2006 Interim Reportï¼A Share.pdf - ä¸å½é¶è¡

2006 Interim Reportï¼A Share.pdf - ä¸å½é¶è¡

2006 Interim Reportï¼A Share.pdf - ä¸å½é¶è¡

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Condensed Financial Statements<br />

For the six month period ended 30 June <strong>2006</strong><br />

(Amount in millions of Renminbi, unless otherwise stated)<br />

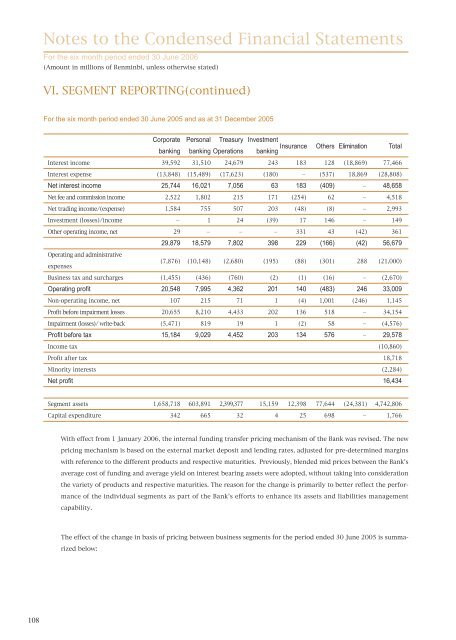

VI. SEGMENT REPORTING(continued)<br />

For the six month period ended 30 June 2005 and as at 31 December 2005<br />

Corporate Personal Treasury Investment<br />

Insurance Others Elimination Total<br />

banking banking Operations banking<br />

Interest income 39,592 31,510 24,679 243 183 128 (18,869) 77,466<br />

Interest expense (13,848) (15,489) (17,623) (180) (537) 18,869 (28,808)<br />

Net interest income 25,744 16,021 7,056 63 183 (409) 48,658<br />

Net fee and commission income 2,522 1,802 215 171 (254) 62 4,518<br />

Net trading income/(expense) 1,584 755 507 203 (48) (8) 2,993<br />

Investment (losses)/income 1 24 (39) 17 146 149<br />

Other operating income, net 29 331 43 (42) 361<br />

29,879 18,579 7,802 398 229 (166) (42) 56,679<br />

Operating and administrative<br />

expenses<br />

(7,876) (10,148) (2,680) (195) (88) (301) 288 (21,000)<br />

Business tax and surcharges (1,455) (436) (760) (2) (1) (16) (2,670)<br />

Operating profit 20,548 7,995 4,362 201 140 (483) 246 33,009<br />

Non-operating income, net 107 215 71 1 (4) 1,001 (246) 1,145<br />

Profit before impairment losses 20,655 8,210 4,433 202 136 518 34,154<br />

Impairment (losses)/ write-back (5,471) 819 19 1 (2) 58 (4,576)<br />

Profit before tax 15,184 9,029 4,452 203 134 576 29,578<br />

Income tax (10,860)<br />

Profit after tax 18,718<br />

Minority interests (2,284)<br />

Net profit 16,434<br />

Segment assets 1,658,718 603,891 2,399,377 15,159 12,398 77,644 (24,381) 4,742,806<br />

Capital expenditure 342 665 32 4 25 698 1,766<br />

With effect from 1 January <strong>2006</strong>, the internal funding transfer pricing mechanism of the Bank was revised. The new<br />

pricing mechanism is based on the external market deposit and lending rates, adjusted for pre-determined margins<br />

with reference to the different products and respective maturities. Previously, blended mid prices between the Bank’s<br />

average cost of funding and average yield on interest bearing assets were adopted, without taking into consideration<br />

the variety of products and respective maturities. The reason for the change is primarily to better reflect the performance<br />

of the individual segments as part of the Bank’s efforts to enhance its assets and liabilities management<br />

capability.<br />

The effect of the change in basis of pricing between business segments for the period ended 30 June 2005 is summarized<br />

below:<br />

108