Financial Statements - United Bank Limited

Financial Statements - United Bank Limited

Financial Statements - United Bank Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO AND FORMING PART OF THE UNCONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED DECEMBER 31, 2012<br />

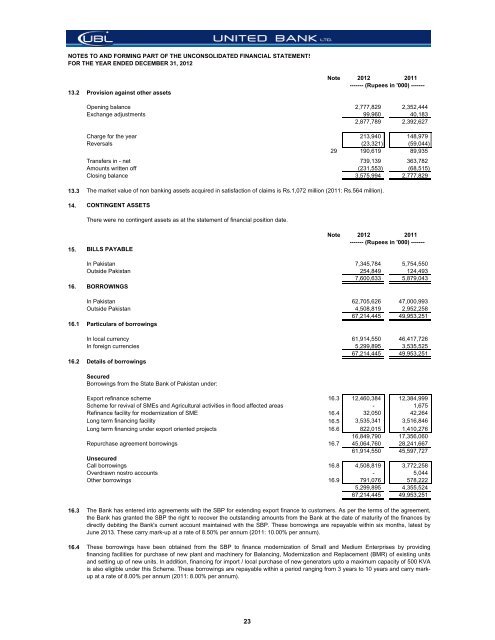

13.2 Provision against other assets<br />

Note 2012 2011<br />

------- (Rupees in '000) -------<br />

Opening balance 2,777,829 2,352,444<br />

Exchange adjustments 99,960 40,183<br />

2,877,789 2,392,627<br />

Charge for the year 213,940 148,979<br />

Reversals (23,321) (59,044)<br />

29 190,619 89,935<br />

Transfers in - net 739,139 363,782<br />

Amounts written off (231,553) (68,515)<br />

Closing balance 3,575,994 2,777,829<br />

13.3 The market value of non banking assets acquired in satisfaction of claims is Rs.1,072 million (2011: Rs.564 million).<br />

14. CONTINGENT ASSETS<br />

There were no contingent assets as at the statement of financial position date.<br />

15. BILLS PAYABLE<br />

Note 2012 2011<br />

------- (Rupees in '000) -------<br />

In Pakistan 7,345,784 5,754,550<br />

Outside Pakistan 254,849 124,493<br />

7,600,633 5,879,043<br />

16. BORROWINGS<br />

In Pakistan 62,705,626 47,000,993<br />

Outside Pakistan 4,508,819 2,952,258<br />

67,214,445 49,953,251<br />

16.1 Particulars of borrowings<br />

In local currency 61,914,550 46,417,726<br />

In foreign currencies 5,299,895 3,535,525<br />

67,214,445 49,953,251<br />

16.2 Details of borrowings<br />

Secured<br />

Borrowings from the State <strong>Bank</strong> of Pakistan under:<br />

Export refinance scheme 16.3 12,460,384 12,384,999<br />

Scheme for revival of SMEs and Agricultural activities in flood affected areas - 1,675<br />

Refinance facility for modernization of SME 16.4 32,050 42,264<br />

Long term financing facility 16.5 3,535,341 3,516,846<br />

Long term financing under export oriented projects 16.6 822,015 1,410,276<br />

16,849,790 17,356,060<br />

Repurchase agreement borrowings 16.7 45,064,760 28,241,667<br />

61,914,550 45,597,727<br />

Unsecured<br />

Call borrowings 16.8 4,508,819 3,772,258<br />

Overdrawn nostro accounts - 5,044<br />

Other borrowings 16.9 791,076 578,222<br />

5,299,895 4,355,524<br />

67,214,445 49,953,251<br />

16.3<br />

The <strong>Bank</strong> has entered into agreements with the SBP for extending export finance to customers. As per the terms of the agreement,<br />

the <strong>Bank</strong> has granted the SBP the right to recover the outstanding amounts from the <strong>Bank</strong> at the date of maturity of the finances by<br />

directly debiting the <strong>Bank</strong>'s current account maintained with the SBP. These borrowings are repayable within six months, latest by<br />

June 2013. These carry mark-up at a rate of 8.50% per annum (2011: 10.00% per annum).<br />

16.4 These borrowings have been obtained from the SBP to finance modernization of Small and Medium Enterprises by providing<br />

financing facilities for purchase of new plant and machinery for Balancing, Modernization and Replacement (BMR) of existing units<br />

and setting up of new units. In addition, financing for import / local purchase of new generators upto a maximum capacity of 500 KVA<br />

is also eligible under this Scheme. These borrowings are repayable within a period ranging from 3 years to 10 years and carry markup<br />

at a rate of 8.00% per annum (2011: 8.00% per annum).<br />

23