2010 annual report - touax group

2010 annual report - touax group

2010 annual report - touax group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Annual <strong>report</strong> <strong>2010</strong><br />

These authorizations are valid for a period of 26 months from<br />

June 10, 2009 and render ineffective all previous delegations<br />

with the same purpose.<br />

All financial instruments giving access to capital resulting in a<br />

dilution are presented in chapter 17, page 38 of this document.<br />

21.1.1. Subscribed capital<br />

The share capital is fully subscribed and paid-up.<br />

21.1.2. Securities not representing capital<br />

There are no securities not representing capital.<br />

21.1.3. Composition of the capital<br />

As of December 31, <strong>2010</strong>, the capital comprised 5,695,651 fully<br />

paid-up shares with a par value of €8, representing 6,121,846<br />

voting rights. The breakdown of TOUAX SCA's capital and voting<br />

rights is detailed in section 18.1 page 40.<br />

21.1.4. Potential capital<br />

Details of the share subscription or purchase options and the<br />

share subscription warrants granted by TOUAX SCA are given<br />

in the appendix to the consolidated financial statements in section<br />

20.1 page 43, note 21.<br />

21.1.5. Unpaid capital<br />

Not applicable<br />

21.1.6. Conditional or unconditional agreements<br />

Not applicable<br />

21.1.7. Capital history<br />

See section 21.1 page 99.<br />

21.2. Share price data<br />

21.2.1. Share price history<br />

On May 7, 1906 TOUAX shares were listed on the Paris Stock<br />

Exchange on the spot market. They were transferred to the<br />

Second Market on June 14, 1999. TOUAX is listed in Paris on<br />

NYSE Euronext and belongs to compartment B since January<br />

1, 2011. In 2008, TOUAX was included in the SBF 250 and CAC<br />

Small 90 and, in 2011, will be part of the CAC ® Small and CAC ®<br />

Mid & Small.<br />

21.2.2. The TOUAX share price<br />

At the end of <strong>2010</strong> the TOUAX share was worth €29.49, up<br />

32.2% compared to the price on December 31, 2009 (€22.30).<br />

The year's highest share price was reached on December 31,<br />

<strong>2010</strong> at €29.49, and the lowest was on February 8, <strong>2010</strong> at<br />

€17.13.<br />

As of December 31, <strong>2010</strong> the Group’s stock market value was<br />

€167.82 million.<br />

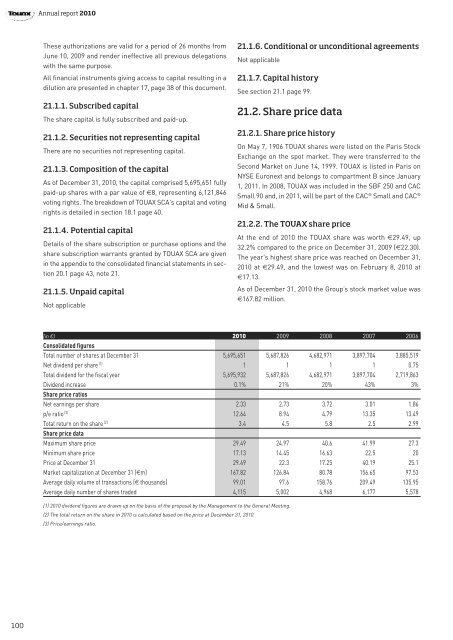

(in €) <strong>2010</strong> 2009 2008 2007 2006<br />

Consolidated figures<br />

Total number of shares at December 31 5,695,651 5,687,826 4,682,971 3,897,704 3,885,519<br />

Net dividend per share (1) 1 1 1 1 0.75<br />

Total dividend for the fiscal year 5,695,932 5,687,826 4,682,971 3,897,704 2,719,863<br />

Dividend increase 0.1% 21% 20% 43% 3%<br />

Share price ratios<br />

Net earnings per share 2.33 2.73 3.72 3.01 1.86<br />

p/e ratio (3) 12.64 8.94 4.79 13.35 13.49<br />

Total return on the share (2) 3.4 4.5 5.8 2.5 2.99<br />

Share price data<br />

Maximum share price 29.49 24.97 40.6 41.99 27.3<br />

Minimum share price 17.13 14.45 16.63 22.5 20<br />

Price at December 31 29.49 22.3 17.25 40.19 25.1<br />

Market capitalization at December 31 (€m) 167.82 126.84 80.78 156.65 97.53<br />

Average daily volume of transactions (€ thousands) 99.01 97.6 158.76 209.49 135.95<br />

Average daily number of shares traded 4,115 5,002 4,968 6,177 5,578<br />

(1) <strong>2010</strong> dividend figures are drawn up on the basis of the proposal by the Management to the General Meeting.<br />

(2) The total return on the share in <strong>2010</strong> is calculated based on the price at December 31, <strong>2010</strong>.<br />

(3) Price/earnings ratio.<br />

100