Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2<br />

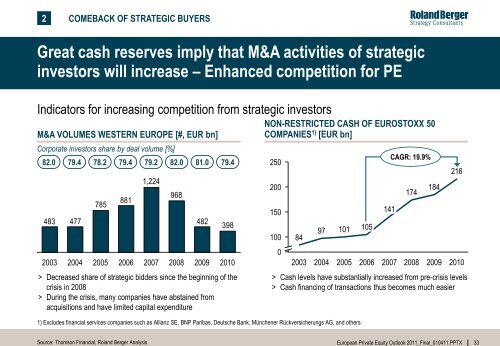

COMEBACK OF STRATEGIC BUYERS<br />

Great cash reserves imply that M&A activities of strategic<br />

investors will increase – Enhanced competition for PE<br />

Indicators for increasing competition from strategic investors<br />

M&A VOLUMES WESTERN EUROPE [#, EUR bn]<br />

Corporate investors share by deal volume [%]<br />

82.0 79.4 78.2 79.4<br />

483<br />

2003<br />

477<br />

2004<br />

785<br />

2005<br />

881<br />

2006<br />

Source: Thomson Financial, Roland Berger Analysis<br />

79.2 82.0 81.0 79.4<br />

1,224<br />

2007<br />

968<br />

2008<br />

482<br />

2009<br />

398<br />

2010<br />

> Decreased share of strategic bidders since the beginning of the<br />

crisis in 2008<br />

> During the crisis, many companies have abstained from<br />

acquisitions and have limited capital expenditure<br />

NON-RESTRICTED CASH OF EUROSTOXX 50<br />

COMPANIES 1) [EUR bn]<br />

1) Excludes financial services companies such as Allianz SE, BNP Paribas, Deutsche Bank, Münchener Rückversicherungs AG, and others<br />

250<br />

200<br />

150<br />

100<br />

0<br />

84<br />

2003<br />

97<br />

2004<br />

101<br />

2005<br />

105<br />

2006<br />

141<br />

2007<br />

CAGR: 19.9%<br />

174<br />

2008<br />

184<br />

2009<br />

216<br />

2010<br />

> Cash levels have substantially increased from pre-crisis levels<br />

> Cash financing of transactions thus becomes much easier<br />

<strong>European</strong> <strong>Private</strong> <strong>Equity</strong> <strong>Outlook</strong> <strong>2011</strong>_Final_010411.PPTX 33