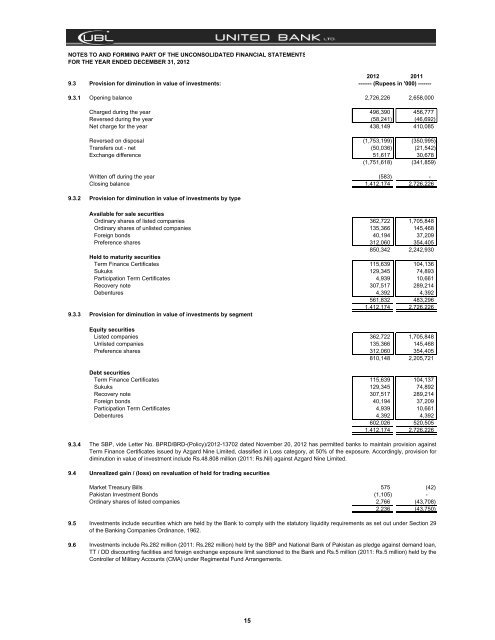

NOTES TO AND FORMING PART OF THE UNCONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2012 9.3 Provision for diminution in value of investments: 2012 2011 ------- (Rupees in '000) ------- 9.3.1 Opening balance 2,726,226 2,658,000 Charged during the year 496,390 456,777 Reversed during the year (58,241) (46,692) Net charge for the year 438,149 410,085 Reversed on disposal (1,753,199) (350,995) Transfers out - net (50,036) (21,542) Exchange difference 51,617 30,678 (1,751,618) (341,859) Written off during the year (583) - Closing balance 1,412,174 2,726,226 9.3.2 Provision for diminution in value of investments by type Available for sale securities Ordinary shares of listed companies 362,722 1,705,848 Ordinary shares of unlisted companies 135,366 145,468 Foreign bonds 40,194 37,209 Preference shares 312,060 354,405 850,342 2,242,930 Held to maturity securities Term Finance Certificates 115,639 104,136 Sukuks 129,345 74,893 Participation Term Certificates 4,939 10,661 Recovery note 307,517 289,214 Debentures 4,392 4,392 561,832 483,296 1,412,174 2,726,226 9.3.3 Provision for diminution in value of investments by segment Equity securities Listed companies 362,722 1,705,848 Unlisted companies 135,366 145,468 Preference shares 312,060 354,405 810,148 2,205,721 Debt securities Term Finance Certificates 115,639 104,137 Sukuks 129,345 74,892 Recovery note 307,517 289,214 Foreign bonds 40,194 37,209 Participation Term Certificates 4,939 10,661 Debentures 4,392 4,392 602,026 520,505 1,412,174 2,726,226 9.3.4 The SBP, vide Letter No. BPRD/BRD-(Policy)/2012-13702 dated November 20, 2012 has permitted banks to maintain provision against Term Finance Certificates issued by Azgard Nine <strong>Limited</strong>, classified in Loss category, at 50% of the exposure. Accordingly, provision for diminution in value of investment include Rs.48.808 million (2011: Rs.Nil) against Azgard Nine <strong>Limited</strong>. 9.4 Unrealized gain / (loss) on revaluation of held for trading securities Market Treasury Bills 575 (42) Pakistan Investment Bonds (1,105) - Ordinary shares of listed companies 2,766 (43,708) 2,236 (43,750) 9.5 9.6 Investments include securities which are held by the <strong>Bank</strong> to comply with the statutory liquidity requirements as set out under Section 29 of the <strong>Bank</strong>ing Companies Ordinance, 1962. Investments include Rs.282 million (2011: Rs.282 million) held by the SBP and National <strong>Bank</strong> of Pakistan as pledge against demand loan, TT / DD discounting facilities and foreign exchange exposure limit sanctioned to the <strong>Bank</strong> and Rs.5 million (2011: Rs.5 million) held by the Controller of Military Accounts (CMA) under Regimental Fund Arrangements. 15

NOTES TO AND FORMING PART OF THE UNCONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2012 9.7 This represents the <strong>Bank</strong>'s investment in Khushhali <strong>Bank</strong> <strong>Limited</strong> (KBL) which is incorporated under the Microfinance Institutions Ordinance, 2001. As mentioned in note 9.7 to the unconsolidated financial statements for the year ended December 31, 2011, a consortium led by the <strong>Bank</strong> and including four international private equity funds had submitted a bid on February 16, 2012 for acquiring majority control of KBL. The consortium's bid was selected as the highest bid by the selling shareholders of KBL and, after completion of regulatory consents and approval from the SBP and the Competition Commission of Pakistan, a Share Purchase Agreement was successfully executed between the <strong>Bank</strong>'s consortium and the selling shareholders of KBL on June 4, 2012. Post acquisition, the <strong>Bank</strong>'s direct shareholding in KBL is 29.69%. The investment in KBL is classified as an associate due to the <strong>Bank</strong>'s significant influence on KBL by virtue of its shareholding. 9.8 9.9 9.10 During the year, the <strong>Bank</strong>'s subsidiary <strong>United</strong> National <strong>Bank</strong> <strong>Limited</strong> adopted the trade name <strong>United</strong> <strong>Bank</strong> UK, however, the legal name remains unchanged. This represents the <strong>Bank</strong>'s investment in UBL <strong>Bank</strong> (Tanzania) <strong>Limited</strong>, which was incorporated on March 13, 2012 and is in the process of completing formalities for receiving a certificate for commencement of business. The <strong>Bank</strong> owns 99.99% of the paid up capital of UBL <strong>Bank</strong> (Tanzania) <strong>Limited</strong>. Information relating to investments required to be disclosed as part of the financial statements under the SBP's BSD Circular No. 4 dated February 17, 2006, is given in Annexure 'A' to these unconsolidated financial statements. Details in respect of the quality of available for sale securities are also disclosed in Annexure 'A'. 10. ADVANCES Note Loans, cash credits, running finances, etc. Performing Non-performing Total 2012 2011 2012 2011 2012 2011 ---------------------------------------------- (Rupees in '000) -------------------------------------------------------- In Pakistan 10.2 230,815,515 217,075,307 42,504,178 41,798,946 273,319,693 258,874,253 Outside Pakistan 92,765,638 71,963,532 7,102,448 6,226,151 99,868,086 78,189,683 323,581,153 289,038,839 49,606,626 48,025,097 373,187,779 337,063,936 Bills discounted and purchased Payable in Pakistan 19,991,220 15,840,765 5,404,969 2,711,544 25,396,189 18,552,309 Payable outside Pakistan 8,171,075 10,310,200 2,335,401 380,183 10,506,476 10,690,383 28,162,295 26,150,965 7,740,370 3,091,727 35,902,665 29,242,692 Advances - gross 351,743,448 315,189,804 57,346,996 51,116,824 409,090,444 366,306,628 Provision against advances 10.4 - Specific - - (43,463,810) (39,950,726) (43,463,810) (39,950,726) - General (1,242,626) (1,002,011) (20,206) (6,683) (1,262,832) (1,008,694) (1,242,626) (1,002,011) (43,484,016) (39,957,409) (44,726,642) (40,959,420) Advances - net of provision 350,500,822 314,187,793 13,862,980 11,159,415 364,363,802 325,347,208 10.1 Particulars of advances - gross Performing Non-performing Total 2012 2011 2012 2011 2012 2011 ---------------------------------------------- (Rupees in '000) -------------------------------------------------------- 10.1.1 In local currency 249,048,415 227,995,007 47,607,666 44,165,843 296,656,081 272,160,850 In foreign currencies 102,695,033 87,194,797 9,739,330 6,950,981 112,434,363 94,145,778 351,743,448 315,189,804 57,346,996 51,116,824 409,090,444 366,306,628 10.1.2 Short term 218,613,468 216,561,336 - - 218,613,468 216,561,336 Long term 133,129,980 98,628,468 57,346,996 51,116,824 190,476,976 149,745,292 351,743,448 315,189,804 57,346,996 51,116,824 409,090,444 366,306,628 16