CFOs: Surviving in a New Era - AGA

CFOs: Surviving in a New Era - AGA

CFOs: Surviving in a New Era - AGA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

14<br />

home — it should be the basic CFO responsibilities,<br />

fundamentals like <strong>in</strong>ternal control over basic<br />

account<strong>in</strong>g. Deal with th<strong>in</strong>gs <strong>in</strong>side your shop<br />

first, and then go outside. Next, look for where<br />

your entity is hemorrhag<strong>in</strong>g money or hav<strong>in</strong>g<br />

other problems that could be mitigated by f<strong>in</strong>ancial<br />

management approaches, skills and tools.”<br />

“We need good estimation models of how much th<strong>in</strong>gs will cost,<br />

the outlays and what are the outcomes. We must make sure to<br />

keep track of funds weekly so that we do not spend more than<br />

we th<strong>in</strong>k we will have. ”<br />

— a state f<strong>in</strong>ancial executive<br />

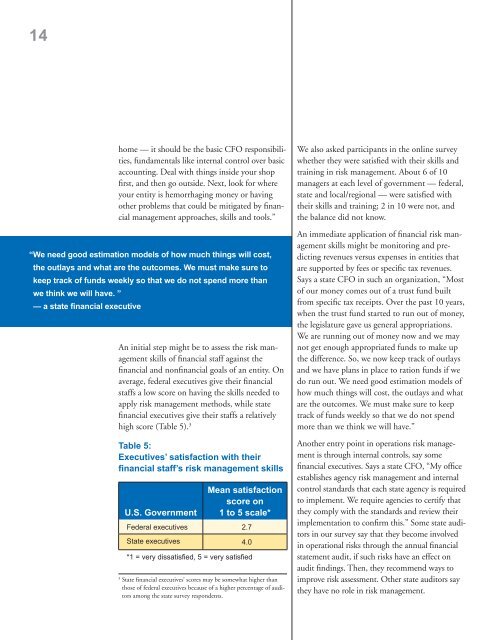

An <strong>in</strong>itial step might be to assess the risk management<br />

skills of f<strong>in</strong>ancial staff aga<strong>in</strong>st the<br />

f<strong>in</strong>ancial and nonf<strong>in</strong>ancial goals of an entity. On<br />

average, federal executives give their f<strong>in</strong>ancial<br />

staffs a low score on hav<strong>in</strong>g the skills needed to<br />

apply risk management methods, while state<br />

f<strong>in</strong>ancial executives give their staffs a relatively<br />

high score (Table 5). 3<br />

Table 5:<br />

Executives’ satisfaction with their<br />

f<strong>in</strong>ancial staff’s risk management skills<br />

U.S. Government<br />

Mean satisfaction<br />

score on<br />

1 to 5 scale*<br />

Federal executives 2.7<br />

State executives 4.0<br />

*1 = very dissatisfied, 5 = very satisfied<br />

3<br />

State f<strong>in</strong>ancial executives’ scores may be somewhat higher than<br />

those of federal executives because of a higher percentage of auditors<br />

among the state survey respondents.<br />

We also asked participants <strong>in</strong> the onl<strong>in</strong>e survey<br />

whether they were satisfied with their skills and<br />

tra<strong>in</strong><strong>in</strong>g <strong>in</strong> risk management. About 6 of 10<br />

managers at each level of government — federal,<br />

state and local/regional — were satisfied with<br />

their skills and tra<strong>in</strong><strong>in</strong>g; 2 <strong>in</strong> 10 were not, and<br />

the balance did not know.<br />

An immediate application of f<strong>in</strong>ancial risk management<br />

skills might be monitor<strong>in</strong>g and predict<strong>in</strong>g<br />

revenues versus expenses <strong>in</strong> entities that<br />

are supported by fees or specific tax revenues.<br />

Says a state CFO <strong>in</strong> such an organization, “Most<br />

of our money comes out of a trust fund built<br />

from specific tax receipts. Over the past 10 years,<br />

when the trust fund started to run out of money,<br />

the legislature gave us general appropriations.<br />

We are runn<strong>in</strong>g out of money now and we may<br />

not get enough appropriated funds to make up<br />

the difference. So, we now keep track of outlays<br />

and we have plans <strong>in</strong> place to ration funds if we<br />

do run out. We need good estimation models of<br />

how much th<strong>in</strong>gs will cost, the outlays and what<br />

are the outcomes. We must make sure to keep<br />

track of funds weekly so that we do not spend<br />

more than we th<strong>in</strong>k we will have.”<br />

Another entry po<strong>in</strong>t <strong>in</strong> operations risk management<br />

is through <strong>in</strong>ternal controls, say some<br />

f<strong>in</strong>ancial executives. Says a state CFO, “My office<br />

establishes agency risk management and <strong>in</strong>ternal<br />

control standards that each state agency is required<br />

to implement. We require agencies to certify that<br />

they comply with the standards and review their<br />

implementation to confirm this.” Some state auditors<br />

<strong>in</strong> our survey say that they become <strong>in</strong>volved<br />

<strong>in</strong> operational risks through the annual f<strong>in</strong>ancial<br />

statement audit, if such risks have an effect on<br />

audit f<strong>in</strong>d<strong>in</strong>gs. Then, they recommend ways to<br />

improve risk assessment. Other state auditors say<br />

they have no role <strong>in</strong> risk management.