You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

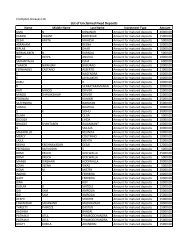

Crompton Greaves Ltd.<br />

Schedule (B) (Contd)<br />

Rs Crores<br />

(i) Voluntary retirement scheme 5396<br />

(ii) Technical know how 448<br />

(iii) Testing fees 589<br />

(iv) Deferred tax asset 7946<br />

(v) Debit balance in the Profit & Loss Account 827<br />

15206<br />

15 The <strong>com</strong>pany, with effect from 1st August <strong>2003</strong>, has charged to Profit and Loss Account the entire<br />

expenditure on voluntary retirement scheme, as against amortising this expenditure over five years as in<br />

the past Had these amounts been amortised as in the past, profit before taxes for the year would have<br />

been Rs10157 crores (as against the reported figure of Rs9555 crores) reserves and surplus would<br />

have been Rs30307 crores (as against the reported figure of Rs29705 crores)<br />

16 (a) During the year 135% Secured Non-Convertible Debentures (IX series) were fully redeemed and<br />

instalments pertaining to 135% secured non-convertible Debentures (VIII Series) were paid as per<br />

stipulation<br />

(b) In view of the above, no amount is required to be transferred to Debenture Redemption Reserve (DRR)<br />

in accordance with the General Circular No9/2002 dated 18/04/2002 issued by the Department of<br />

Company Affairs The amount outstanding to the credit of DRR as on 31-03-<strong>2004</strong> was in excess of<br />

the requirements amounting to Rs360 crores, has been transferred to the credit of General Reserve<br />

<strong>2003</strong>-04 2002-03<br />

17 Exceptional items in the Profit & Loss account pertain to : Rs Crores Rs Crores<br />

(a)<br />

Profit on sale of investment in CG Igarashi Motors Ltd and<br />

CG Newage Electrical Ltd and lumpsum in lieu thereof 000 3032<br />

(b) Diminution in Value of Advances -325 -273<br />

(c)<br />

Decline in value of certain Long Term Investments net of write<br />

back of earlier decline Rs075 crores -009 -1197<br />

(d) Loss on sale of other investments 000 -1250<br />

(e) Profit on sale of Land & Building situated at Worli 480 000<br />

(f) Profit on sale of Land & Building situated at Bhandup 437 000<br />

18 (a) In view of the set off of accumulated losses / unabsorbed depreciation available to the <strong>com</strong>pany<br />

under Section 72A of the In<strong>com</strong>e Tax Act, 1961 there is no tax liability on the <strong>com</strong>pany except u/s<br />

115JB of the Act for which necessary provision has been made<br />

583<br />

312<br />

108