You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Crompton Greaves Ltd.<br />

72<br />

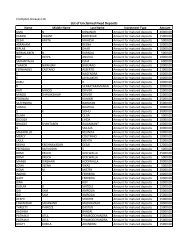

SCHEDULE [ A ] (Contd.)<br />

5 FOREIGN CURRENCY TRANSACTIONS<br />

(a) Foreign currency transactions are recorded at the exchange rate prevailing at the time of transactions.<br />

(b) Foreign currency current assets and liabilities are converted at the contracted / year end rate, as<br />

applicable.<br />

(c) Exchange difference on account of acquisition of fixed assets are adjusted to carrying cost of fixed<br />

assets. Other exchange differences are adjusted in the Profit & Loss Account.<br />

(d) The cost of forward exchange contracts is spread over the period of the contract.<br />

6 REVENUE RECOGNITION<br />

Revenues from sales and services is recognised in terms of contract with customers. Revenues from<br />

construction contracts is recognised based on percentage <strong>com</strong>pletion after providing for expected losses.<br />

7 RETIREMENT BENEFITS<br />

(a) Provident fund and superannuation contributions are accrued each year in terms of contracts with the<br />

employees.<br />

(b)<br />

Provisions for gratuity and leave encashment are determined and accrued on the basis of actuarial<br />

valuation.<br />

8 DEPRECIATION<br />

(a)<br />

(b)<br />

(c)<br />

(d)<br />

(e)<br />

Depreciation on the fixed assets is provided at the rates and in the manner specified in Schedule XIV<br />

of the Companies Act, 1956, on written down value method other than on buildings and plant and<br />

equipment which are depreciated on a straight line method.<br />

Building constructed on leasehold land are depreciated at normal rate as prescribed in Schedule XIV<br />

of the Companies Act, 1956 where the lease period of land is beyond the life of the building.<br />

Lumpsum amounts paid for leasehold land are amortised and charged to depreciation over the<br />

primary lease periods except where the option of refund is available.<br />

In the case of revalued assets the difference between the depreciation based on revaluation and the<br />

depreciation charged on historical cost is recouped out of revaluation reserve.<br />

The intangible assets are amortised over its estimated useful life.<br />

9 BORROWING COSTS<br />

Borrowing costs that are attributable to the acquisition, construction or production of qualifying assets are<br />

capitalised as part of the cost of such assets. A qualifying asset is an asset that necessarily takes a<br />

substantial period of time to get ready for its intended use or sale. All other borrowing costs are<br />

recognised as expense in the period in which they are incurred.<br />

10 TAXES ON INCOME<br />

(a) Tax on in<strong>com</strong>e for the current period is determined on the basis of estimated taxable in<strong>com</strong>e and tax<br />

credits <strong>com</strong>puted in accordance with the provisions of the In<strong>com</strong>e Tax Act, 1961 and based on the<br />

expected out<strong>com</strong>e of assessments / appeals.<br />

(b) Deferred tax is recognised on timing difference between the accounting in<strong>com</strong>e and the estimated<br />

taxable in<strong>com</strong>e for the period and quantified using the tax rates and laws enacted or substantively<br />

enacted on the balance sheet date.<br />

(c) Deferred tax assets which arise mainly on account of unabsorbed losses or unabsorbed depreciation<br />

are recognised and carried forward only to the extent that there is virtual certainty supported by<br />

convincing evidence that sufficient future taxable in<strong>com</strong>e will be available against which such deferred<br />

tax assets can be realised.<br />

11 CONTINGENCIES AND EVENTS OCCURRING AFTER THE BALANCE SHEET DATE<br />

(a)<br />

(b)<br />

Accounting for contingencies (gains and losses) arising out of contractual obligations, are made only<br />

on the basis of mutual acceptances.<br />

Where material events occurring after the date of balance sheet are considered upto the date of<br />

approval of the accounts by the Board of Directors.