Annual Report 2002 - Agfa

Annual Report 2002 - Agfa

Annual Report 2002 - Agfa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

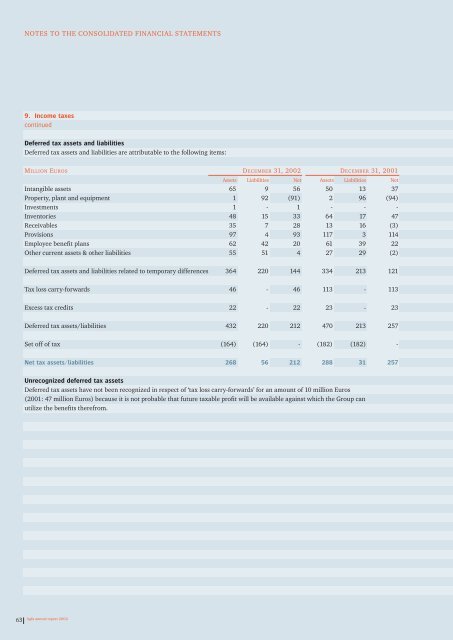

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

9. Income taxes<br />

continued<br />

Deferred tax assets and liabilities<br />

Deferred tax assets and liabilities are attributable to the following items:<br />

MILLION EUROS DECEMBER 31, <strong>2002</strong> DECEMBER 31, 2001<br />

Assets Liabilities<br />

Net Assets Liabilities<br />

Net<br />

Intangible assets 65 9 56 50 13 37<br />

Property, plant and equipment 1 92 (91) 2 96 (94)<br />

Investments 1 - 1 - - -<br />

Inventories 48 15 33 64 17 47<br />

Receivables 35 7 28 13 16 (3)<br />

Provisions 97 4 93 117 3 114<br />

Employee benefit plans 62 42 20 61 39 22<br />

Other current assets & other liabilities 55 51 4 27 29 (2)<br />

Deferred tax assets and liabilities related to temporary differences 364 220 144 334 213 121<br />

Tax loss carry-forwards 46 - 46 113 - 113<br />

Excess tax credits 22 - 22 23 - 23<br />

Deferred tax assets/liabilities 432 220 212 470 213 257<br />

Set off of tax (164) (164) - (182) (182) -<br />

Net tax assets/liabilities 268 56 212 288 31 257<br />

Unrecognized deferred tax assets<br />

Deferred tax assets have not been recognized in respect of ‘tax loss carry-forwards’ for an amount of 10 million Euros<br />

(2001: 47 million Euros) because it is not probable that future taxable profit will be available against which the Group can<br />

utilize the benefits therefrom.<br />

63<br />

<strong>Agfa</strong> annual report <strong>2002</strong>