download PDF - Newron

download PDF - Newron

download PDF - Newron

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

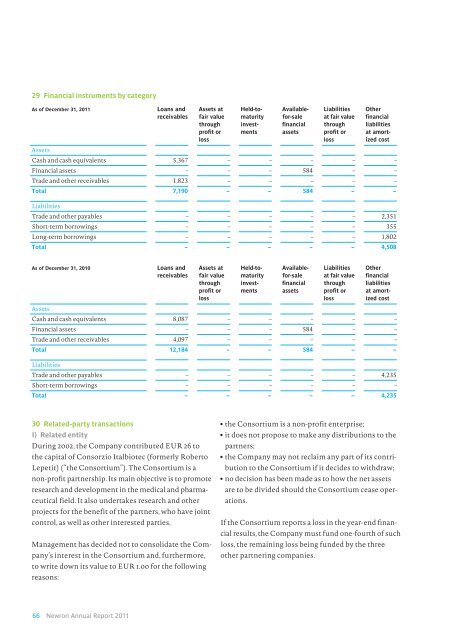

29 Financial instruments by category<br />

As of December 31, 2011<br />

Assets<br />

Loans and<br />

receivables<br />

Assets at<br />

fair value<br />

through<br />

profit or<br />

loss<br />

Held-tomaturity<br />

investments<br />

Availablefor-sale<br />

financial<br />

assets<br />

Liabilities<br />

at fair value<br />

through<br />

profit or<br />

loss<br />

Other<br />

financial<br />

liabilities<br />

at amortized<br />

cost<br />

Cash and cash equivalents 5,367 – – – – –<br />

Financial assets – – – 584 – –<br />

Trade and other receivables 1,823 – – – – –<br />

Total 7,190 – – 584 – –<br />

Liabilities<br />

Trade and other payables – – – – – 2,351<br />

Short-term borrowings – – – – – 355<br />

Long-term borrowings – – – – – 1,802<br />

Total – – – – – 4,508<br />

As of December 31, 2010<br />

Assets<br />

Loans and<br />

receivables<br />

Assets at<br />

fair value<br />

through<br />

profit or<br />

loss<br />

Held-tomaturity<br />

investments<br />

Availablefor-sale<br />

financial<br />

assets<br />

Liabilities<br />

at fair value<br />

through<br />

profit or<br />

loss<br />

Other<br />

financial<br />

liabilities<br />

at amortized<br />

cost<br />

Cash and cash equivalents 8,087 – – – – –<br />

Financial assets – – – 584 – –<br />

Trade and other receivables 4,097 – – – – –<br />

Total 12,184 – – 584 – –<br />

Liabilities<br />

Trade and other payables – – – – – 4,235<br />

Short-term borrowings – – – – – –<br />

Total – – – – – 4,235<br />

30 Related-party transactions<br />

I) Related entity<br />

During 2002, the Company contributed EUR 26 to<br />

the capital of Consorzio Italbiotec (formerly Roberto<br />

Lepetit) (“the Consortium”). The Consortium is a<br />

non-profit partnership. Its main objective is to promote<br />

research and development in the medical and pharmaceutical<br />

field. It also undertakes research and other<br />

projects for the benefit of the partners, who have joint<br />

control, as well as other interested parties.<br />

Management has decided not to consolidate the Company’s<br />

interest in the Consortium and, furthermore,<br />

to write down its value to EUR 1.00 for the following<br />

reasons:<br />

• the Consortium is a non-profit enterprise;<br />

• it does not propose to make any distributions to the<br />

partners;<br />

• the Company may not reclaim any part of its contribution<br />

to the Consortium if it decides to withdraw;<br />

• no decision has been made as to how the net assets<br />

are to be divided should the Consortium cease operations.<br />

If the Consortium reports a loss in the year-end financial<br />

results, the Company must fund one-fourth of such<br />

loss, the remaining loss being funded by the three<br />

other partnering companies.<br />

66 <strong>Newron</strong> Annual Report 2011