Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Crompton Greaves Ltd.<br />

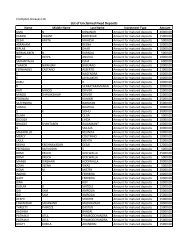

Significant Accounting Policies<br />

SCHEDULE [ A ]<br />

1 BASIS OF PRESENTATION<br />

The accounts have been prepared using historical cost convention, except for the revaluation of certain<br />

fixed assets, in accordance with the Generally Accepted Accounting Principles (GAAP) on the accrual basis<br />

and in accordance with the Accounting Standards referred to in Section 211(3C) and other provisions of<br />

the Companies Act 1956. Insurance and other claims are accounted for as and when admitted by the<br />

appropriate authorities.<br />

The preparation of accounts under GAAP requires management to make estimates and assumptions that<br />

affect the reported amounts of assets & liabilities and disclosures of contingent liabilities as at the date of<br />

the financial statements and the reported amounts of revenues and expenses during the year. Actual<br />

results could differ from those estimates. Any revisions to accounting estimates is recognised prospectively<br />

in the current and future periods.<br />

2 FIXED ASSETS<br />

(a)<br />

(b)<br />

(c)<br />

(d)<br />

(e)<br />

(f)<br />

Fixed assets are stated at cost, except for land and buildings added prior to 30th June 1985 which<br />

are stated at revalued cost as at that date based on technical expert’s evaluation report.<br />

Expenditure relating to existing fixed assets is added to the cost of the assets where it increases the<br />

performance / life of the assets as assessed earlier.<br />

Fixed assets are eliminated from financial statements, either on disposal or when retired from active<br />

use. Such assets are removed from fixed asset records on disposal. Generally, such retired assets<br />

are disposed off soon thereafter.<br />

Pre-operative expenses for the projects incurred till the projects are ready for <strong>com</strong>mercial production<br />

are capitalised.<br />

Internally manufactured / constructed fixed assets are capitalised at factory cost including excise<br />

duty wherever applicable.<br />

Lumpsum fees paid for acquisition of technical knowhow relating to Plant & Machinery is capitalised<br />

as intangible asset.<br />

(g) i) Machinery spares which are specific to particular item of Fixed Assets and whose use is irregular<br />

are capitalised as part of the cost of machinery.<br />

ii)<br />

Machinery spares which are not specific to a particular item of Fixed Assets but can be used<br />

generally for various items of Fixed Assets are treated as inventory and charged to Profit and<br />

Loss Account as and when issued for consumption in the ordinary course of operation.<br />

3 INVESTMENTS<br />

Current Investments are carried at lower of cost or market value. The determination of carrying costs of<br />

such investments is done on the basis of specific identification. Long term investments are carried at cost<br />

after providing for any diminution in value, if such diminution is of a permanent nature.<br />

4 INVENTORIES<br />

Inventories are valued at the lower of cost or net realisable value after providing for obsolescence and<br />

damage as under:-<br />

(a) Raw materials, packing materials : At Cost, on FIFO/Weighted average basis<br />

stores & spares and construction<br />

material<br />

(b) Work-in-Process : At Cost plus appropriate production overheads<br />

(c) Construction Work-in-Progress : At Cost till a certain percentage of <strong>com</strong>pletion and thereafter<br />

realisable value<br />

(d) Finished goods : At Cost, plus appropriate production overheads, including<br />

excise duty paid/payable on such goods.<br />

71