Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

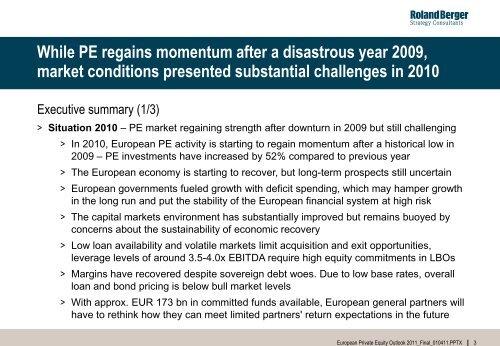

While PE regains momentum after a disastrous year 2009,<br />

market conditions presented substantial challenges in 2010<br />

Executive summary (1/3)<br />

> Situation 2010 – PE market regaining strength after downturn in 2009 but still challenging<br />

> In 2010, <strong>European</strong> PE activity is starting to regain momentum after a historical low in<br />

2009 – PE investments have increased by 52% compared to previous year<br />

> The <strong>European</strong> economy is starting to recover, but long-term prospects still uncertain<br />

> <strong>European</strong> governments fueled growth with deficit spending, which may hamper growth<br />

in the long run and put the stability of the <strong>European</strong> financial system at high risk<br />

> The capital markets environment has substantially improved but remains buoyed by<br />

concerns about the sustainability of economic recovery<br />

> Low loan availability and volatile markets limit acquisition and exit opportunities,<br />

leverage levels of around 3.5-4.0x EBITDA require high equity commitments in LBOs<br />

> Margins have recovered despite sovereign debt woes. Due to low base rates, overall<br />

loan and bond pricing is below bull market levels<br />

> With approx. EUR 173 bn in committed funds available, <strong>European</strong> general partners will<br />

have to rethink how they can meet limited partners' return expectations in the future<br />

<strong>European</strong> <strong>Private</strong> <strong>Equity</strong> <strong>Outlook</strong> <strong>2011</strong>_Final_010411.PPTX 3