2010 annual report - touax group

2010 annual report - touax group

2010 annual report - touax group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Annual <strong>report</strong> <strong>2010</strong><br />

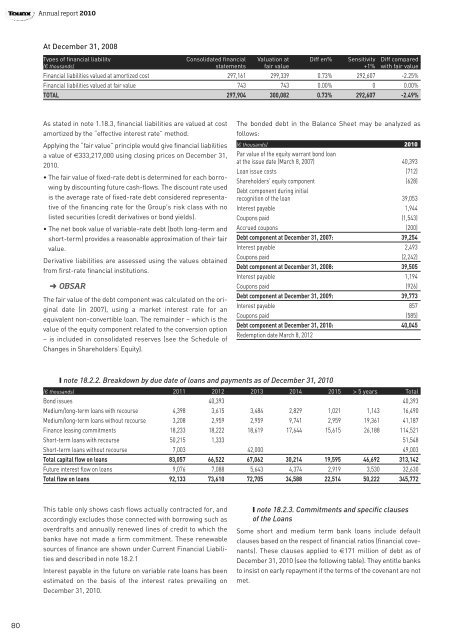

At December 31, 2008<br />

Types of financial liability Consolidated financial Valuation at Diff en% Sensitivity Diff compared<br />

(€ thousands) statements fair value +1% with fair value<br />

Financial liabilities valued at amortized cost 297,161 299,339 0.73% 292,607 -2.25%<br />

Financial liabilities valued at fair value 743 743 0.00% 0 0.00%<br />

TOTAL 297,904 300,082 0.73% 292,607 -2.49%<br />

As stated in note 1.18.3, financial liabilities are valued at cost<br />

amortized by the “effective interest rate” method.<br />

Applying the “fair value” principle would give financial liabilities<br />

a value of €333,217,000 using closing prices on December 31,<br />

<strong>2010</strong>.<br />

• The fair value of fixed-rate debt is determined for each borrowing<br />

by discounting future cash-flows. The discount rate used<br />

is the average rate of fixed-rate debt considered representative<br />

of the financing rate for the Group's risk class with no<br />

listed securities (credit derivatives or bond yields).<br />

• The net book value of variable-rate debt (both long-term and<br />

short-term) provides a reasonable approximation of their fair<br />

value.<br />

Derivative liabilities are assessed using the values obtained<br />

from first-rate financial institutions.<br />

➜ OBSAR<br />

The fair value of the debt component was calculated on the original<br />

date (in 2007), using a market interest rate for an<br />

equivalent non-convertible loan. The remainder – which is the<br />

value of the equity component related to the conversion option<br />

– is included in consolidated reserves (see the Schedule of<br />

Changes in Shareholders’ Equity).<br />

The bonded debt in the Balance Sheet may be analyzed as<br />

follows:<br />

(€ thousands) <strong>2010</strong><br />

Par value of the equity warrant bond loan<br />

at the issue date (March 8, 2007) 40,393<br />

Loan issue costs (712)<br />

Shareholders' equity component (628)<br />

Debt component during initial<br />

recognition of the loan 39,053<br />

Interest payable 1,944<br />

Coupons paid (1,543)<br />

Accrued coupons (200)<br />

Debt component at December 31, 2007: 39,254<br />

Interest payable 2,493<br />

Coupons paid (2,242)<br />

Debt component at December 31, 2008: 39,505<br />

Interest payable 1,194<br />

Coupons paid (926)<br />

Debt component at December 31, 2009: 39,773<br />

Interest payable 857<br />

Coupons paid (585)<br />

Debt component at December 31, <strong>2010</strong>: 40,045<br />

Redemption date March 8, 2012<br />

❙ note 18.2.2. Breakdown by due date of loans and payments as of December 31, <strong>2010</strong><br />

(€ thousands) 2011 2012 2013 2014 2015 > 5 years Total<br />

Bond issues 40,393 40,393<br />

Medium/long-term loans with recourse 4,398 3,615 3,484 2,829 1,021 1,143 16,490<br />

Medium/long-term loans without recourse 3,208 2,959 2,959 9,741 2,959 19,361 41,187<br />

Finance leasing commitments 18,233 18,222 18,619 17,644 15,615 26,188 114,521<br />

Short-term loans with recourse 50,215 1,333 51,548<br />

Short-term loans without recourse 7,003 42,000 49,003<br />

Total capital flow on loans 83,057 66,522 67,062 30,214 19,595 46,692 313,142<br />

Future interest flow on loans 9,076 7,088 5,643 4,374 2,919 3,530 32,630<br />

Total flow on loans 92,133 73,610 72,705 34,588 22,514 50,222 345,772<br />

This table only shows cash flows actually contracted for, and<br />

accordingly excludes those connected with borrowing such as<br />

overdrafts and <strong>annual</strong>ly renewed lines of credit to which the<br />

banks have not made a firm commitment. These renewable<br />

sources of finance are shown under Current Financial Liabilities<br />

and described in note 18.2.1<br />

Interest payable in the future on variable rate loans has been<br />

estimated on the basis of the interest rates prevailing on<br />

December 31, <strong>2010</strong>.<br />

❙ note 18.2.3. Commitments and specific clauses<br />

of the Loans<br />

Some short and medium term bank loans include default<br />

clauses based on the respect of financial ratios (financial covenants).<br />

These clauses applied to €171 million of debt as of<br />

December 31, <strong>2010</strong> (see the following table). They entitle banks<br />

to insist on early repayment if the terms of the covenant are not<br />

met.<br />

80