You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

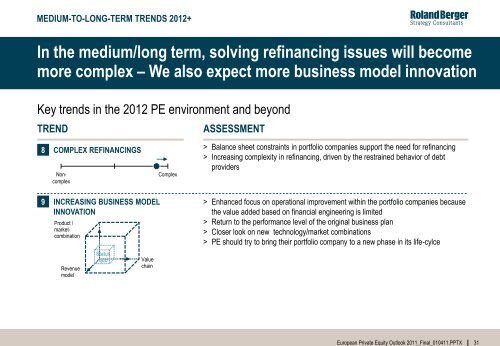

MEDIUM-TO-LONG-TERM TRENDS 2012+<br />

In the medium/long term, solving refinancing issues will become<br />

more complex – We also expect more business model innovation<br />

Key trends in the 2012 PE environment and beyond<br />

TREND<br />

8 COMPLEX REFINANCINGS<br />

Noncomplex<br />

9 INCREASING BUSINESS MODEL<br />

INNOVATION<br />

Product /<br />

marketcombination<br />

Revenue<br />

model<br />

Status<br />

quo<br />

Value<br />

chain<br />

Complex<br />

ASSESSMENT<br />

> Balance sheet constraints in portfolio companies support the need for refinancing<br />

> Increasing complexity in refinancing, driven by the restrained behavior of debt<br />

providers<br />

> Enhanced focus on operational improvement within the portfolio companies because<br />

the value added based on financial engineering is limited<br />

> Return to the performance level of the original business plan<br />

> Closer look on new technology/market combinations<br />

> PE should try to bring their portfolio company to a new phase in its life-cylce<br />

<strong>European</strong> <strong>Private</strong> <strong>Equity</strong> <strong>Outlook</strong> <strong>2011</strong>_Final_010411.PPTX 31