View - Atkins

View - Atkins

View - Atkins

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

34 Reviews<br />

Operating and Financial Review<br />

Financial performance<br />

Net finance income<br />

Net finance income for the year was £4.3m<br />

(2007: £3.6m) with the increase partly<br />

attributable to a £1.3m decrease in the net<br />

finance cost on retirement benefit liabilities.<br />

Taxation<br />

The Group’s income tax expense for<br />

the year, on continuing operations, was<br />

£23.3m (2007: £15.2m). As expected,<br />

the normalised effective tax rate increased<br />

to 25.7% from 22.0% in the prior year<br />

which benefited from three years’ research<br />

and development tax credits. The Group’s<br />

effective tax rate is expected to remain below<br />

the UK statutory rate due to the continuing<br />

benefit of research and development tax<br />

credits and the increasing proportion of<br />

profits earned in jurisdictions with lower<br />

tax rates than the UK.<br />

Earnings per share (EPS)<br />

EPS was 98.9p (2007: loss per share 56.8p).<br />

Normalised diluted EPS, which is considered<br />

to be a more representative measure of<br />

underlying trading and relates to continuing<br />

operations, was 66.7p (2007: 56.5p), an<br />

increase of 18%. Further details are given<br />

in note 12 to the Financial Statements.<br />

Pensions<br />

Funding<br />

The latest actuarial valuation of the defined<br />

benefit <strong>Atkins</strong> Pension Plan (the Plan) carried<br />

out as at 1 April 2007 indicated that the<br />

Plan had an actuarial deficit of approximately<br />

£215m. Accelerated contributions of<br />

£37.5m were made during the year with<br />

a further £12.5m on 1 April 2008. A<br />

commitment to contribute a further £32m<br />

per year for the next six years has been<br />

agreed with the Trustees.<br />

Charges<br />

The Group accounts for pension costs<br />

under IAS 19, Employee benefits. As<br />

expected, following the transfer of 1,622<br />

members from the defined benefit section<br />

to the defined contribution section on<br />

1 October 2007, the total charge to the<br />

income statement in respect of defined<br />

benefit schemes reduced to £17.8m<br />

(2007: £24.9m), comprising total service<br />

cost of £16.7m (2007: £22.5m) and net<br />

finance cost of £1.1m (2007: £2.4m).<br />

The charge relating to defined contribution<br />

schemes increased to £23.3m<br />

(2007: £16.0m).<br />

IAS 19 valuation and<br />

accounting treatment<br />

The Group assesses pension scheme funding<br />

with reference to actuarial valuations but<br />

for reporting purposes uses IAS 19. Under<br />

IAS 19, the Group recognised a post-tax<br />

retirement benefit liability of £153.9m at<br />

31 March 2008 (2007: £175.1m). The<br />

actuarial gain recognised through equity<br />

amounted to £6.4m (2007: £31.3m).<br />

However, after taking into account the<br />

impact of the change in UK tax rates, there<br />

was a post-tax actuarial loss of £1.0m<br />

(2007: gain of £21.7m).<br />

The assumptions used in the IAS 19<br />

valuation are detailed in note 29 to the<br />

Financial Statements.<br />

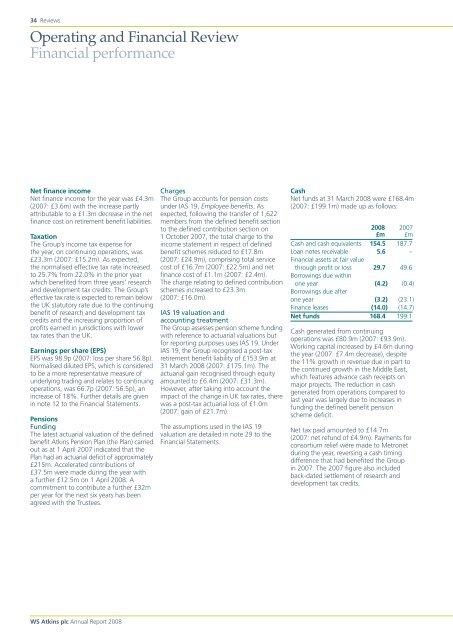

Cash<br />

Net funds at 31 March 2008 were £168.4m<br />

(2007: £199.1m) made up as follows:<br />

2008 2007<br />

£m £m<br />

Cash and cash equivalents 154.5 187.7<br />

Loan notes receivable 5.6 –<br />

Financial assets at fair value<br />

through profit or loss 29.7 49.6<br />

Borrowings due within<br />

one year (4.2) (0.4)<br />

Borrowings due after<br />

one year (3.2) (23.1)<br />

Finance leases (14.0) (14.7)<br />

Net funds 168.4 199.1<br />

Cash generated from continuing<br />

operations was £80.9m (2007: £93.9m).<br />

Working capital increased by £4.6m during<br />

the year (2007: £7.4m decrease), despite<br />

the 11% growth in revenue due in part to<br />

the continued growth in the Middle East,<br />

which features advance cash receipts on<br />

major projects. The reduction in cash<br />

generated from operations compared to<br />

last year was largely due to increases in<br />

funding the defined benefit pension<br />

scheme deficit.<br />

Net tax paid amounted to £14.7m<br />

(2007: net refund of £4.9m). Payments for<br />

consortium relief were made to Metronet<br />

during the year, reversing a cash timing<br />

difference that had benefited the Group<br />

in 2007. The 2007 figure also included<br />

back-dated settlement of research and<br />

development tax credits.<br />

WS <strong>Atkins</strong> plc Annual Report 2008