2010 Access Bank Annual Report and Accounts

2010 Access Bank Annual Report and Accounts

2010 Access Bank Annual Report and Accounts

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong><br />

Introduction & Business Chairman & Chief Operating Our People Corporate Social<br />

Contents Overview Executive’s Review Review & Culture Responsibility<br />

At a glance<br />

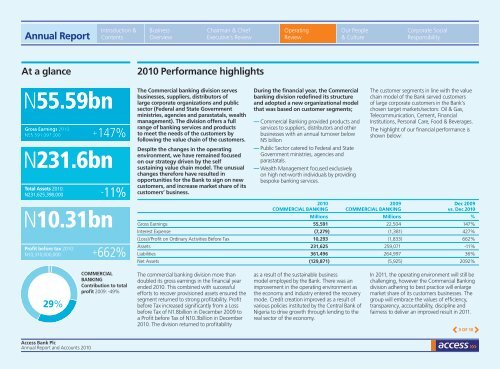

<strong>2010</strong> Performance highlights<br />

N55.59bn<br />

Gross Earnings <strong>2010</strong>:<br />

N55,591,097,000<br />

Total Assets <strong>2010</strong>:<br />

N231,625,398,000<br />

Profit before tax <strong>2010</strong>:<br />

N10,310,000,000<br />

+147%<br />

N231.6bn<br />

N10.31bn<br />

-11%<br />

+662%<br />

The Commercial banking division serves<br />

businesses, suppliers, distributors of<br />

large corporate organizations <strong>and</strong> public<br />

sector (Federal <strong>and</strong> State Government<br />

ministries, agencies <strong>and</strong> parastatals, wealth<br />

management). The division offers a full<br />

range of banking services <strong>and</strong> products<br />

to meet the needs of the customers by<br />

following the value chain of the customers.<br />

Despite the changes in the operating<br />

environment, we have remained focused<br />

on our strategy driven by the self<br />

sustaining value chain model. The unusual<br />

changes therefore have resulted in<br />

opportunities for the <strong>Bank</strong> to sign on new<br />

customers, <strong>and</strong> increase market share of its<br />

customers’ business.<br />

During the financial year, the Commercial<br />

banking division redefined its structure<br />

<strong>and</strong> adopted a new organizational model<br />

that was based on customer segments;<br />

— Commercial <strong>Bank</strong>ing provided products <strong>and</strong><br />

services to suppliers, distributors <strong>and</strong> other<br />

businesses with an annual turnover below<br />

N5 billion<br />

— Public Sector catered to Federal <strong>and</strong> State<br />

Government ministries, agencies <strong>and</strong><br />

parastatals.<br />

— Wealth Management focused exclusively<br />

on high net-worth individuals by providing<br />

bespoke banking services.<br />

The customer segments in line with the value<br />

chain model of the <strong>Bank</strong> served customers<br />

of large corporate customers in the <strong>Bank</strong>’s<br />

chosen target markets/sectors: Oil & Gas,<br />

Telecommunication, Cement, Financial<br />

Institutions, Personal Care, Food & Beverages.<br />

The highlight of our financial performance is<br />

shown below:<br />

<strong>2010</strong> 2009 Dec 2009<br />

COMMERCIAL BANKING COMMERCIAL BANKING vs. Dec <strong>2010</strong><br />

Millions Millions %<br />

Gross Earnings 55,591 22,504 147%<br />

Interest Expense (7,279) (1,381) 427%<br />

(Loss)/Profit on Ordinary Activities Before Tax 10,293 (1,833) 662%<br />

Assets 231,625 259,071 -11%<br />

Liabilities 361,496 264,997 36%<br />

Net Assets (129,871) (5,925) 2092%<br />

29%<br />

Commercial<br />

<strong>Bank</strong>ing<br />

Contribution to total<br />

profit 2009: -49%<br />

The commercial banking division more than<br />

doubled its gross earnings in the financial year<br />

ended <strong>2010</strong>. This combined with successful<br />

efforts to recover provisioned assets ensured the<br />

segment returned to strong profitability. Profit<br />

before Tax increased significantly from a Loss<br />

before Tax of N1.8billion in December 2009 to<br />

a Profit before Tax of N10.3billion in December<br />

<strong>2010</strong>. The division returned to profitability<br />

as a result of the sustainable business<br />

model employed by the <strong>Bank</strong>. There was an<br />

improvement in the operating environment as<br />

the economy <strong>and</strong> industry entered the recovery<br />

mode. Credit creation improved as a result of<br />

various policies instituted by the Central <strong>Bank</strong> of<br />

Nigeria to drive growth through lending to the<br />

real sector of the economy.<br />

In 2011, the operating environment will still be<br />

challenging, however the Commercial <strong>Bank</strong>ing<br />

division adhering to best practice will enlarge<br />

market share of its customers businesses. The<br />

group will embrace the values of efficiency,<br />

transparency, accountability, discipline <strong>and</strong><br />

fairness to deliver an improved result in 2011.<br />

3 OF 10<br />

<strong>Access</strong> <strong>Bank</strong> Plc<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2010</strong>