br />

Price Number<br />

Outstanding, beginning of year 21,607,944 $ 10 25,897,324 $ 8 28,656,392 $ 7<br />

Granted 2,555,200 $ 22 3,451,470 $ 19 5,186,920 $ 12<br />

Exercised (4,599,180 ) $ 7 (6,476,232 ) $ 7 (7,314,712 ) $ 5<br />

Cancelled or expired (688,242 ) $ 13 (1,264,618 ) $ 10 (631,276 ) $ 9<br />

Outstanding, end of year 18,875,722 $ 12 21,607,944 $ 10 25,897,324 $ 8<br />

Exercisable, end of year 10,436,970 $ 9 10,509,818 $ 7 11,122,360 $ 6<br />

Range of Exercise<br />

Price Number<br />

Options Outstanding Options Exercisable<br />

Exercise Contractual Aggregate<br />

Intrinsic<br />

Exercise Contractual<br />

Price Life (years) Value Number Price Life (years)<br />

Exercise<br />

Price<br />

Aggregate<br />

Intrinsic<br />

Value<br />

$ 1.00 -$7.49 3,650,650 $ 5 4.0 $ 82,953 3,443,650 $ 5 3.9 $ 78,599<br />

$ 7.50 -$8.99 4,771,104 $ 8 5.6 93,172 3,552,524 $ 8 5.2 69,458<br />

$ 9.00 -$11.99 4,003,946 $ 11 6.5 66,375 2,304,682 $ 11 5.9 38,451<br />

$ 12.00 -$20.49 3,843,898 $ 18 8.1 38,750 1,036,156 $ 16 7.6 11,766<br />

$ 20.50 -$29.99 2,606,124 $ 22 9.3 14,979 99,958 $ 22 8.5 611<br />

$ 1.00 -$29.99 18,875,722 $ 12 6.5 $ 296,229 10,436,970 $ 9 5.2 $ 198,885