STENA METALL AB - Stena Metall Group

STENA METALL AB - Stena Metall Group

STENA METALL AB - Stena Metall Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

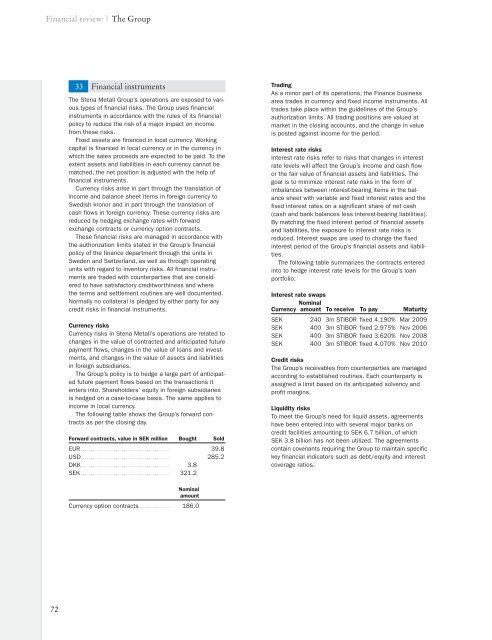

Financial review | The <strong>Group</strong><br />

33 Financial instruments<br />

The <strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong>’s operations are exposed to various<br />

types of financial risks. The <strong>Group</strong> uses financial<br />

instruments in accordance with the rules of its financial<br />

policy to reduce the risk of a major impact on income<br />

from these risks.<br />

Fixed assets are financed in local currency. Working<br />

capital is financed in local currency or in the currency in<br />

which the sales proceeds are expected to be paid. To the<br />

extent assets and liabilities in each currency cannot be<br />

matched, the net position is adjusted with the help of<br />

financial instruments.<br />

Currency risks arise in part through the translation of<br />

income and balance sheet items in foreign currency to<br />

Swedish kronor and in part through the translation of<br />

cash flows in foreign currency. These currency risks are<br />

reduced by hedging exchange rates with forward<br />

exchange contracts or currency option contracts.<br />

These financial risks are managed in accordance with<br />

the authorization limits stated in the <strong>Group</strong>’s financial<br />

policy of the finance department through the units in<br />

Sweden and Switzerland, as well as through operating<br />

units with regard to inventory risks. All financial instruments<br />

are traded with counterparties that are considered<br />

to have satisfactory creditworthiness and where<br />

the terms and settlement routines are well documented.<br />

Normally no collateral is pledged by either party for any<br />

credit risks in financial instruments.<br />

Currency risks<br />

Currency risks in <strong>Stena</strong> <strong>Metall</strong>’s operations are related to<br />

changes in the value of contracted and anticipated future<br />

payment flows, changes in the value of loans and investments,<br />

and changes in the value of assets and liabilities<br />

in foreign subsidiaries.<br />

The <strong>Group</strong>’s policy is to hedge a large part of anticipated<br />

future payment flows based on the transactions it<br />

enters into. Shareholders’ equity in foreign subsidiaries<br />

is hedged on a case-to-case basis. The same applies to<br />

income in local currency.<br />

The following table shows the <strong>Group</strong>’s forward contracts<br />

as per the closing day.<br />

Forward contracts, value in SEK million Bought Sold<br />

EUR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39.8<br />

USD . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 285.2<br />

DKK . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.8<br />

SEK . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 321.2<br />

Trading<br />

As a minor part of its operations, the Finance business<br />

area trades in currency and fixed income instruments. All<br />

trades take place within the guidelines of the <strong>Group</strong>’s<br />

authorization limits. All trading positions are valued at<br />

market in the closing accounts, and the change in value<br />

is posted against income for the period.<br />

Interest rate risks<br />

Interest rate risks refer to risks that changes in interest<br />

rate levels will affect the <strong>Group</strong>’s income and cash flow<br />

or the fair value of financial assets and liabilities. The<br />

goal is to minimize interest rate risks in the form of<br />

imbalances between interest-bearing items in the balance<br />

sheet with variable and fixed interest rates and the<br />

fixed interest rates on a significant share of net cash<br />

(cash and bank balances less interest-bearing liabilities).<br />

By matching the fixed interest period of financial assets<br />

and liabilities, the exposure to interest rate risks is<br />

reduced. Interest swaps are used to change the fixed<br />

interest period of the <strong>Group</strong>’s financial assets and liabilities.<br />

The following table summarizes the contracts entered<br />

into to hedge interest rate levels for the <strong>Group</strong>’s loan<br />

portfolio:<br />

Interest rate swaps<br />

Nominal<br />

Currency amount To receive To pay Maturity<br />

SEK 240 3m STIBOR fixed 4.190% Mar 2009<br />

SEK 400 3m STIBOR fixed 2.975% Nov 2006<br />

SEK 400 3m STIBOR fixed 3.620% Nov 2008<br />

SEK 400 3m STIBOR fixed 4.070% Nov 2010<br />

Credit risks<br />

The <strong>Group</strong>’s receivables from counterparties are managed<br />

according to established routines. Each counterparty is<br />

assigned a limit based on its anticipated solvency and<br />

profit margins.<br />

Liquidity risks<br />

To meet the <strong>Group</strong>’s need for liquid assets, agreements<br />

have been entered into with several major banks on<br />

credit facilities amounting to SEK 6.7 billion, of which<br />

SEK 3.8 billion has not been utilized. The agreements<br />

contain covenants requiring the <strong>Group</strong> to maintain specific<br />

key financial indicators such as debt/equity and interest<br />

coverage ratios.<br />

Nominal<br />

amount<br />

Currency option contracts . . . . . . . . . . . . . . . . 186.0<br />

72