LOGITECH INTERNATIONAL SA - Shareholder.com

LOGITECH INTERNATIONAL SA - Shareholder.com

LOGITECH INTERNATIONAL SA - Shareholder.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Table of Contents<br />

<strong>LOGITECH</strong> <strong>INTERNATIONAL</strong> S.A.<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)<br />

jurisdictions different than projected, the Company could be required to increase the valuation allowance for deferred tax assets. This would<br />

result in an increase in the Company’s effective tax rate.<br />

Deferred tax assets relating to tax benefits of employee stock option grants have been reduced to reflect the exercises in fiscal year 2007.<br />

Some exercises resulted in tax deductions in excess of previously recorded benefits based on the option value at the time of grant (“windfalls”).<br />

Although these additional tax benefits are reflected in net operating loss carryforwards, pursuant to SFAS 123(R), the additional tax benefit<br />

associated with the windfall is not recognized until the deduction reduces cash taxes payable. When the tax benefit reduces cash taxes payable,<br />

the Company will credit equity. During fiscal year 2007, the Company recorded a credit to equity of $14.7 million. As of March 31, 2007, the<br />

net operating loss and tax credit carryforwards related to unrecognized tax benefits of $47.2 million are not reflected in the Company’s deferred<br />

tax assets. Substantially all of the Company’s foreign net operating loss and tax credit carryforwards for in<strong>com</strong>e tax purposes of $100.6 million<br />

and $8.3 million are related to stock options. If not utilized, the net operating loss carryforwards will expire in fiscal years 2019 to 2026, and<br />

the tax credit carryforwards will expire in fiscal years 2008 to 2027.<br />

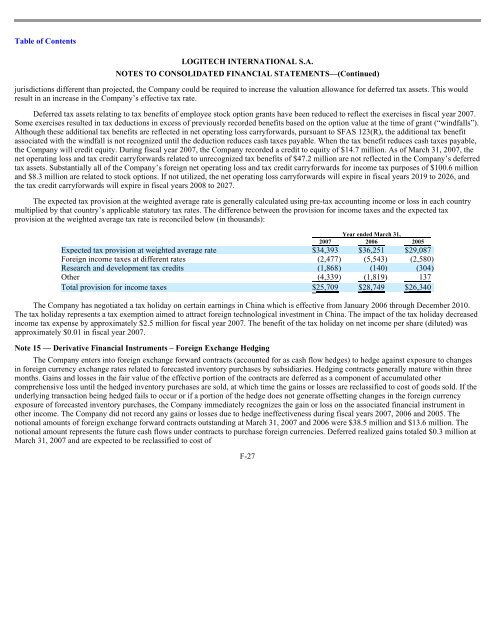

The expected tax provision at the weighted average rate is generally calculated using pre-tax accounting in<strong>com</strong>e or loss in each country<br />

multiplied by that country’s applicable statutory tax rates. The difference between the provision for in<strong>com</strong>e taxes and the expected tax<br />

provision at the weighted average tax rate is reconciled below (in thousands):<br />

Year ended March 31,<br />

2007 2006 2005<br />

Expected tax provision at weighted average rate $ 34,393 $ 36,251 $ 29,087<br />

Foreign in<strong>com</strong>e taxes at different rates (2,477 ) (5,543 ) (2,580 )<br />

Research and development tax credits (1,868 ) (140 ) (304 )<br />

Other (4,339 ) (1,819 ) 137<br />

Total provision for in<strong>com</strong>e taxes $ 25,709 $ 28,749 $ 26,340<br />

The Company has negotiated a tax holiday on certain earnings in China which is effective from January 2006 through December 2010.<br />

The tax holiday represents a tax exemption aimed to attract foreign technological investment in China. The impact of the tax holiday decreased<br />

in<strong>com</strong>e tax expense by approximately $2.5 million for fiscal year 2007. The benefit of the tax holiday on net in<strong>com</strong>e per share (diluted) was<br />

approximately $0.01 in fiscal year 2007.<br />

Note 15 — Derivative Financial Instruments – Foreign Exchange Hedging<br />

The Company enters into foreign exchange forward contracts (accounted for as cash flow hedges) to hedge against exposure to changes<br />

in foreign currency exchange rates related to forecasted inventory purchases by subsidiaries. Hedging contracts generally mature within three<br />

months. Gains and losses in the fair value of the effective portion of the contracts are deferred as a <strong>com</strong>ponent of accumulated other<br />

<strong>com</strong>prehensive loss until the hedged inventory purchases are sold, at which time the gains or losses are reclassified to cost of goods sold. If the<br />

underlying transaction being hedged fails to occur or if a portion of the hedge does not generate offsetting changes in the foreign currency<br />

exposure of forecasted inventory purchases, the Company immediately recognizes the gain or loss on the associated financial instrument in<br />

other in<strong>com</strong>e. The Company did not record any gains or losses due to hedge ineffectiveness during fiscal years 2007, 2006 and 2005. The<br />

notional amounts of foreign exchange forward contracts outstanding at March 31, 2007 and 2006 were $38.5 million and $13.6 million. The<br />

notional amount represents the future cash flows under contracts to purchase foreign currencies. Deferred realized gains totaled $0.3 million at<br />

March 31, 2007 and are expected to be reclassified to cost of<br />

F-27