Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

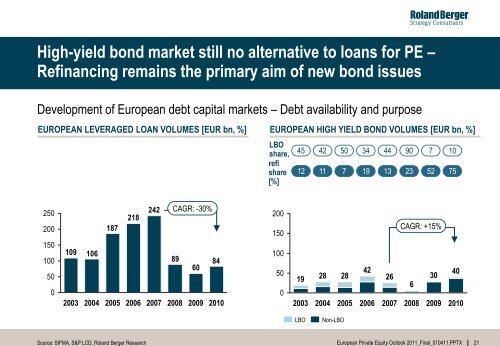

High-yield bond market still no alternative to loans for PE –<br />

Refinancing remains the primary aim of new bond issues<br />

Development of <strong>European</strong> debt capital markets – Debt availability and purpose<br />

EUROPEAN LEVERAGED LOAN VOLUMES [EUR bn, %] EUROPEAN HIGH YIELD BOND VOLUMES [EUR bn, %]<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

109<br />

106<br />

187<br />

2003 2004 2005<br />

218<br />

Source: SIFMA, S&P LCD, Roland Berger Research<br />

242<br />

CAGR: -30%<br />

89<br />

60<br />

84<br />

2006 2007 2008 2009 2010<br />

LBO<br />

share,<br />

refi<br />

share<br />

[%]<br />

200<br />

150<br />

100<br />

50<br />

0<br />

45 42 50 34 44 90 7 10<br />

12 11 7 19 13 23 52 75<br />

19<br />

2003<br />

28<br />

42<br />

2004 2005 2006 2007<br />

LBO Non-LBO<br />

28<br />

26<br />

CAGR: +15%<br />

2008<br />

30<br />

2009<br />

40<br />

2010<br />

<strong>European</strong> <strong>Private</strong> <strong>Equity</strong> <strong>Outlook</strong> <strong>2011</strong>_Final_010411.PPTX 21<br />

6