Financial Statements - United Bank Limited

Financial Statements - United Bank Limited

Financial Statements - United Bank Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

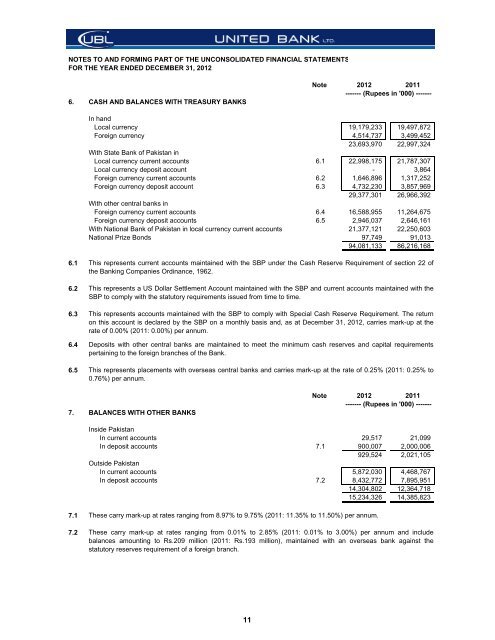

NOTES TO AND FORMING PART OF THE UNCONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED DECEMBER 31, 2012<br />

6. CASH AND BALANCES WITH TREASURY BANKS<br />

Note 2012 2011<br />

------- (Rupees in '000) -------<br />

In hand<br />

Local currency 19,179,233 19,497,872<br />

Foreign currency 4,514,737 3,499,452<br />

23,693,970 22,997,324<br />

With State <strong>Bank</strong> of Pakistan in<br />

Local currency current accounts 6.1 22,998,175 21,787,307<br />

Local currency deposit account - 3,864<br />

Foreign currency current accounts 6.2 1,646,896 1,317,252<br />

Foreign currency deposit account 6.3 4,732,230 3,857,969<br />

29,377,301 26,966,392<br />

With other central banks in<br />

Foreign currency current accounts 6.4 16,588,955 11,264,675<br />

Foreign currency deposit accounts 6.5 2,946,037 2,646,161<br />

With National <strong>Bank</strong> of Pakistan in local currency current accounts 21,377,121 22,250,603<br />

National Prize Bonds 97,749 91,013<br />

94,081,133 86,216,168<br />

6.1<br />

6.2<br />

6.3<br />

6.4<br />

6.5<br />

This represents current accounts maintained with the SBP under the Cash Reserve Requirement of section 22 of<br />

the <strong>Bank</strong>ing Companies Ordinance, 1962.<br />

This represents a US Dollar Settlement Account maintained with the SBP and current accounts maintained with the<br />

SBP to comply with the statutory requirements issued from time to time.<br />

This represents accounts maintained with the SBP to comply with Special Cash Reserve Requirement. The return<br />

on this account is declared by the SBP on a monthly basis and, as at December 31, 2012, carries mark-up at the<br />

rate of 0.00% (2011: 0.00%) per annum.<br />

Deposits with other central banks are maintained to meet the minimum cash reserves and capital requirements<br />

pertaining to the foreign branches of the <strong>Bank</strong>.<br />

This represents placements with overseas central banks and carries mark-up at the rate of 0.25% (2011: 0.25% to<br />

0.76%) per annum.<br />

7. BALANCES WITH OTHER BANKS<br />

Note 2012 2011<br />

------- (Rupees in '000) -------<br />

Inside Pakistan<br />

In current accounts 29,517 21,099<br />

In deposit accounts 7.1 900,007 2,000,006<br />

929,524 2,021,105<br />

Outside Pakistan<br />

In current accounts 5,872,030 4,468,767<br />

In deposit accounts 7.2 8,432,772 7,895,951<br />

14,304,802 12,364,718<br />

15,234,326 14,385,823<br />

7.1<br />

These carry mark-up at rates ranging from 8.97% to 9.75% (2011: 11.35% to 11.50%) per annum.<br />

7.2 These carry mark-up at rates ranging from 0.01% to 2.85% (2011: 0.01% to 3.00%) per annum and include<br />

balances amounting to Rs.209 million (2011: Rs.193 million), maintained with an overseas bank against the<br />

statutory reserves requirement of a foreign branch.<br />

11