2010 annual report - touax group

2010 annual report - touax group

2010 annual report - touax group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Annual <strong>report</strong> <strong>2010</strong><br />

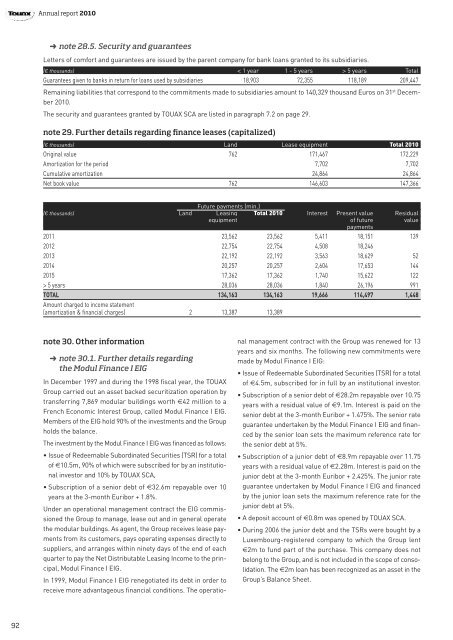

➜ note 28.5. Security and guarantees<br />

Letters of comfort and guarantees are issued by the parent company for bank loans granted to its subsidiaries.<br />

(€ thousands) < 1 year 1 - 5 years > 5 years Total<br />

Guarantees given to banks in return for loans used by subsidiaries 18,903 72,355 118,189 209,447<br />

Remaining liabilities that correspond to the commitments made to subsidiaries amount to 140,329 thousand Euros on 31 st December<br />

<strong>2010</strong>.<br />

The security and guarantees granted by TOUAX SCA are listed in paragraph 7.2 on page 29.<br />

note 29. Further details regarding finance leases (capitalized)<br />

(€ thousands) Land Lease equipment Total <strong>2010</strong><br />

Original value 762 171,467 172,229<br />

Amortization for the period 7,702 7,702<br />

Cumulative amortization 24,864 24,864<br />

Net book value 762 146,603 147,366<br />

Future payments (min.)<br />

(€ thousands) Land Leasing Total <strong>2010</strong> Interest Present value Residual<br />

equipment of future value<br />

payments<br />

2011 23,562 23,562 5,411 18,151 139<br />

2012 22,754 22,754 4,508 18,246<br />

2013 22,192 22,192 3,563 18,629 52<br />

2014 20,257 20,257 2,604 17,653 144<br />

2015 17,362 17,362 1,740 15,622 122<br />

> 5 years 28,036 28,036 1,840 26,196 991<br />

TOTAL 134,163 134,163 19,666 114,497 1,448<br />

Amount charged to income statement<br />

(amortization & financial charges) 2 13,387 13,389<br />

note 30. Other information<br />

➜ note 30.1. Further details regarding<br />

the Modul Finance I EIG<br />

In December 1997 and during the 1998 fiscal year, the TOUAX<br />

Group carried out an asset backed securitization operation by<br />

transferring 7,869 modular buildings worth €42 million to a<br />

French Economic Interest Group, called Modul Finance I EIG.<br />

Members of the EIG hold 90% of the investments and the Group<br />

holds the balance.<br />

The investment by the Modul Finance I EIG was financed as follows:<br />

• Issue of Redeemable Subordinated Securities (TSR) for a total<br />

of €10.5m, 90% of which were subscribed for by an institutional<br />

investor and 10% by TOUAX SCA,<br />

• Subscription of a senior debt of €32.6m repayable over 10<br />

years at the 3-month Euribor + 1.8%.<br />

Under an operational management contract the EIG commissioned<br />

the Group to manage, lease out and in general operate<br />

the modular buildings. As agent, the Group receives lease payments<br />

from its customers, pays operating expenses directly to<br />

suppliers, and arranges within ninety days of the end of each<br />

quarter to pay the Net Distributable Leasing Income to the principal,<br />

Modul Finance I EIG.<br />

In 1999, Modul Finance I EIG renegotiated its debt in order to<br />

receive more advantageous financial conditions. The operational<br />

management contract with the Group was renewed for 13<br />

years and six months. The following new commitments were<br />

made by Modul Finance I EIG:<br />

• Issue of Redeemable Subordinated Securities (TSR) for a total<br />

of €4.5m, subscribed for in full by an institutional investor.<br />

• Subscription of a senior debt of €28.2m repayable over 10.75<br />

years with a residual value of €9.1m. Interest is paid on the<br />

senior debt at the 3-month Euribor + 1.475%. The senior rate<br />

guarantee undertaken by the Modul Finance I EIG and financed<br />

by the senior loan sets the maximum reference rate for<br />

the senior debt at 5%.<br />

• Subscription of a junior debt of €8.9m repayable over 11.75<br />

years with a residual value of €2.28m. Interest is paid on the<br />

junior debt at the 3-month Euribor + 2.425%. The junior rate<br />

guarantee undertaken by Modul Finance I EIG and financed<br />

by the junior loan sets the maximum reference rate for the<br />

junior debt at 5%.<br />

• A deposit account of €0.8m was opened by TOUAX SCA.<br />

• During 2006 the junior debt and the TSRs were bought by a<br />

Luxembourg-registered company to which the Group lent<br />

€2m to fund part of the purchase. This company does not<br />

belong to the Group, and is not included in the scope of consolidation.<br />

The €2m loan has been recognized as an asset in the<br />

Group’s Balance Sheet.<br />

92