You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

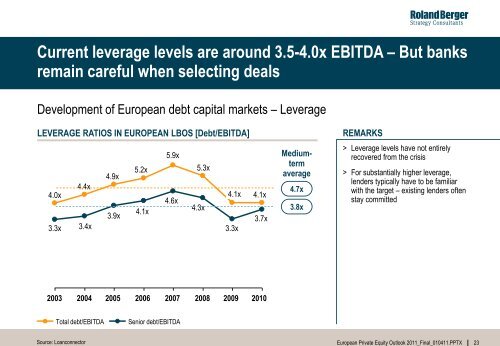

Current leverage levels are around 3.5-4.0x EBITDA – But banks<br />

remain careful when selecting deals<br />

Development of <strong>European</strong> debt capital markets – Leverage<br />

LEVERAGE RATIOS IN EUROPEAN LBOS [Debt/EBITDA]<br />

4.0x<br />

3.3x<br />

2003<br />

4.4x<br />

3.4x<br />

Source: Loanconnector<br />

4.9x<br />

3.9x<br />

5.2x<br />

4.1x<br />

5.9x<br />

4.6x<br />

5.3x<br />

4.3x<br />

4.1x<br />

3.3x<br />

4.1x<br />

3.7x<br />

2004 2005 2006 2007 2008 2009 2010<br />

Total debt/EBITDA Senior debt/EBITDA<br />

Mediumterm<br />

average<br />

4.7x<br />

3.8x<br />

REMARKS<br />

> Leverage levels have not entirely<br />

recovered from the crisis<br />

> For substantially higher leverage,<br />

lenders typically have to be familiar<br />

with the target – existing lenders often<br />

stay committed<br />

<strong>European</strong> <strong>Private</strong> <strong>Equity</strong> <strong>Outlook</strong> <strong>2011</strong>_Final_010411.PPTX 23