download PDF - Newron

download PDF - Newron

download PDF - Newron

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

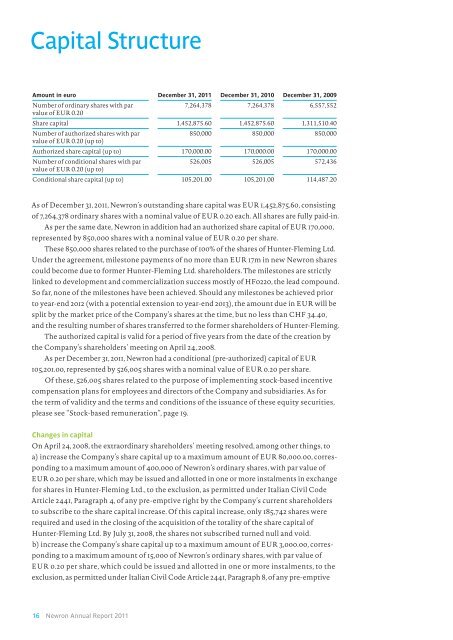

Capital Structure<br />

Amount in euro December 31, 2011 December 31, 2010 December 31, 2009<br />

Number of ordinary shares with par<br />

7,264,378 7,264,378 6,557,552<br />

value of EUR 0.20<br />

Share capital 1,452,875.60 1,452,875.60 1,311,510.40<br />

Number of authorized shares with par<br />

850,000 850,000 850,000<br />

value of EUR 0.20 (up to)<br />

Authorized share capital (up to) 170,000.00 170,000.00 170,000.00<br />

Number of conditional shares with par<br />

526,005 526,005 572,436<br />

value of EUR 0.20 (up to)<br />

Conditional share capital (up to) 105,201.00 105,201.00 114,487.20<br />

As of December 31, 2011, <strong>Newron</strong>’s outstanding share capital was EUR 1,452,875.60, consisting<br />

of 7,264,378 ordinary shares with a nominal value of EUR 0.20 each. All shares are fully paid-in.<br />

As per the same date, <strong>Newron</strong> in addition had an authorized share capital of EUR 170,000,<br />

represented by 850,000 shares with a nominal value of EUR 0.20 per share.<br />

These 850,000 shares related to the purchase of 100% of the shares of Hunter-Fleming Ltd.<br />

Under the agreement, milestone payments of no more than EUR 17m in new <strong>Newron</strong> shares<br />

could become due to former Hunter-Fleming Ltd. shareholders. The milestones are strictly<br />

linked to development and commercialization success mostly of HF0220, the lead compound.<br />

So far, none of the milestones have been achieved. Should any milestones be achieved prior<br />

to year-end 2012 (with a potential extension to year-end 2013), the amount due in EUR will be<br />

split by the market price of the Company’s shares at the time, but no less than CHF 34.40,<br />

and the resulting number of shares transferred to the former shareholders of Hunter-Fleming.<br />

The authorized capital is valid for a period of five years from the date of the creation by<br />

the Company’s shareholders’ meeting on April 24, 2008.<br />

As per December 31, 2011, <strong>Newron</strong> had a conditional (pre-authorized) capital of EUR<br />

105,201.00, represented by 526,005 shares with a nominal value of EUR 0.20 per share.<br />

Of these, 526,005 shares related to the purpose of implementing stock-based incentive<br />

compensation plans for employees and directors of the Company and subsidiaries. As for<br />

the term of validity and the terms and conditions of the issuance of these equity securities,<br />

please see “Stock-based remuneration”, page 19.<br />

Changes in capital<br />

On April 24, 2008, the extraordinary shareholders’ meeting resolved, among other things, to<br />

a) increase the Company’s share capital up to a maximum amount of EUR 80,000.00, corresponding<br />

to a maximum amount of 400,000 of <strong>Newron</strong>’s ordinary shares, with par value of<br />

EUR 0.20 per share, which may be issued and allotted in one or more instalments in exchange<br />

for shares in Hunter-Fleming Ltd., to the exclusion, as permitted under Italian Civil Code<br />

Article 2441, Paragraph 4, of any pre-emptive right by the Company’s current shareholders<br />

to subscribe to the share capital increase. Of this capital increase, only 185,742 shares were<br />

required and used in the closing of the acquisition of the totality of the share capital of<br />

Hunter-Fleming Ltd. By July 31, 2008, the shares not subscribed turned null and void.<br />

b) increase the Company’s share capital up to a maximum amount of EUR 3,000.00, corresponding<br />

to a maximum amount of 15,000 of <strong>Newron</strong>’s ordinary shares, with par value of<br />

EUR 0.20 per share, which could be issued and allotted in one or more instalments, to the<br />

exclusion, as permitted under Italian Civil Code Article 2441, Paragraph 8, of any pre -emptive<br />

16 <strong>Newron</strong> Annual Report 2011