LOGITECH INTERNATIONAL SA - Shareholder.com

LOGITECH INTERNATIONAL SA - Shareholder.com

LOGITECH INTERNATIONAL SA - Shareholder.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Table of Contents<br />

Interest In<strong>com</strong>e, Net<br />

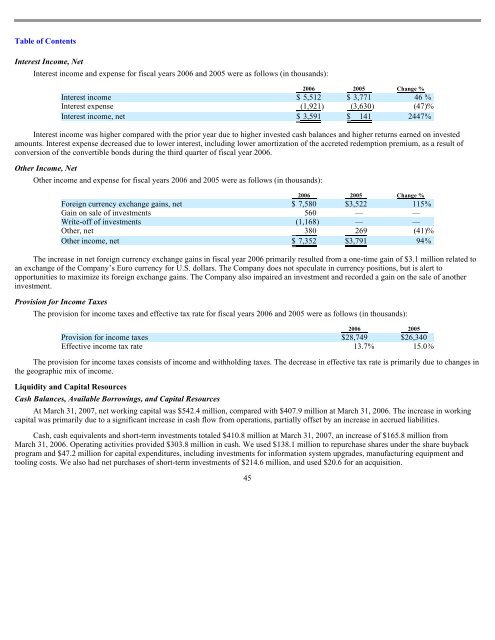

Interest in<strong>com</strong>e and expense for fiscal years 2006 and 2005 were as follows (in thousands):<br />

Interest in<strong>com</strong>e was higher <strong>com</strong>pared with the prior year due to higher invested cash balances and higher returns earned on invested<br />

amounts. Interest expense decreased due to lower interest, including lower amortization of the accreted redemption premium, as a result of<br />

conversion of the convertible bonds during the third quarter of fiscal year 2006.<br />

Other In<strong>com</strong>e, Net<br />

2006 2005 Change %<br />

Interest in<strong>com</strong>e $ 5,512 $ 3,771 46 %<br />

Interest expense (1,921 ) (3,630 ) (47 )%<br />

Interest in<strong>com</strong>e, net $ 3,591 $ 141 2447 %<br />

Other in<strong>com</strong>e and expense for fiscal years 2006 and 2005 were as follows (in thousands):<br />

2006 2005 Change %<br />

Foreign currency exchange gains, net $ 7,580 $ 3,522 115 %<br />

Gain on sale of investments 560 — —<br />

Write-off of investments (1,168 ) — —<br />

Other, net 380 269 (41 )%<br />

Other in<strong>com</strong>e, net $ 7,352 $ 3,791 94 %<br />

The increase in net foreign currency exchange gains in fiscal year 2006 primarily resulted from a one-time gain of $3.1 million related to<br />

an exchange of the Company’s Euro currency for U.S. dollars. The Company does not speculate in currency positions, but is alert to<br />

opportunities to maximize its foreign exchange gains. The Company also impaired an investment and recorded a gain on the sale of another<br />

investment.<br />

Provision for In<strong>com</strong>e Taxes<br />

The provision for in<strong>com</strong>e taxes and effective tax rate for fiscal years 2006 and 2005 were as follows (in thousands):<br />

2006 2005<br />

Provision for in<strong>com</strong>e taxes $ 28,749 $ 26,340<br />

Effective in<strong>com</strong>e tax rate 13.7 % 15.0 %<br />

The provision for in<strong>com</strong>e taxes consists of in<strong>com</strong>e and withholding taxes. The decrease in effective tax rate is primarily due to changes in<br />

the geographic mix of in<strong>com</strong>e.<br />

Liquidity and Capital Resources<br />

Cash Balances, Available Borrowings, and Capital Resources<br />

At March 31, 2007, net working capital was $542.4 million, <strong>com</strong>pared with $407.9 million at March 31, 2006. The increase in working<br />

capital was primarily due to a significant increase in cash flow from operations, partially offset by an increase in accrued liabilities.<br />

Cash, cash equivalents and short-term investments totaled $410.8 million at March 31, 2007, an increase of $165.8 million from<br />

March 31, 2006. Operating activities provided $303.8 million in cash. We used $138.1 million to repurchase shares under the share buyback<br />

program and $47.2 million for capital expenditures, including investments for information system upgrades, manufacturing equipment and<br />

tooling costs. We also had net purchases of short-term investments of $214.6 million, and used $20.6 for an acquisition.<br />

45