2010 Access Bank Annual Report and Accounts

2010 Access Bank Annual Report and Accounts

2010 Access Bank Annual Report and Accounts

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Annual</strong> <strong>Report</strong><br />

Introduction & Business Chairman & Chief Operating Our People Corporate Social<br />

Contents Overview Executive’s Review Review & Culture Responsibility<br />

At a glance<br />

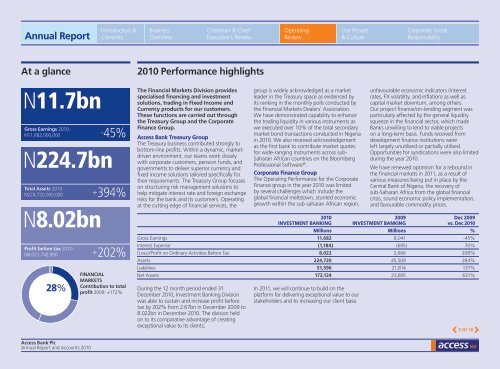

<strong>2010</strong> Performance highlights<br />

N11.7bn<br />

Gross Earnings <strong>2010</strong>:<br />

N11,682,000,000<br />

N224.7bn<br />

Total Assets <strong>2010</strong>:<br />

N224,720,000,000<br />

N8.02bn<br />

Profit before tax <strong>2010</strong>:<br />

N8,021,742,900<br />

28%<br />

-45%<br />

+394%<br />

+202%<br />

FINANCIAL<br />

MARKETS<br />

Contribution to total<br />

profit 2009: +172%<br />

The Financial Markets Division provides<br />

specialised financing <strong>and</strong> investment<br />

solutions, trading in Fixed Income <strong>and</strong><br />

Currency products for our customers.<br />

These functions are carried out through<br />

the Treasury Group <strong>and</strong> the Corporate<br />

Finance Group.<br />

<strong>Access</strong> <strong>Bank</strong> Treasury Group<br />

The Treasury business contributed strongly to<br />

bottom-line profits. Within a dynamic, marketdriven<br />

environment, our teams work closely<br />

with corporate customers, pension funds, <strong>and</strong><br />

governments to deliver superior currency <strong>and</strong><br />

fixed income solutions tailored specifically for<br />

their requirements. The Treasury Group focuses<br />

on structuring risk management solutions to<br />

help mitigate interest rate <strong>and</strong> foreign exchange<br />

risks for the bank <strong>and</strong> its customers. Operating<br />

at the cutting edge of financial services, the<br />

During the 12 month period ended 31<br />

December <strong>2010</strong>, Investment <strong>Bank</strong>ing Division<br />

was able to sustain <strong>and</strong> increase profit before<br />

tax by 202% from 2.67bn in December 2009 to<br />

8.022bn in December <strong>2010</strong>. The division held<br />

on to its comparative advantage of creating<br />

exceptional value to its clients;<br />

group is widely acknowledged as a market<br />

leader in the Treasury space as evidenced by<br />

its ranking in the monthly polls conducted by<br />

the Financial Markets Dealers’ Association.<br />

We have demonstrated capability to enhance<br />

the trading liquidity in various instruments as<br />

we executed over 10% of the total secondary<br />

market bond transactions conducted in Nigeria<br />

in <strong>2010</strong>. We also received acknowledgement<br />

as the first bank to contribute market quotes<br />

for wide-ranging instruments across sub-<br />

Saharan African countries on the Bloomberg<br />

Professional Software ® .<br />

Corporate Finance Group<br />

The Operating Performance for the Corporate<br />

Finance group in the year <strong>2010</strong> was limited<br />

by several challenges which include the<br />

global financial meltdown, stunted economic<br />

growth within the sub-saharan African region,<br />

In 2011, we will continue to build on the<br />

platform for delivering exceptional value to our<br />

stakeholders <strong>and</strong> to increasing our client base.<br />

unfavourable economic indicators (interest<br />

rates, FX volatility, <strong>and</strong> inflation) as well as<br />

capital market downturn, among others.<br />

Our project finance/on-lending segment was<br />

particularly affected by the general liquidity<br />

squeeze in the financial sector, which made<br />

<strong>Bank</strong>s unwilling to lend to viable projects<br />

on a long-term basis. Funds received from<br />

development finance institutions were<br />

left largely unutilised or partially utilised.<br />

Opportunities for syndications were also limited<br />

during the year <strong>2010</strong>.<br />

We have renewed optimism for a rebound in<br />

the financial markets in 2011, as a result of<br />

various measures being put in place by the<br />

Central <strong>Bank</strong> of Nigeria, the recovery of<br />

sub-Saharan Africa from the global financial<br />

crisis, sound economic policy implementation,<br />

<strong>and</strong> favourable commodity prices.<br />

<strong>2010</strong> 2009 Dec 2009<br />

INVESTMENT BANKING INVESTMENT BANKING vs. Dec <strong>2010</strong><br />

Millions Millions %<br />

Gross Earnings 11,682 8,041 -45%<br />

Interest Expense (1,184) (695) 70%<br />

(Loss)/Profit on Ordinary Activities Before Tax 8,022 2,666 208%<br />

Assets 224,720 45,509 394%<br />

Liabilities 51,596 21,814 137%<br />

Net Assets 173,124 23,695 631%<br />

5 OF 10<br />

<strong>Access</strong> <strong>Bank</strong> Plc<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2010</strong>