Financial Statements - United Bank Limited

Financial Statements - United Bank Limited

Financial Statements - United Bank Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

U N I T E D B A N K L I M I T E D<br />

Directors’ Report to the Members<br />

On behalf of the Board of Directors, I am pleased to present to you the 54 th Annual Report of<br />

<strong>United</strong> <strong>Bank</strong> <strong>Limited</strong> for the year ended December 31, 2012.<br />

<strong>Financial</strong> Highlights<br />

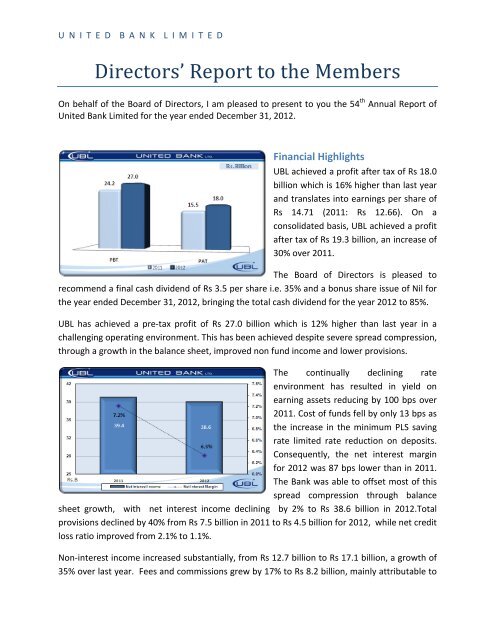

UBL achieved a profit after tax of Rs 18.0<br />

billion which is 16% higher than last year<br />

and translates into earnings per share of<br />

Rs 14.71 (2011: Rs 12.66). On a<br />

consolidated basis, UBL achieved a profit<br />

after tax of Rs 19.3 billion, an increase of<br />

30% over 2011.<br />

The Board of Directors is pleased to<br />

recommend a final cash dividend of Rs 3.5 per share i.e. 35% and a bonus share issue of Nil for<br />

the year ended December 31, 2012, bringing the total cash dividend for the year 2012 to 85%.<br />

UBL has achieved a pre-tax profit of Rs 27.0 billion which is 12% higher than last year in a<br />

challenging operating environment. This has been achieved despite severe spread compression,<br />

through a growth in the balance sheet, improved non fund income and lower provisions.<br />

The continually declining rate<br />

environment has resulted in yield on<br />

earning assets reducing by 100 bps over<br />

2011. Cost of funds fell by only 13 bps as<br />

the increase in the minimum PLS saving<br />

rate limited rate reduction on deposits.<br />

Consequently, the net interest margin<br />

for 2012 was 87 bps lower than in 2011.<br />

The <strong>Bank</strong> was able to offset most of this<br />

spread compression through balance<br />

sheet growth, with net interest income declining by 2% to Rs 38.6 billion in 2012.Total<br />

provisions declined by 40% from Rs 7.5 billion in 2011 to Rs 4.5 billion for 2012, while net credit<br />

loss ratio improved from 2.1% to 1.1%.<br />

Non-interest income increased substantially, from Rs 12.7 billion to Rs 17.1 billion, a growth of<br />

35% over last year. Fees and commissions grew by 17% to Rs 8.2 billion, mainly attributable to