CFOs: Surviving in a New Era - AGA

CFOs: Surviving in a New Era - AGA

CFOs: Surviving in a New Era - AGA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

13<br />

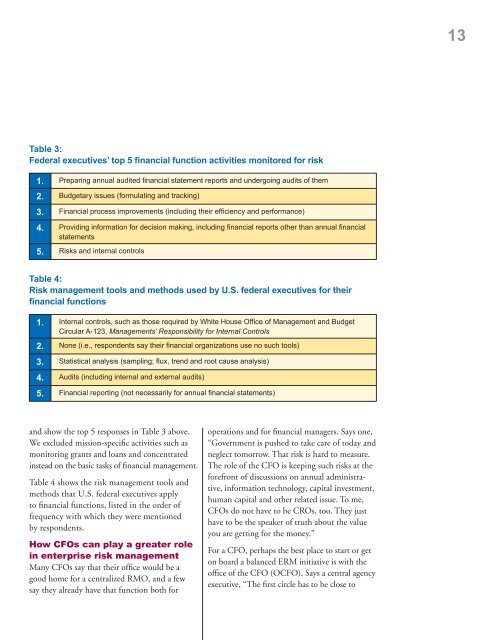

Table 3:<br />

Federal executives’ top 5 f<strong>in</strong>ancial function activities monitored for risk<br />

1. Prepar<strong>in</strong>g annual audited f<strong>in</strong>ancial statement reports and undergo<strong>in</strong>g audits of them<br />

2. Budgetary issues (formulat<strong>in</strong>g and track<strong>in</strong>g)<br />

3. F<strong>in</strong>ancial process improvements (<strong>in</strong>clud<strong>in</strong>g their efficiency and performance)<br />

4. Provid<strong>in</strong>g <strong>in</strong>formation for decision mak<strong>in</strong>g, <strong>in</strong>clud<strong>in</strong>g f<strong>in</strong>ancial reports other than annual f<strong>in</strong>ancial<br />

statements<br />

5. Risks and <strong>in</strong>ternal controls<br />

Table 4:<br />

Risk management tools and methods used by U.S. federal executives for their<br />

f<strong>in</strong>ancial functions<br />

1. Internal controls, such as those required by White House Office of Management and Budget<br />

Circular A-123, Managements’ Responsibility for Internal Controls<br />

2. None (i.e., respondents say their f<strong>in</strong>ancial organizations use no such tools)<br />

3. Statistical analysis (sampl<strong>in</strong>g; flux, trend and root cause analysis)<br />

4. Audits (<strong>in</strong>clud<strong>in</strong>g <strong>in</strong>ternal and external audits)<br />

5. F<strong>in</strong>ancial report<strong>in</strong>g (not necessarily for annual f<strong>in</strong>ancial statements)<br />

and show the top 5 responses <strong>in</strong> Table 3 above.<br />

We excluded mission-specific activities such as<br />

monitor<strong>in</strong>g grants and loans and concentrated<br />

<strong>in</strong>stead on the basic tasks of f<strong>in</strong>ancial management.<br />

Table 4 shows the risk management tools and<br />

methods that U.S. federal executives apply<br />

to f<strong>in</strong>ancial functions, listed <strong>in</strong> the order of<br />

frequency with which they were mentioned<br />

by respondents.<br />

How <strong>CFOs</strong> can play a greater role<br />

<strong>in</strong> enterprise risk management<br />

Many <strong>CFOs</strong> say that their office would be a<br />

good home for a centralized RMO, and a few<br />

say they already have that function both for<br />

operations and for f<strong>in</strong>ancial managers. Says one,<br />

“Government is pushed to take care of today and<br />

neglect tomorrow. That risk is hard to measure.<br />

The role of the CFO is keep<strong>in</strong>g such risks at the<br />

forefront of discussions on annual adm<strong>in</strong>istrative,<br />

<strong>in</strong>formation technology, capital <strong>in</strong>vestment,<br />

human capital and other related issue. To me,<br />

<strong>CFOs</strong> do not have to be CROs, too. They just<br />

have to be the speaker of truth about the value<br />

you are gett<strong>in</strong>g for the money.”<br />

For a CFO, perhaps the best place to start or get<br />

on board a balanced ERM <strong>in</strong>itiative is with the<br />

office of the CFO (OCFO). Says a central agency<br />

executive, “The first circle has to be close to