You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

6<br />

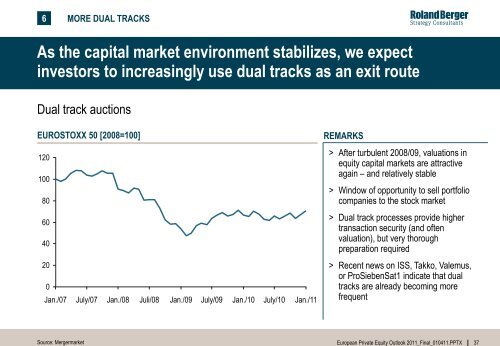

MORE DUAL TRACKS<br />

As the capital market environment stabilizes, we expect<br />

investors to increasingly use dual tracks as an exit route<br />

Dual track auctions<br />

EUROSTOXX 50 [2008=100]<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

Jan./07 July/07 Jan./08 Juli/08 Jan./09 July/09 Jan./10 July/10<br />

Jan./11<br />

Source: Mergermarket<br />

REMARKS<br />

> After turbulent 2008/09, valuations in<br />

equity capital markets are attractive<br />

again – and relatively stable<br />

> Window of opportunity to sell portfolio<br />

companies to the stock market<br />

> Dual track processes provide higher<br />

transaction security (and often<br />

valuation), but very thorough<br />

preparation required<br />

> Recent news on ISS, Takko, Valemus,<br />

or ProSiebenSat1 indicate that dual<br />

tracks are already becoming more<br />

frequent<br />

<strong>European</strong> <strong>Private</strong> <strong>Equity</strong> <strong>Outlook</strong> <strong>2011</strong>_Final_010411.PPTX 37