Annual Report 2002 - Agfa

Annual Report 2002 - Agfa

Annual Report 2002 - Agfa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

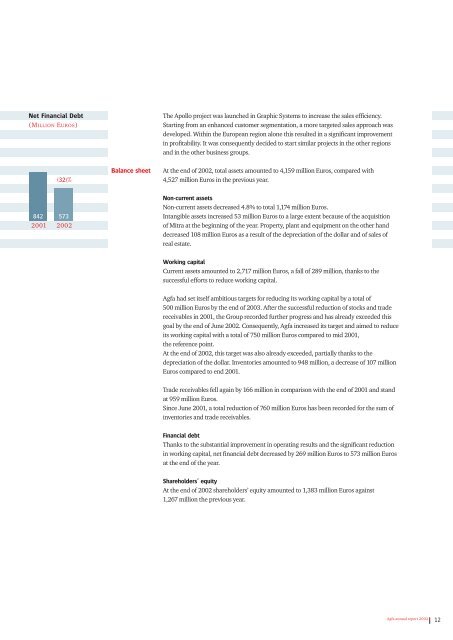

Net Financial Debt<br />

(MILLION EUROS)<br />

(32)%<br />

Balance sheet<br />

The Apollo project was launched in Graphic Systems to increase the sales efficiency.<br />

Starting from an enhanced customer segmentation, a more targeted sales approach was<br />

developed. Within the European region alone this resulted in a significant improvement<br />

in profitability. It was consequently decided to start similar projects in the other regions<br />

and in the other business groups.<br />

At the end of <strong>2002</strong>, total assets amounted to 4,159 million Euros, compared with<br />

4,527 million Euros in the previous year.<br />

842 573<br />

2001 <strong>2002</strong><br />

Non-current assets<br />

Non-current assets decreased 4.8% to total 1,174 million Euros.<br />

Intangible assets increased 53 million Euros to a large extent because of the acquisition<br />

of Mitra at the beginning of the year. Property, plant and equipment on the other hand<br />

decreased 108 million Euros as a result of the depreciation of the dollar and of sales of<br />

real estate.<br />

Working capital<br />

Current assets amounted to 2,717 million Euros, a fall of 289 million, thanks to the<br />

successful efforts to reduce working capital.<br />

<strong>Agfa</strong> had set itself ambitious targets for reducing its working capital by a total of<br />

500 million Euros by the end of 2003. After the successful reduction of stocks and trade<br />

receivables in 2001, the Group recorded further progress and has already exceeded this<br />

goal by the end of June <strong>2002</strong>. Consequently, <strong>Agfa</strong> increased its target and aimed to reduce<br />

its working capital with a total of 750 million Euros compared to mid 2001,<br />

the reference point.<br />

At the end of <strong>2002</strong>, this target was also already exceeded, partially thanks to the<br />

depreciation of the dollar. Inventories amounted to 948 million, a decrease of 107 million<br />

Euros compared to end 2001.<br />

Trade receivables fell again by 166 million in comparison with the end of 2001 and stand<br />

at 959 million Euros.<br />

Since June 2001, a total reduction of 760 million Euros has been recorded for the sum of<br />

inventories and trade receivables.<br />

Financial debt<br />

Thanks to the substantial improvement in operating results and the significant reduction<br />

in working capital, net financial debt decreased by 269 million Euros to 573 million Euros<br />

at the end of the year.<br />

Shareholders’ equity<br />

At the end of <strong>2002</strong> shareholders’ equity amounted to 1,383 million Euros against<br />

1,267 million the previous year.<br />

<strong>Agfa</strong> annual report <strong>2002</strong><br />

12