2010 annual report - touax group

2010 annual report - touax group

2010 annual report - touax group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Annual <strong>report</strong> <strong>2010</strong><br />

The security deposits for EIG Modul Finance I EIG were fully<br />

written down for a total of €1.9m at December 31, 2006. As a<br />

result the same amount of commission deferred at the time of<br />

the creation of Modul Finance I EIG (€1.9m), which had been<br />

booked as a non-current liability, was cancelled). Part of the<br />

Group’s deferred income from the EIG was written down by €0.3<br />

million in 2007. In 2009, the Group’s deferred income from the<br />

EIG was once again written down by €1 million.<br />

On January 14, 2011, the companies that are partners in the EIG<br />

agreed to acquire “senior” shares through HPMF. HPMF financed<br />

this acquisition by issuing type A, B and C bonds that will be<br />

subscribed to by HPMC1, Apicius and the TOUAX Group.<br />

➜ note 30.2. Further details regarding<br />

the Trust TCLRT 98<br />

On 16 December 1998, the Group conducted a second asset<br />

backed securitization operation, this time for shipping containers,<br />

in the form of a trust registered in the State of Delaware<br />

(USA), under the name of “TOUAX Container Lease Receivables<br />

Trust TCLRT 98”. This Trust was entirely financed by investors<br />

outside the Group (Indenture Agreement) through the issue of<br />

a senior debt (Senior Notes) and a subordinated debt (certificates)<br />

used to fund the purchase of shipping containers with a<br />

total value of $40.4 million, to be operated and managed by the<br />

Group under a management contract (Sales and Servicing<br />

Agreement) for a minimum of 10 years.<br />

In April 2009, the Trust 1998's assets were sold; 85% (12,006.5<br />

FTEU) and 15% (2,095.5 FTEU) were acquired respectively by<br />

investors and Gold Container Investment Ltd.<br />

Gold Container’s leasing of the Trust’s containers has the following<br />

implications for the Group’s accounts (in thousands of<br />

euros) in 2009 and 2008. There were no longer any containers<br />

belonging to Trust 98 on December 31, <strong>2010</strong>:<br />

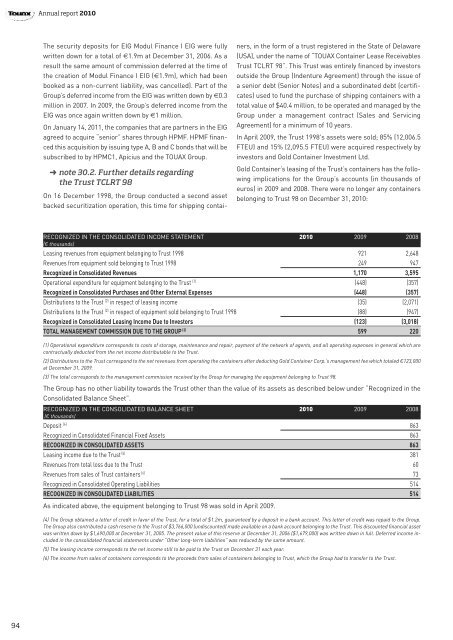

RECOGNIZED IN THE CONSOLIDATED INCOME STATEMENT <strong>2010</strong> 2009 2008<br />

(€ thousands)<br />

Leasing revenues from equipment belonging to Trust 1998 921 2,648<br />

Revenues from equipment sold belonging to Trust 1998 249 947<br />

Recognized in Consolidated Revenues 1,170 3,595<br />

Operational expenditure for equipment belonging to the Trust (1) (448) (357)<br />

Recognized in Consolidated Purchases and Other External Expenses (448) (357)<br />

Distributions to the Trust (2) in respect of leasing income (35) (2,071)<br />

Distributions to the Trust (2) in respect of equipment sold belonging to Trust 1998 (88) (947)<br />

Recognized in Consolidated Leasing Income Due to Investors (123) (3,018)<br />

TOTAL MANAGEMENT COMMISSION DUE TO THE GROUP (3) 599 220<br />

(1) Operational expenditure corresponds to costs of storage, maintenance and repair, payment of the network of agents, and all operating expenses in general which are<br />

contractually deducted from the net income distributable to the Trust.<br />

(2) Distributions to the Trust correspond to the net revenues from operating the containers after deducting Gold Container Corp.’s management fee which totaled €123,000<br />

at December 31, 2009.<br />

(3) The total corresponds to the management commission received by the Group for managing the equipment belonging to Trust 98.<br />

The Group has no other liability towards the Trust other than the value of its assets as described below under “Recognized in the<br />

Consolidated Balance Sheet”.<br />

RECOGNIZED IN THE CONSOLIDATED BALANCE SHEET <strong>2010</strong> 2009 2008<br />

(€ thousands)<br />

Deposit (4) 863<br />

Recognized in Consolidated Financial Fixed Assets 863<br />

RECOGNIZED IN CONSOLIDATED ASSETS 863<br />

Leasing income due to the Trust (5) 381<br />

Revenues from total loss due to the Trust 60<br />

Revenues from sales of Trust containers (6) 73<br />

Recognized in Consolidated Operating Liabilities 514<br />

RECOGNIZED IN CONSOLIDATED LIABILITIES 514<br />

As indicated above, the equipment belonging to Trust 98 was sold in April 2009.<br />

(4) The Group obtained a letter of credit in favor of the Trust, for a total of $1.2m, guaranteed by a deposit in a bank account. This letter of credit was repaid to the Group.<br />

The Group also contributed a cash reserve to the Trust of $3,766,000 (undiscounted) made available on a bank account belonging to the Trust. This discounted financial asset<br />

was written down by $1,690,000 at December 31, 2005. The present value of this reserve at December 31, 2006 ($1,679,000) was written down in full. Deferred income included<br />

in the consolidated financial statements under “Other long-term liabilities” was reduced by the same amount.<br />

(5) The leasing income corresponds to the net income still to be paid to the Trust on December 31 each year.<br />

(6) The income from sales of containers corresponds to the proceeds from sales of containers belonging to Trust, which the Group had to transfer to the Trust.<br />

94