2010 annual report - touax group

2010 annual report - touax group

2010 annual report - touax group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Annual <strong>report</strong> <strong>2010</strong><br />

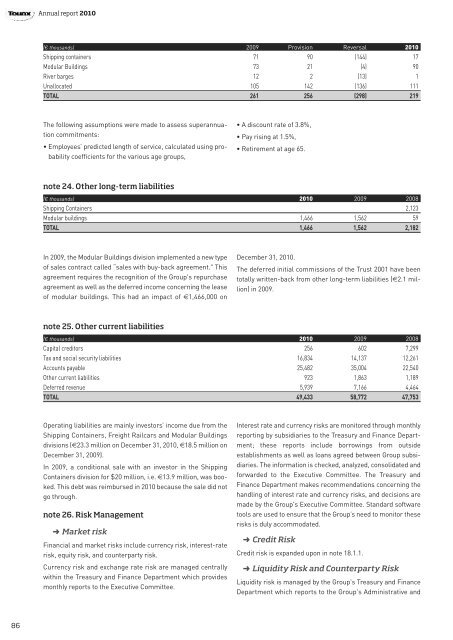

(€ thousands) 2009 Provision Reversal <strong>2010</strong><br />

Shipping containers 71 90 (144) 17<br />

Modular Buildings 73 21 (4) 90<br />

River barges 12 2 (13) 1<br />

Unallocated 105 142 (136) 111<br />

TOTAL 261 256 (298) 219<br />

The following assumptions were made to assess superannuation<br />

commitments:<br />

• Employees’ predicted length of service, calculated using probability<br />

coefficients for the various age <strong>group</strong>s,<br />

• A discount rate of 3.8%,<br />

• Pay rising at 1.5%,<br />

• Retirement at age 65.<br />

note 24. Other long-term liabilities<br />

(€ thousands) <strong>2010</strong> 2009 2008<br />

Shipping Containers 2,123<br />

Modular buildings 1,466 1,562 59<br />

TOTAL 1,466 1,562 2,182<br />

In 2009, the Modular Buildings division implemented a new type<br />

of sales contract called “sales with buy-back agreement." This<br />

agreement requires the recognition of the Group's repurchase<br />

agreement as well as the deferred income concerning the lease<br />

of modular buildings. This had an impact of €1,466,000 on<br />

December 31, <strong>2010</strong>.<br />

The deferred initial commissions of the Trust 2001 have been<br />

totally written-back from other long-term liabilities (€2.1 million)<br />

in 2009.<br />

note 25. Other current liabilities<br />

(€ thousands) <strong>2010</strong> 2009 2008<br />

Capital creditors 256 602 7,299<br />

Tax and social security liabilities 16,834 14,137 12,261<br />

Accounts payable 25,482 35,004 22,540<br />

Other current liabilities 923 1,863 1,189<br />

Deferred revenue 5,939 7,166 4,464<br />

TOTAL 49,433 58,772 47,753<br />

Operating liabilities are mainly investors’ income due from the<br />

Shipping Containers, Freight Railcars and Modular Buildings<br />

divisions (€23.3 million on December 31, <strong>2010</strong>, €18.5 million on<br />

December 31, 2009).<br />

In 2009, a conditional sale with an investor in the Shipping<br />

Containers division for $20 million, i.e. €13.9 million, was booked.<br />

This debt was reimbursed in <strong>2010</strong> because the sale did not<br />

go through.<br />

note 26. Risk Management<br />

➜ Market risk<br />

Financial and market risks include currency risk, interest-rate<br />

risk, equity risk, and counterparty risk.<br />

Currency risk and exchange rate risk are managed centrally<br />

within the Treasury and Finance Department which provides<br />

monthly <strong>report</strong>s to the Executive Committee.<br />

Interest rate and currency risks are monitored through monthly<br />

<strong>report</strong>ing by subsidiaries to the Treasury and Finance Department;<br />

these <strong>report</strong>s include borrowings from outside<br />

establishments as well as loans agreed between Group subsidiaries.<br />

The information is checked, analyzed, consolidated and<br />

forwarded to the Executive Committee. The Treasury and<br />

Finance Department makes recommendations concerning the<br />

handling of interest rate and currency risks, and decisions are<br />

made by the Group's Executive Committee. Standard software<br />

tools are used to ensure that the Group’s need to monitor these<br />

risks is duly accommodated.<br />

➜ Credit Risk<br />

Credit risk is expanded upon in note 18.1.1.<br />

➜ Liquidity Risk and Counterparty Risk<br />

Liquidity risk is managed by the Group's Treasury and Finance<br />

Department which <strong>report</strong>s to the Group's Administrative and<br />

86