You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

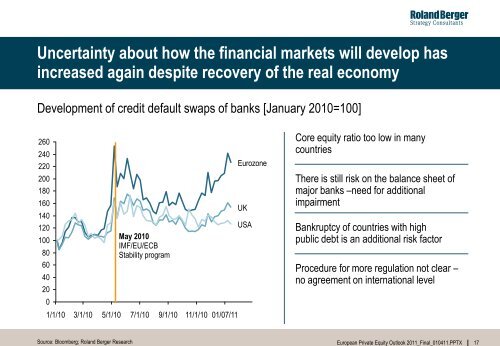

Uncertainty about how the financial markets will develop has<br />

increased again despite recovery of the real economy<br />

Development of credit default swaps of banks [January 2010=100]<br />

260<br />

240<br />

220<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

1/1/10<br />

3/1/10<br />

5/1/10<br />

Source: Bloomberg; Roland Berger Research<br />

May 2010<br />

IMF/EU/ECB<br />

Stability program<br />

7/1/10<br />

9/1/10<br />

11/1/10<br />

01/07/11<br />

Eurozone<br />

UK<br />

USA<br />

Core equity ratio too low in many<br />

countries<br />

There is still risk on the balance sheet of<br />

major banks –need for additional<br />

impairment<br />

Bankruptcy of countries with high<br />

public debt is an additional risk factor<br />

Procedure for more regulation not clear –<br />

no agreement on international level<br />

<strong>European</strong> <strong>Private</strong> <strong>Equity</strong> <strong>Outlook</strong> <strong>2011</strong>_Final_010411.PPTX 17