2010 annual report - touax group

2010 annual report - touax group

2010 annual report - touax group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

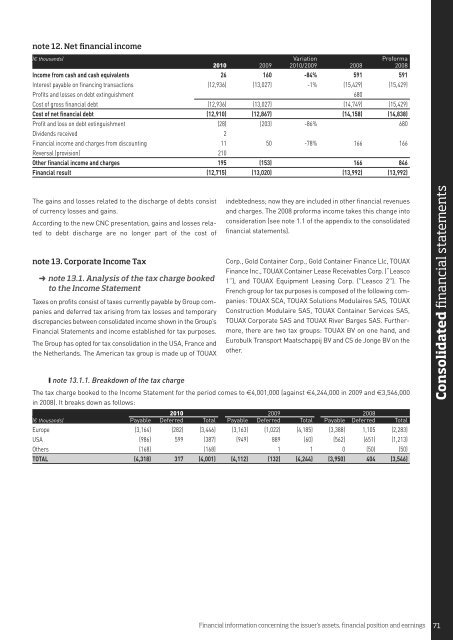

note 12. Net financial income<br />

(€ thousands) Variation Proforma<br />

<strong>2010</strong> 2009 <strong>2010</strong>/2009 2008 2008<br />

Income from cash and cash equivalents 26 160 -84% 591 591<br />

Interest payable on financing transactions (12,936) (13,027) -1% (15,429) (15,429)<br />

Profits and losses on debt extinguishment 680<br />

Cost of gross financial debt (12,936) (13,027) (14,749) (15,429)<br />

Cost of net financial debt (12,910) (12,867) (14,158) (14,838)<br />

Profit and loss on debt extinguishment (28) (203) -86% 680<br />

Dividends received 2<br />

Financial income and charges from discounting 11 50 -78% 166 166<br />

Reversal (provision) 210<br />

Other financial income and charges 195 (153) 166 846<br />

Financial result (12,715) (13,020) (13,992) (13,992)<br />

The gains and losses related to the discharge of debts consist<br />

of currency losses and gains.<br />

According to the new CNC presentation, gains and losses related<br />

to debt discharge are no longer part of the cost of<br />

note 13. Corporate Income Tax<br />

➜ note 13.1. Analysis of the tax charge booked<br />

to the Income Statement<br />

Taxes on profits consist of taxes currently payable by Group companies<br />

and deferred tax arising from tax losses and temporary<br />

discrepancies between consolidated income shown in the Group’s<br />

Financial Statements and income established for tax purposes.<br />

The Group has opted for tax consolidation in the USA, France and<br />

the Netherlands. The American tax <strong>group</strong> is made up of TOUAX<br />

indebtedness; now they are included in other financial revenues<br />

and charges. The 2008 proforma income takes this change into<br />

consideration (see note 1.1 of the appendix to the consolidated<br />

financial statements).<br />

Corp., Gold Container Corp., Gold Container Finance Llc, TOUAX<br />

Finance Inc., TOUAX Container Lease Receivables Corp. (“Leasco<br />

1”), and TOUAX Equipment Leasing Corp. ("Leasco 2"). The<br />

French <strong>group</strong> for tax purposes is composed of the following companies:<br />

TOUAX SCA, TOUAX Solutions Modulaires SAS, TOUAX<br />

Construction Modulaire SAS, TOUAX Container Services SAS,<br />

TOUAX Corporate SAS and TOUAX River Barges SAS. Furthermore,<br />

there are two tax <strong>group</strong>s: TOUAX BV on one hand, and<br />

Eurobulk Transport Maatschappij BV and CS de Jonge BV on the<br />

other.<br />

❙ note 13.1.1. Breakdown of the tax charge<br />

The tax charge booked to the Income Statement for the period comes to €4,001,000 (against €4,244,000 in 2009 and €3,546,000<br />

in 2008). It breaks down as follows:<br />

<strong>2010</strong> 2009 2008<br />

(€ thousands) Payable Deferred Total Payable Deferred Total Payable Deferred Total<br />

Europe (3,164) (282) (3,446) (3,163) (1,022) (4,185) (3,388) 1,105 (2,283)<br />

USA (986) 599 (387) (949) 889 (60) (562) (651) (1,213)<br />

Others (168) (168) 1 1 0 (50) (50)<br />

TOTAL (4,318) 317 (4,001) (4,112) (132) (4,244) (3,950) 404 (3,546)<br />

Consolidated financial statements<br />

Financial information concerning the issuer’s assets, financial position and earnings I 71