2010 annual report - touax group

2010 annual report - touax group

2010 annual report - touax group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Annual <strong>report</strong> <strong>2010</strong><br />

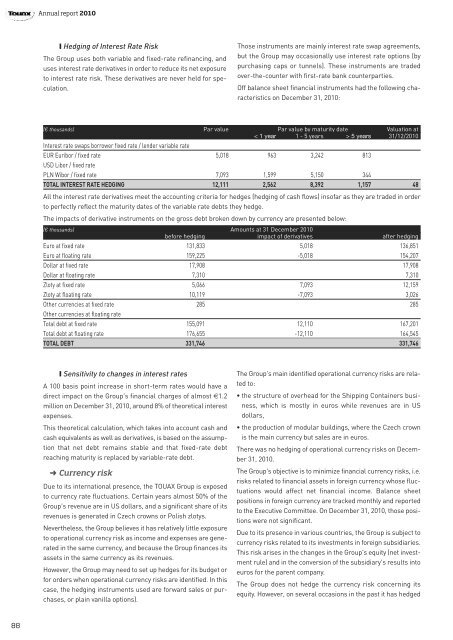

❙ Hedging of Interest Rate Risk<br />

The Group uses both variable and fixed-rate refinancing, and<br />

uses interest rate derivatives in order to reduce its net exposure<br />

to interest rate risk. These derivatives are never held for speculation.<br />

Those instruments are mainly interest rate swap agreements,<br />

but the Group may occasionally use interest rate options (by<br />

purchasing caps or tunnels). These instruments are traded<br />

over-the-counter with first-rate bank counterparties.<br />

Off balance sheet financial instruments had the following characteristics<br />

on December 31, <strong>2010</strong>:<br />

(€ thousands) Par value Par value by maturity date Valuation at<br />

< 1 year 1 - 5 years > 5 years 31/12/<strong>2010</strong><br />

Interest rate swaps borrower fixed rate / lender variable rate<br />

EUR Euribor / fixed rate 5,018 963 3,242 813<br />

USD Libor / fixed rate<br />

PLN Wibor / fixed rate 7,093 1,599 5,150 344<br />

TOTAL INTEREST RATE HEDGING 12,111 2,562 8,392 1,157 48<br />

All the interest rate derivatives meet the accounting criteria for hedges (hedging of cash flows) insofar as they are traded in order<br />

to perfectly reflect the maturity dates of the variable rate debts they hedge.<br />

The impacts of derivative instruments on the gross debt broken down by currency are presented below:<br />

(€ thousands) Amounts at 31 December <strong>2010</strong><br />

before hedging impact of derivatives after hedging<br />

Euro at fixed rate 131,833 5,018 136,851<br />

Euro at floating rate 159,225 -5,018 154,207<br />

Dollar at fixed rate 17,908 17,908<br />

Dollar at floating rate 7,310 7,310<br />

Zloty at fixed rate 5,066 7,093 12,159<br />

Zloty at floating rate 10,119 -7,093 3,026<br />

Other currencies at fixed rate 285 285<br />

Other currencies at floating rate<br />

Total debt at fixed rate 155,091 12,110 167,201<br />

Total debt at floating rate 176,655 -12,110 164,545<br />

TOTAL DEBT 331,746 331,746<br />

❙ Sensitivity to changes in interest rates<br />

A 100 basis point increase in short-term rates would have a<br />

direct impact on the Group's financial charges of almost €1.2<br />

million on December 31, <strong>2010</strong>, around 8% of theoretical interest<br />

expenses.<br />

This theoretical calculation, which takes into account cash and<br />

cash equivalents as well as derivatives, is based on the assumption<br />

that net debt remains stable and that fixed-rate debt<br />

reaching maturity is replaced by variable-rate debt.<br />

➜ Currency risk<br />

Due to its international presence, the TOUAX Group is exposed<br />

to currency rate fluctuations. Certain years almost 50% of the<br />

Group's revenue are in US dollars, and a significant share of its<br />

revenues is generated in Czech crowns or Polish zlotys.<br />

Nevertheless, the Group believes it has relatively little exposure<br />

to operational currency risk as income and expenses are generated<br />

in the same currency, and because the Group finances its<br />

assets in the same currency as its revenues.<br />

However, the Group may need to set up hedges for its budget or<br />

for orders when operational currency risks are identified. In this<br />

case, the hedging instruments used are forward sales or purchases,<br />

or plain vanilla options).<br />

The Group's main identified operational currency risks are related<br />

to:<br />

• the structure of overhead for the Shipping Containers business,<br />

which is mostly in euros while revenues are in US<br />

dollars,<br />

• the production of modular buildings, where the Czech crown<br />

is the main currency but sales are in euros.<br />

There was no hedging of operational currency risks on December<br />

31, <strong>2010</strong>.<br />

The Group's objective is to minimize financial currency risks, i.e.<br />

risks related to financial assets in foreign currency whose fluctuations<br />

would affect net financial income. Balance sheet<br />

positions in foreign currency are tracked monthly and <strong>report</strong>ed<br />

to the Executive Committee. On December 31, <strong>2010</strong>, those positions<br />

were not significant.<br />

Due to its presence in various countries, the Group is subject to<br />

currency risks related to its investments in foreign subsidiaries.<br />

This risk arises in the changes in the Group's equity (net investment<br />

rule) and in the conversion of the subsidiary's results into<br />

euros for the parent company.<br />

The Group does not hedge the currency risk concerning its<br />

equity. However, on several occasions in the past it has hedged<br />

88