2010 Access Bank Annual Report and Accounts

2010 Access Bank Annual Report and Accounts

2010 Access Bank Annual Report and Accounts

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Annual</strong> <strong>Report</strong><br />

Introduction & Business Chairman & Chief Operating Our People Corporate Social<br />

Contents Overview Executive’s Review Review & Culture Responsibility<br />

At a glance<br />

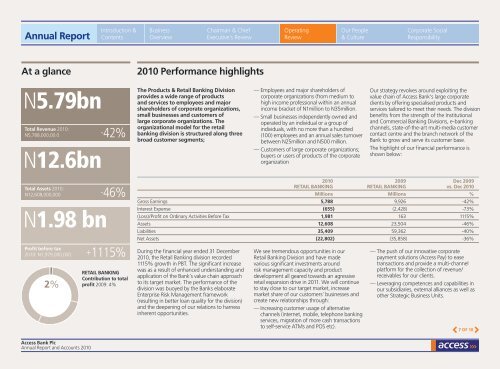

<strong>2010</strong> Performance highlights<br />

N5.79bn<br />

Total Revenue <strong>2010</strong>:<br />

N5,788,000,00.0<br />

N12.6bn<br />

-42%<br />

The Products & Retail <strong>Bank</strong>ing Division<br />

provides a wide range of products<br />

<strong>and</strong> services to employees <strong>and</strong> major<br />

shareholders of corporate organizations,<br />

small businesses <strong>and</strong> customers of<br />

large corporate organizations. The<br />

organizational model for the retail<br />

banking division is structured along three<br />

broad customer segments;<br />

— Employees <strong>and</strong> major shareholders of<br />

corporate organizations (from medium to<br />

high income professional within an annual<br />

income bracket of N1million to N35million.<br />

— Small businesses independently owned <strong>and</strong><br />

operated by an individual or a group of<br />

individuals, with no more than a hundred<br />

(100) employees <strong>and</strong> an annual sales turnover<br />

between N25million <strong>and</strong> N500 million.<br />

— Customers of large corporate organizations;<br />

buyers or users of products of the corporate<br />

organization<br />

Our strategy revolves around exploiting the<br />

value chain of <strong>Access</strong> <strong>Bank</strong>’s large corporate<br />

clients by offering specialised products <strong>and</strong><br />

services tailored to meet their needs. The division<br />

benefits from the strength of the Institutional<br />

<strong>and</strong> Commercial <strong>Bank</strong>ing Divisions, e-banking<br />

channels, state-of-the-art multi-media customer<br />

contact centre <strong>and</strong> the branch network of the<br />

<strong>Bank</strong> to grow <strong>and</strong> serve its customer base.<br />

The highlight of our financial performance is<br />

shown below:<br />

Total Assets <strong>2010</strong>:<br />

N12,608,000,000<br />

N1.98 bn<br />

Profit before tax<br />

<strong>2010</strong>: N1,979,000,000<br />

2%<br />

-46%<br />

+1115%<br />

RETAIl <strong>Bank</strong>ing<br />

Contribution to total<br />

profit 2009: 4%<br />

During the financial year ended 31 December<br />

<strong>2010</strong>, the Retail <strong>Bank</strong>ing division recorded<br />

1115% growth in PBT. The significant increase<br />

was as a result of enhanced underst<strong>and</strong>ing <strong>and</strong><br />

application of the <strong>Bank</strong>’s value chain approach<br />

to its target market. The performance of the<br />

division was buoyed by the <strong>Bank</strong>s elaborate<br />

Enterprise Risk Management framework<br />

(resulting in better loan quality for the division)<br />

<strong>and</strong> the deepening of our relations to harness<br />

inherent opportunities.<br />

<strong>2010</strong> 2009 Dec 2009<br />

RETAIL BANKING RETAIL BANKING vs. Dec <strong>2010</strong><br />

We see tremendous opportunities in our<br />

Retail <strong>Bank</strong>ing Division <strong>and</strong> have made<br />

various significant investments around<br />

risk management capacity <strong>and</strong> product<br />

development all geared towards an agressive<br />

retail expansion drive in 2011. We will continue<br />

to stay close to our target market, increase<br />

market share of our customers’ businesses <strong>and</strong><br />

create new relationships through:<br />

— Increasing customer usage of alternative<br />

channels (internet, mobile, telephone banking<br />

services, migration of more cash transactions<br />

to self-service ATMs <strong>and</strong> POS etc).<br />

Millions Millions %<br />

Gross Earnings 5,788 9,926 -42%<br />

Interest Expense (655) (2,428) -73%<br />

(Loss)/Profit on Ordinary Activities Before Tax 1,981 163 1115%<br />

Assets 12,608 23,504 -46%<br />

Liabilities 35,409 59,362 -40%<br />

Net Assets (22,802) (35,858) -36%<br />

— The push of our innovative corporate<br />

payment solutions (<strong>Access</strong> Pay) to ease<br />

transactions <strong>and</strong> provide a multi-channel<br />

platform for the collection of revenue/<br />

receivables for our clients.<br />

— Leveraging competences <strong>and</strong> capabilities in<br />

our subsidiaries, external alliances as well as<br />

other Strategic Business Units.<br />

7 OF 10<br />

<strong>Access</strong> <strong>Bank</strong> Plc<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2010</strong>