Financial Statements - United Bank Limited

Financial Statements - United Bank Limited

Financial Statements - United Bank Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO AND FORMING PART OF THE UNCONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED DECEMBER 31, 2012<br />

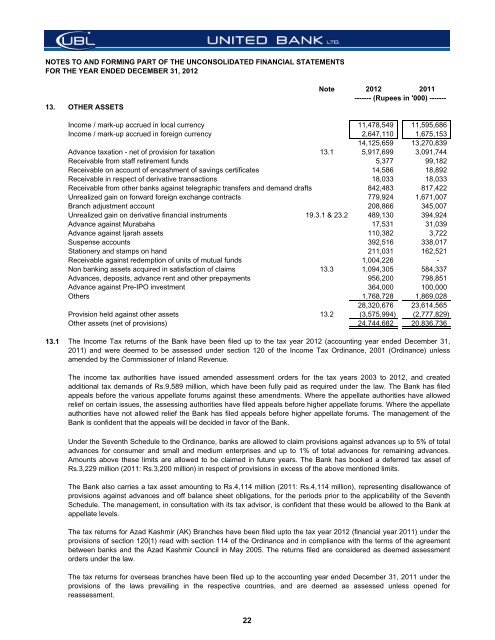

13. OTHER ASSETS<br />

Note 2012 2011<br />

------- (Rupees in '000) -------<br />

Income / mark-up accrued in local currency 11,478,549 11,595,686<br />

Income / mark-up accrued in foreign currency 2,647,110 1,675,153<br />

14,125,659 13,270,839<br />

Advance taxation - net of provision for taxation 13.1 5,917,699 3,091,744<br />

Receivable from staff retirement funds 5,377 99,182<br />

Receivable on account of encashment of savings certificates 14,586 18,892<br />

Receivable in respect of derivative transactions 18,033 18,033<br />

Receivable from other banks against telegraphic transfers and demand drafts 842,483 817,422<br />

Unrealized gain on forward foreign exchange contracts 779,924 1,671,007<br />

Branch adjustment account 208,866 345,007<br />

Unrealized gain on derivative financial instruments 19.3.1 & 23.2 489,130 394,924<br />

Advance against Murabaha 17,531 31,039<br />

Advance against Ijarah assets 110,382 3,722<br />

Suspense accounts 392,516 338,017<br />

Stationery and stamps on hand 211,031 162,521<br />

Receivable against redemption of units of mutual funds 1,004,226 -<br />

Non banking assets acquired in satisfaction of claims 13.3 1,094,305 584,337<br />

Advances, deposits, advance rent and other prepayments 956,200 798,851<br />

Advance against Pre-IPO investment 364,000 100,000<br />

Others 1,768,728 1,869,028<br />

28,320,676 23,614,565<br />

Provision held against other assets 13.2 (3,575,994) (2,777,829)<br />

Other assets (net of provisions) 24,744,682 20,836,736<br />

13.1<br />

The Income Tax returns of the <strong>Bank</strong> have been filed up to the tax year 2012 (accounting year ended December 31,<br />

2011) and were deemed to be assessed under section 120 of the Income Tax Ordinance, 2001 (Ordinance) unless<br />

amended by the Commissioner of Inland Revenue.<br />

The income tax authorities have issued amended assessment orders for the tax years 2003 to 2012, and created<br />

additional tax demands of Rs.9,589 million, which have been fully paid as required under the law. The <strong>Bank</strong> has filed<br />

appeals before the various appellate forums against these amendments. Where the appellate authorities have allowed<br />

relief on certain issues, the assessing authorities have filed appeals before higher appellate forums. Where the appellate<br />

authorities have not allowed relief the <strong>Bank</strong> has filed appeals before higher appellate forums. The management of the<br />

<strong>Bank</strong> is confident that the appeals will be decided in favor of the <strong>Bank</strong>.<br />

Under the Seventh Schedule to the Ordinance, banks are allowed to claim provisions against advances up to 5% of total<br />

advances for consumer and small and medium enterprises and up to 1% of total advances for remaining advances.<br />

Amounts above these limits are allowed to be claimed in future years. The <strong>Bank</strong> has booked a deferred tax asset of<br />

Rs.3,229 million (2011: Rs.3,200 million) in respect of provisions in excess of the above mentioned limits.<br />

The <strong>Bank</strong> also carries a tax asset amounting to Rs.4,114 million (2011: Rs.4,114 million), representing disallowance of<br />

provisions against advances and off balance sheet obligations, for the periods prior to the applicability of the Seventh<br />

Schedule. The management, in consultation with its tax advisor, is confident that these would be allowed to the <strong>Bank</strong> at<br />

appellate levels.<br />

The tax returns for Azad Kashmir (AK) Branches have been filed upto the tax year 2012 (financial year 2011) under the<br />

provisions of section 120(1) read with section 114 of the Ordinance and in compliance with the terms of the agreement<br />

between banks and the Azad Kashmir Council in May 2005. The returns filed are considered as deemed assessment<br />

orders under the law.<br />

The tax returns for overseas branches have been filed up to the accounting year ended December 31, 2011 under the<br />

provisions of the laws prevailing in the respective countries, and are deemed as assessed unless opened for<br />

reassessment.<br />

22