2010 annual report - touax group

2010 annual report - touax group

2010 annual report - touax group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Annual <strong>report</strong> <strong>2010</strong><br />

Other Non-Current Financial Assets and other fixed assets are<br />

valued at cost and amortized using the effective interest rate; it<br />

is considered that their book values are a reasonable approximation<br />

to fair value.<br />

Other Non-Current Financial Assets and other fixed assets<br />

undergo impairment tests on the basis of the estimated future<br />

income streams. Impairments amounting to €6.7 million have<br />

been booked in earlier financial periods (before 2008). In 2009,<br />

a €1 million impairment was booked on the deferred payment<br />

of EIG management commissions concerning the Group, as<br />

well as a €2.1 million impairment on liquidity reserves granted<br />

to the Trusts 2001 (see the appendix to the consolidated financial<br />

statements, note 30.1 and note 30.3).<br />

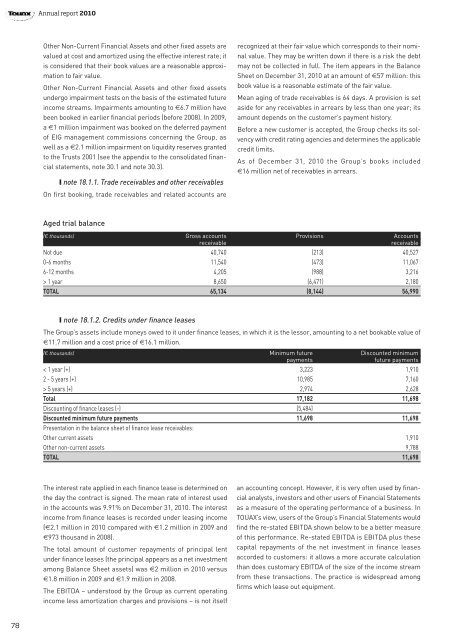

❙ note 18.1.1. Trade receivables and other receivables<br />

On first booking, trade receivables and related accounts are<br />

recognized at their fair value which corresponds to their nominal<br />

value. They may be written down if there is a risk the debt<br />

may not be collected in full. The item appears in the Balance<br />

Sheet on December 31, <strong>2010</strong> at an amount of €57 million: this<br />

book value is a reasonable estimate of the fair value.<br />

Mean aging of trade receivables is 64 days. A provision is set<br />

aside for any receivables in arrears by less than one year; its<br />

amount depends on the customer’s payment history.<br />

Before a new customer is accepted, the Group checks its solvency<br />

with credit rating agencies and determines the applicable<br />

credit limits.<br />

As of December 31, <strong>2010</strong> the Group’s books included<br />

€16 million net of receivables in arrears.<br />

Aged trial balance<br />

(€ thousands) Gross accounts Provisions Accounts<br />

receivable<br />

receivable<br />

Not due 40,740 (213) 40,527<br />

0-6 months 11,540 (473) 11,067<br />

6-12 months 4,205 (988) 3,216<br />

> 1 year 8,650 (6,471) 2,180<br />

TOTAL 65,134 (8,144) 56,990<br />

❙ note 18.1.2. Credits under finance leases<br />

The Group’s assets include moneys owed to it under finance leases, in which it is the lessor, amounting to a net bookable value of<br />

€11.7 million and a cost price of €16.1 million.<br />

(€ thousands) Minimum future Discounted minimum<br />

payments<br />

future payments<br />

< 1 year (+) 3,223 1,910<br />

2 - 5 years (+) 10,985 7,160<br />

> 5 years (+) 2,974 2,628<br />

Total 17,182 11,698<br />

Discounting of finance leases (-) (5,484)<br />

Discounted minimum future payments 11,698 11,698<br />

Presentation in the balance sheet of finance lease receivables:<br />

Other current assets 1,910<br />

Other non-current assets 9,788<br />

TOTAL 11,698<br />

The interest rate applied in each finance lease is determined on<br />

the day the contract is signed. The mean rate of interest used<br />

in the accounts was 9.91% on December 31, <strong>2010</strong>. The interest<br />

income from finance leases is recorded under leasing income<br />

(€2.1 million in <strong>2010</strong> compared with €1.2 million in 2009 and<br />

€973 thousand in 2008).<br />

The total amount of customer repayments of principal lent<br />

under finance leases (the principal appears as a net investment<br />

among Balance Sheet assets) was €2 million in <strong>2010</strong> versus<br />

€1.8 million in 2009 and €1.9 million in 2008.<br />

The EBITDA – understood by the Group as current operating<br />

income less amortization charges and provisions – is not itself<br />

an accounting concept. However, it is very often used by financial<br />

analysts, investors and other users of Financial Statements<br />

as a measure of the operating performance of a business. In<br />

TOUAX’s view, users of the Group’s Financial Statements would<br />

find the re-stated EBITDA shown below to be a better measure<br />

of this performance. Re-stated EBITDA is EBITDA plus these<br />

capital repayments of the net investment in finance leases<br />

accorded to customers: it allows a more accurate calculation<br />

than does customary EBITDA of the size of the income stream<br />

from these transactions. The practice is widespread among<br />

firms which lease out equipment.<br />

78