LOGITECH INTERNATIONAL SA - Shareholder.com

LOGITECH INTERNATIONAL SA - Shareholder.com

LOGITECH INTERNATIONAL SA - Shareholder.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Table of Contents<br />

<strong>LOGITECH</strong> <strong>INTERNATIONAL</strong> S.A.<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)<br />

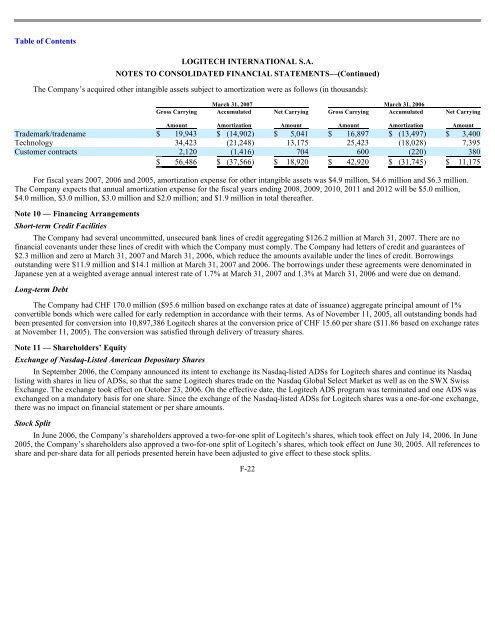

The Company’s acquired other intangible assets subject to amortization were as follows (in thousands):<br />

For fiscal years 2007, 2006 and 2005, amortization expense for other intangible assets was $4.9 million, $4.6 million and $6.3 million.<br />

The Company expects that annual amortization expense for the fiscal years ending 2008, 2009, 2010, 2011 and 2012 will be $5.0 million,<br />

$4.0 million, $3.0 million, $3.0 million and $2.0 million; and $1.9 million in total thereafter.<br />

Note 10 — Financing Arrangements<br />

Gross Carrying<br />

Amount<br />

March 31, 2007 March 31, 2006<br />

Accumulated Net Carrying Gross Carrying Accumulated<br />

Amortization<br />

Amount<br />

Amount<br />

Amortization<br />

Net Carrying<br />

Trademark/tradename $ 19,943 $ (14,902 ) $ 5,041 $ 16,897 $ (13,497 ) $ 3,400<br />

Technology 34,423 (21,248 ) 13,175 25,423 (18,028 ) 7,395<br />

Customer contracts 2,120 (1,416 ) 704 600 (220 ) 380<br />

$ 56,486 $ (37,566 ) $ 18,920 $ 42,920 $ (31,745 ) $ 11,175<br />

Short-term Credit Facilities<br />

The Company had several un<strong>com</strong>mitted, unsecured bank lines of credit aggregating $126.2 million at March 31, 2007. There are no<br />

financial covenants under these lines of credit with which the Company must <strong>com</strong>ply. The Company had letters of credit and guarantees of<br />

$2.3 million and zero at March 31, 2007 and March 31, 2006, which reduce the amounts available under the lines of credit. Borrowings<br />

outstanding were $11.9 million and $14.1 million at March 31, 2007 and 2006. The borrowings under these agreements were denominated in<br />

Japanese yen at a weighted average annual interest rate of 1.7% at March 31, 2007 and 1.3% at March 31, 2006 and were due on demand.<br />

Long-term Debt<br />

The Company had CHF 170.0 million ($95.6 million based on exchange rates at date of issuance) aggregate principal amount of 1%<br />

convertible bonds which were called for early redemption in accordance with their terms. As of November 11, 2005, all outstanding bonds had<br />

been presented for conversion into 10,897,386 Logitech shares at the conversion price of CHF 15.60 per share ($11.86 based on exchange rates<br />

at November 11, 2005). The conversion was satisfied through delivery of treasury shares.<br />

Note 11 — <strong>Shareholder</strong>s’ Equity<br />

Exchange of Nasdaq-Listed American Depositary Shares<br />

In September 2006, the Company announced its intent to exchange its Nasdaq-listed ADSs for Logitech shares and continue its Nasdaq<br />

listing with shares in lieu of ADSs, so that the same Logitech shares trade on the Nasdaq Global Select Market as well as on the SWX Swiss<br />

Exchange. The exchange took effect on October 23, 2006. On the effective date, the Logitech ADS program was terminated and one ADS was<br />

exchanged on a mandatory basis for one share. Since the exchange of the Nasdaq-listed ADSs for Logitech shares was a one-for-one exchange,<br />

there was no impact on financial statement or per share amounts.<br />

Stock Split<br />

In June 2006, the Company’s shareholders approved a two-for-one split of Logitech’s shares, which took effect on July 14, 2006. In June<br />

2005, the Company’s shareholders also approved a two-for-one split of Logitech’s shares, which took effect on June 30, 2005. All references to<br />

share and per-share data for all periods presented herein have been adjusted to give effect to these stock splits.<br />

F-22<br />

Amount