2006 Interim Reportï¼A Share.pdf - ä¸å½é¶è¡

2006 Interim Reportï¼A Share.pdf - ä¸å½é¶è¡

2006 Interim Reportï¼A Share.pdf - ä¸å½é¶è¡

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

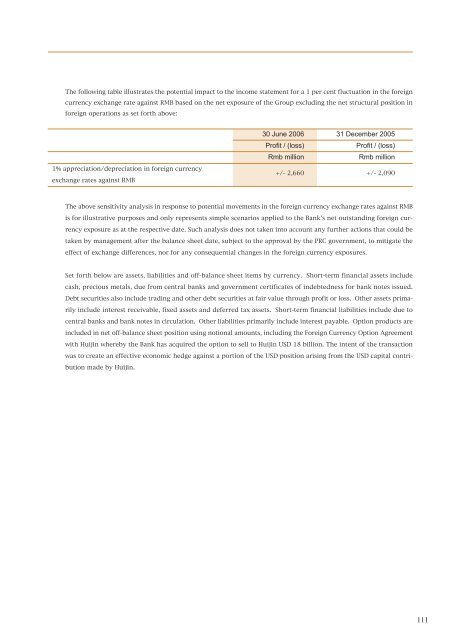

The following table illustrates the potential impact to the income statement for a 1 per cent fluctuation in the foreign<br />

currency exchange rate against RMB based on the net exposure of the Group excluding the net structural position in<br />

foreign operations as set forth above:<br />

1% appreciation/depreciation in foreign currency<br />

exchange rates against RMB<br />

30 June <strong>2006</strong> 31 December 2005<br />

Profit / (loss)<br />

Profit / (loss)<br />

Rmb million<br />

Rmb million<br />

+/- 2,660 +/- 2,090<br />

The above sensitivity analysis in response to potential movements in the foreign currency exchange rates against RMB<br />

is for illustrative purposes and only represents simple scenarios applied to the Bank's net outstanding foreign currency<br />

exposure as at the respective date. Such analysis does not taken into account any further actions that could be<br />

taken by management after the balance sheet date, subject to the approval by the PRC government, to mitigate the<br />

effect of exchange differences, nor for any consequential changes in the foreign currency exposures.<br />

Set forth below are assets, liabilities and off-balance sheet items by currency. Short-term financial assets include<br />

cash, precious metals, due from central banks and government certificates of indebtedness for bank notes issued.<br />

Debt securities also include trading and other debt securities at fair value through profit or loss. Other assets primarily<br />

include interest receivable, fixed assets and deferred tax assets. Short-term financial liabilities include due to<br />

central banks and bank notes in circulation. Other liabilities primarily include interest payable. Option products are<br />

included in net off-balance sheet position using notional amounts, including the Foreign Currency Option Agreement<br />

with Huijin whereby the Bank has acquired the option to sell to Huijin USD 18 billion. The intent of the transaction<br />

was to create an effective economic hedge against a portion of the USD position arising from the USD capital contribution<br />

made by Huijin.<br />

111