MelbourneâBrisbane Inland Rail Alignment Study - Australian Rail ...

MelbourneâBrisbane Inland Rail Alignment Study - Australian Rail ...

MelbourneâBrisbane Inland Rail Alignment Study - Australian Rail ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

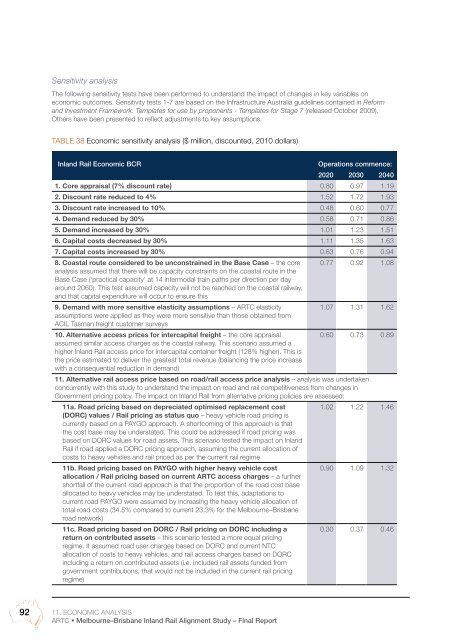

Sensitivity analysis<br />

The following sensitivity tests have been performed to understand the impact of changes in key variables on<br />

economic outcomes. Sensitivity tests 1-7 are based on the Infrastructure Australia guidelines contained in Reform<br />

and Investment Framework: Templates for use by proponents - Templates for Stage 7 (released October 2009).<br />

Others have been presented to reflect adjustments to key assumptions.<br />

Table 38 Economic sensitivity analysis ($ million, discounted, 2010 dollars)<br />

<strong>Inland</strong> <strong>Rail</strong> Economic BCR<br />

Operations commence:<br />

2020 2030 2040<br />

1. Core appraisal (7% discount rate) 0.80 0.97 1.19<br />

2. Discount rate reduced to 4% 1.52 1.72 1.93<br />

3. Discount rate increased to 10% 0.48 0.60 0.77<br />

4. Demand reduced by 30% 0.58 0.71 0.86<br />

5. Demand increased by 30% 1.01 1.23 1.51<br />

6. Capital costs decreased by 30% 1.11 1.35 1.63<br />

7. Capital costs increased by 30% 0.63 0.76 0.94<br />

8. Coastal route considered to be unconstrained in the Base Case – the core 0.77 0.92 1.08<br />

analysis assumed that there will be capacity constraints on the coastal route in the<br />

Base Case (‘practical capacity’ at 14 intermodal train paths per direction per day<br />

around 2060). This test assumed capacity will not be reached on the coastal railway,<br />

and that capital expenditure will occur to ensure this<br />

9. Demand with more sensitive elasticity assumptions – ARTC elasticity<br />

1.07 1.31 1.62<br />

assumptions were applied as they were more sensitive than those obtained from<br />

ACIL Tasman freight customer surveys<br />

10. Alternative access prices for intercapital freight – the core appraisal<br />

0.60 0.73 0.89<br />

assumed similar access charges as the coastal railway. This scenario assumed a<br />

higher <strong>Inland</strong> <strong>Rail</strong> access price for intercapital container freight (128% higher). This is<br />

the price estimated to deliver the greatest total revenue (balancing the price increase<br />

with a consequential reduction in demand)<br />

11. Alternative rail access price based on road/rail access price analysis – analysis was undertaken<br />

concurrently with this study to understand the impact on road and rail competitiveness from changes in<br />

Government pricing policy. The impact on <strong>Inland</strong> <strong>Rail</strong> from alternative pricing policies are assessed:<br />

11a. Road pricing based on depreciated optimised replacement cost<br />

1.02 1.22 1.46<br />

(DORC) values / <strong>Rail</strong> pricing as status quo – heavy vehicle road pricing is<br />

currently based on a PAYGO approach. A shortcoming of this approach is that<br />

the cost base may be understated. This could be addressed if road pricing was<br />

based on DORC values for road assets. This scenario tested the impact on <strong>Inland</strong><br />

<strong>Rail</strong> if road applied a DORC pricing approach, assuming the current allocation of<br />

costs to heavy vehicles and rail priced as per the current rail regime<br />

11b. Road pricing based on PAYGO with higher heavy vehicle cost<br />

0.90 1.09 1.32<br />

allocation / <strong>Rail</strong> pricing based on current ARTC access charges – a further<br />

shortfall of the current road approach is that the proportion of the road cost base<br />

allocated to heavy vehicles may be understated. To test this, adaptations to<br />

current road PAYGO were assumed by increasing the heavy vehicle allocation of<br />

total road costs (34.5% compared to current 23.3% for the Melbourne–Brisbane<br />

road network)<br />

11c. Road pricing based on DORC / <strong>Rail</strong> pricing on DORC including a<br />

return on contributed assets – this scenario tested a more equal pricing<br />

regime. It assumed road user charges based on DORC and current NTC<br />

allocation of costs to heavy vehicles, and rail access charges based on DORC<br />

including a return on contributed assets (i.e. included rail assets funded from<br />

government contributions, that would not be included in the current rail pricing<br />

regime)<br />

0.30 0.37 0.46<br />

92<br />

11. Economic analysis<br />

ARTC • Melbourne–Brisbane <strong>Inland</strong> <strong>Rail</strong> <strong>Alignment</strong> <strong>Study</strong> – Final Report