You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

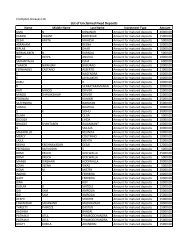

Crompton Greaves Ltd.<br />

Schedule (B) (Contd)<br />

<strong>2003</strong>-04 2002-03<br />

Rs Crores Rs Crores<br />

8 Miscellaneous expenditure amortised upto 31st July <strong>2003</strong> relates to<br />

(Refer Note 14 below)<br />

(a) Testing Fees 082 186<br />

(b) Payments under Voluntary Retirement Schemes 747 2521<br />

(c) Technical Know-How Fees 126 274<br />

9 Effects of changes in foreign exchange rates {Gain (+) / Loss (-)}:<br />

955<br />

2981<br />

Exchange difference charged to Profit & Loss Account<br />

(a) On account of forward contracts taken during the year -001 -004<br />

pertaining to future accounting period<br />

(b) Others 618 -238<br />

617 -242<br />

10 Interest and <strong>com</strong>mitment charges include interest on<br />

(a) Fixed loans 1898 3020<br />

(b) Debentures 279 817<br />

(c) Others 1854 2868<br />

4031<br />

6705<br />

(d) Less: Interest in<strong>com</strong>e (including tax deducted at source<br />

Rs023 crores; Previous year Rs027 crores) 141 192<br />

3890<br />

6513<br />

11 Advances recoverable in cash or in kind or for value to be received<br />

include:<br />

(a) Advances to associate <strong>com</strong>pany pending allotment of shares -<br />

Globalstar India Satellite Services Private Limited 116 116<br />

(b) Rent deposit with Directors 020 020<br />

(c) Due by an Officer RsNil ( Previous year Rs30000) (Maximum<br />

amount outstanding at any time during the year RsNil; 000 000<br />

Previous year Rs157170 )<br />

12 Arrears of preferential dividend of an amalgamated <strong>com</strong>pany payable<br />

in nine equal installments in terms of BIFR Order and the Scheme of 000 005<br />

Amalgamation<br />

13 During the year, the Company prepaid certain deferred sales tax liabilities in accordance with the scheme<br />

formulated by the State Government of Maharashtra for such optional prepayments Based on an expert’s<br />

opinion, the resultant surplus of Rs1912 crores, representing the excess of the recorded liability over the<br />

amount paid has been credited to “Capital Reserve”<br />

14 Pursuant to the approval by shareholders at the Annual General Meeting held on 22nd July <strong>2003</strong>, the<br />

<strong>com</strong>pany had filed petition in the High Court of Judicature at Mumbai and the said High Court had<br />

approved the Capital Reduction vide its Order dated 15th September <strong>2003</strong> Accordingly, the balances of<br />

the undermentioned accounts as on 31st July <strong>2003</strong> have been adjusted against the Securities Premium<br />

Account:-<br />

107