You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

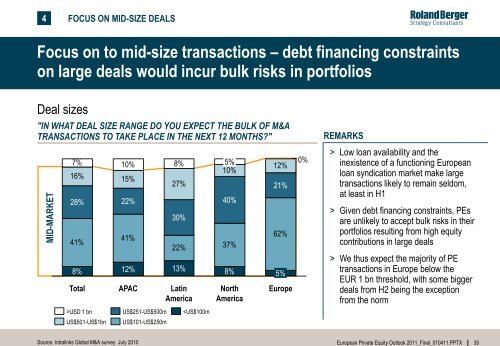

4 FOCUS ON MID-SIZE DEALS<br />

Focus on to mid-size transactions – debt financing constraints<br />

on large deals would incur bulk risks in portfolios<br />

Deal sizes<br />

"IN WHAT DEAL SIZE RANGE DO YOU EXPECT THE BULK OF M&A<br />

TRANSACTIONS TO TAKE PLACE IN THE NEXT 12 MONTHS?"<br />

MID-MARKET<br />

7% 10% 8%<br />

16% 15%<br />

28%<br />

41%<br />

8%<br />

Total<br />

>USD 1 bn<br />

US$501-US$1bn<br />

22%<br />

41%<br />

12%<br />

APAC<br />

Source: Intralinks Global M&A survey July 2010<br />

US$251-US$500m<br />

US$101-US$250m<br />

27%<br />

30%<br />

22%<br />

13%<br />

Latin<br />

America<br />

Low loan availability and the<br />

inexistence of a functioning <strong>European</strong><br />

loan syndication market make large<br />

transactions likely to remain seldom,<br />

at least in H1<br />

> Given debt financing constraints, PEs<br />

are unlikely to accept bulk risks in their<br />

portfolios resulting from high equity<br />

contributions in large deals<br />

> We thus expect the majority of PE<br />

transactions in Europe below the<br />

EUR 1 bn threshold, with some bigger<br />

deals from H2 being the exception<br />

from the norm<br />

<strong>European</strong> <strong>Private</strong> <strong>Equity</strong> <strong>Outlook</strong> <strong>2011</strong>_Final_010411.PPTX 35